We've used "seller financing" on two self storage deals in the past year.

And it raised our cash on cash return by 20%+.

And lowered the amount of capital we needed by $500k.

Here's a THREAD about a deal of mine and how this magical debt structure can work.

👇👇

And it raised our cash on cash return by 20%+.

And lowered the amount of capital we needed by $500k.

Here's a THREAD about a deal of mine and how this magical debt structure can work.

👇👇

My method is simple. In the late stages of negotiation I submit two offers:

One at a lower price.

And one at the exact price the seller wants but with him holding back 10-20% of the purchase price in the form of a 2nd mortgage (with a second position to your bank loan).

One at a lower price.

And one at the exact price the seller wants but with him holding back 10-20% of the purchase price in the form of a 2nd mortgage (with a second position to your bank loan).

Contrary to popular belief seller financing rarely includes the seller holding back 70-80% and acting as your bank.

Two reasons:

#1 most have some debt on the property.

#2 most want most of their money now.

Two reasons:

#1 most have some debt on the property.

#2 most want most of their money now.

Have you heard the saying:

"you name the price and i'll name the terms?"

This is a case of that situation exactly.

Lets paint a picture here:

"you name the price and i'll name the terms?"

This is a case of that situation exactly.

Lets paint a picture here:

Last week I was negotiating with a seller on a property.

Not many interested buyers so I knew I had some leverage.

His asking price was $4.5MM. I wanted to pay $4.2M.

After a week or two and a lot of back and forth I found his lowest number.

Not many interested buyers so I knew I had some leverage.

His asking price was $4.5MM. I wanted to pay $4.2M.

After a week or two and a lot of back and forth I found his lowest number.

$4.325MM.

At that point I made the two offers.

One at $4.2MM with normal terms and a bank financed closing.

The second at a price of $4.325MM with $500k of "seller financing".

So lets go over the dynamics:

At that point I made the two offers.

One at $4.2MM with normal terms and a bank financed closing.

The second at a price of $4.325MM with $500k of "seller financing".

So lets go over the dynamics:

My advantage is clear.

Instead of getting 70% ($3MM) financed through my bank and coming up with the last 30% ($1.3MM)...

I finance 70% ($3MM) through my bank, 11.5% ($500k) through the seller, and only needed to come up with 18.5% ($800k).

Instead of getting 70% ($3MM) financed through my bank and coming up with the last 30% ($1.3MM)...

I finance 70% ($3MM) through my bank, 11.5% ($500k) through the seller, and only needed to come up with 18.5% ($800k).

And when you raise money on a deal the capital you raise is expensive over time.

Generally 25% per year is what you pay to your LPs or what you expect as a return on your own capital.

But the seller only gets 5%.

Lets talk about how its structured with him:

Generally 25% per year is what you pay to your LPs or what you expect as a return on your own capital.

But the seller only gets 5%.

Lets talk about how its structured with him:

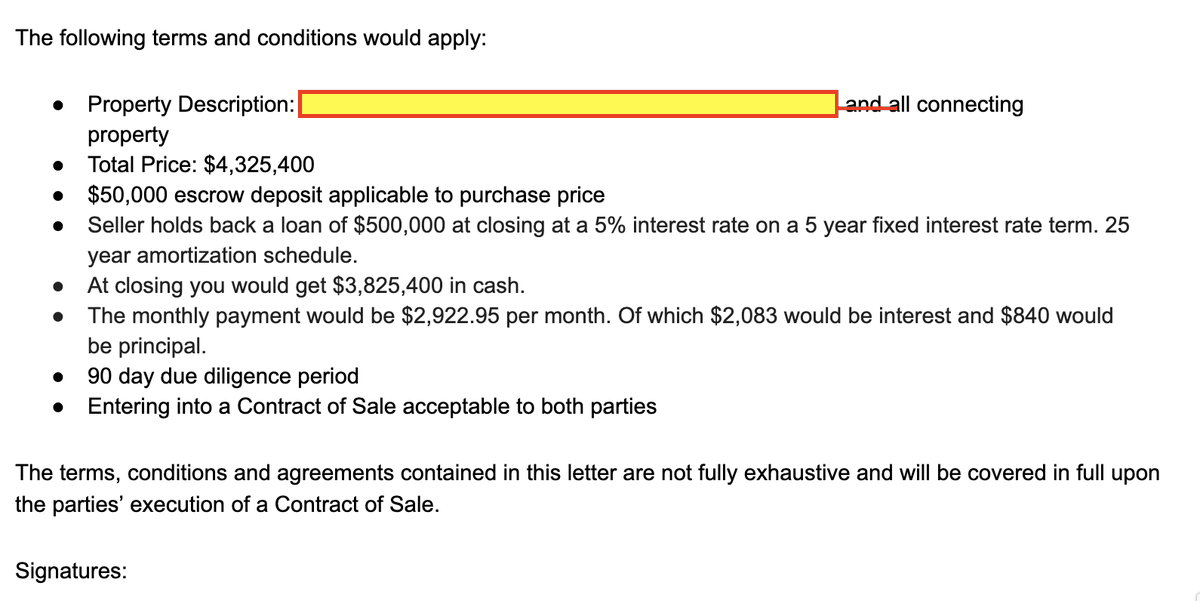

Here's a picture of my Letter of Intent.

It's a 5 year term, meaning the rate is locked for 5 years. After that the rate goes up to 7%.

If I ever refinance, which I plan to do at 18 months, I have to clear his loan and pay it off.

It's a 5 year term, meaning the rate is locked for 5 years. After that the rate goes up to 7%.

If I ever refinance, which I plan to do at 18 months, I have to clear his loan and pay it off.

Our bank is fine with this because our entire debt obligation on the deal still meets their 1.25x debt service coverage ratio. Aka its juicy.

And they have first position. Meaning if we default, they get made whole first.

+ they trust us and like us (that matters, a lot).

And they have first position. Meaning if we default, they get made whole first.

+ they trust us and like us (that matters, a lot).

I don't use this on every offer.

Definitely not on competitive properties.

And not unless I have some leverage and rapport with the sellers.

Because it's a risk for them. They are your new banker. You stop paying or run the property into the ground, they lose big.

Definitely not on competitive properties.

And not unless I have some leverage and rapport with the sellers.

Because it's a risk for them. They are your new banker. You stop paying or run the property into the ground, they lose big.

Note:

This increases your risk. It increases your leverage. And your obligation on a monthly basis.

Do not do this unless the deal is juicy enough to support the added debt.

This increases your risk. It increases your leverage. And your obligation on a monthly basis.

Do not do this unless the deal is juicy enough to support the added debt.

• • •

Missing some Tweet in this thread? You can try to

force a refresh