$TWLO - Twilio chart storm - Aggressive grower

Sizeable co growing fast -> $2B at 60%

CPaaS expanding into cust experience mgmnt

Some say unprofitable & just buying growth

Let’s analyze some of the numbers

A short thread...

Sizeable co growing fast -> $2B at 60%

CPaaS expanding into cust experience mgmnt

Some say unprofitable & just buying growth

Let’s analyze some of the numbers

A short thread...

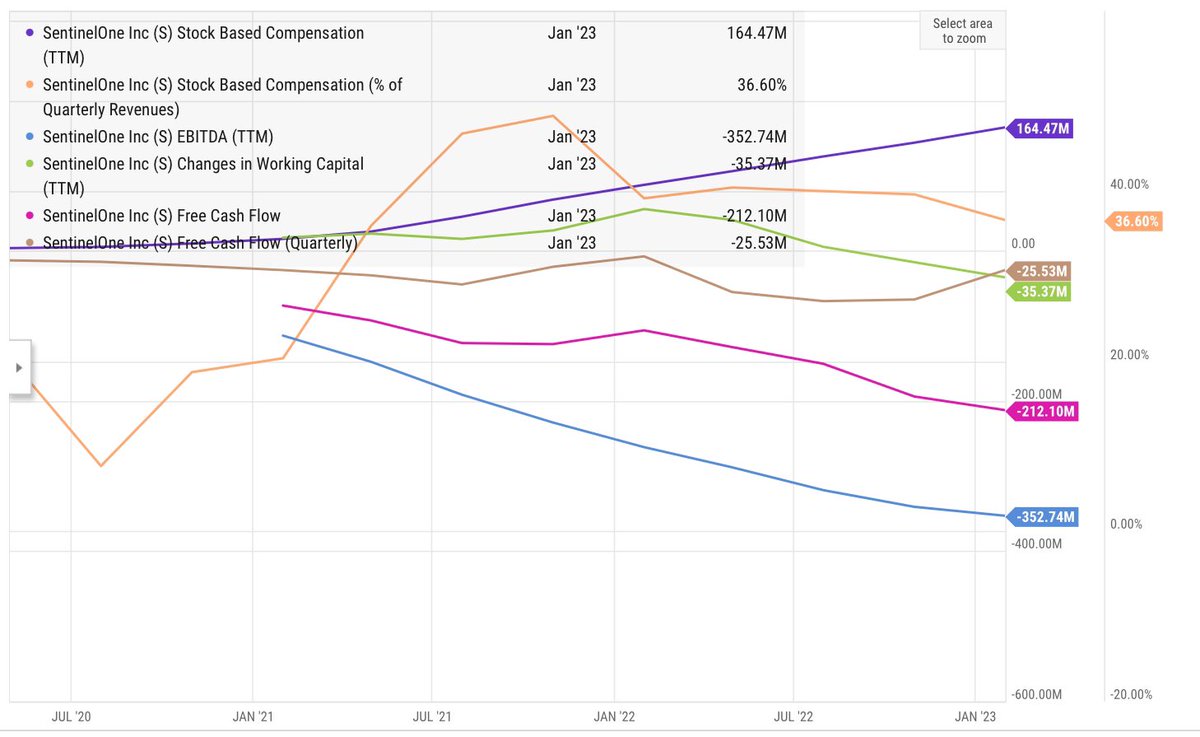

FCF components

FCF running slightly negative

EBITDA & SBC mirror images (after SBC its ~EBITDA breakeven)

WCap & capex modest (WCap neg since ‘17)

“Cost” has been that # Shares has doubled in past 4y (acq played a role)

BUT

Rev is ~7X in that period ! Beast

Rev/sh >3X

FCF running slightly negative

EBITDA & SBC mirror images (after SBC its ~EBITDA breakeven)

WCap & capex modest (WCap neg since ‘17)

“Cost” has been that # Shares has doubled in past 4y (acq played a role)

BUT

Rev is ~7X in that period ! Beast

Rev/sh >3X

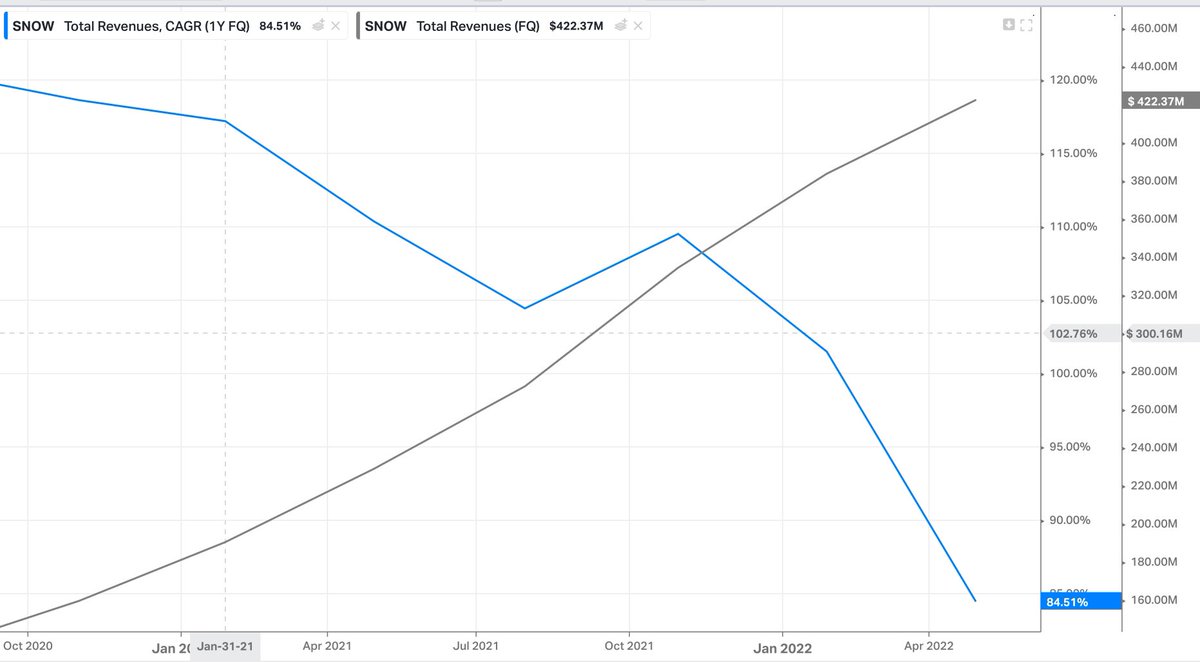

Operating performance

Strong Rev g 40-80%, now ~60%. (Impressive at $2B rev)

GP mgn has declined slightly to 52% but holding

EBITDA remaining negative

Sendgrid acq in Feb19 & Segment in Nov20 playing a role in the numbers, so too the mix of intnl vs domestic

Strong Rev g 40-80%, now ~60%. (Impressive at $2B rev)

GP mgn has declined slightly to 52% but holding

EBITDA remaining negative

Sendgrid acq in Feb19 & Segment in Nov20 playing a role in the numbers, so too the mix of intnl vs domestic

But they have plenty firepower on the balance sheet

Cash (given raises) is up to $5.7B while debt is $1.2B

So they have a net cash position of ~$4.5B

Debt to capital low at about 10%

FCF burn (<50M) is tiny compared to their cash mountain

-> Can make strategic acquisitions

Cash (given raises) is up to $5.7B while debt is $1.2B

So they have a net cash position of ~$4.5B

Debt to capital low at about 10%

FCF burn (<50M) is tiny compared to their cash mountain

-> Can make strategic acquisitions

In my view, it’s too early to judge them on profitability

They running it at a small FCF outflow with a ginormous cash pile

It’s about where the tech is going & what they’re creating for the future. Cust experience mgmnt is a big area

✅ CEO @jeffiel Jeff Lawson is very strong

They running it at a small FCF outflow with a ginormous cash pile

It’s about where the tech is going & what they’re creating for the future. Cust experience mgmnt is a big area

✅ CEO @jeffiel Jeff Lawson is very strong

Will continue monitoring and holding this fascinating co

Let’s see what they can create in 3 yrs time

Charts courtesy of @ycharts

(Annotations in previous charts included by hand)

Let’s see what they can create in 3 yrs time

Charts courtesy of @ycharts

(Annotations in previous charts included by hand)

PS - judging from responses

Let me make it clear, I am not saying people must buy $TWLO now. I did not touch on valuation / fcasts

I was just looking at some of the historic perf

Share is valued highly. Lots of risk. You could lose a lot if you buy now & they execute poorly

Let me make it clear, I am not saying people must buy $TWLO now. I did not touch on valuation / fcasts

I was just looking at some of the historic perf

Share is valued highly. Lots of risk. You could lose a lot if you buy now & they execute poorly

• • •

Missing some Tweet in this thread? You can try to

force a refresh