Technology equity analyst. Investor. Tech co’s. Electrical Engineer. CFA Charterholder. Took that photo above in the Kruger Park in Jun '17. Lovely cheetah!

3 subscribers

How to get URL link on X (Twitter) App

$S

$S

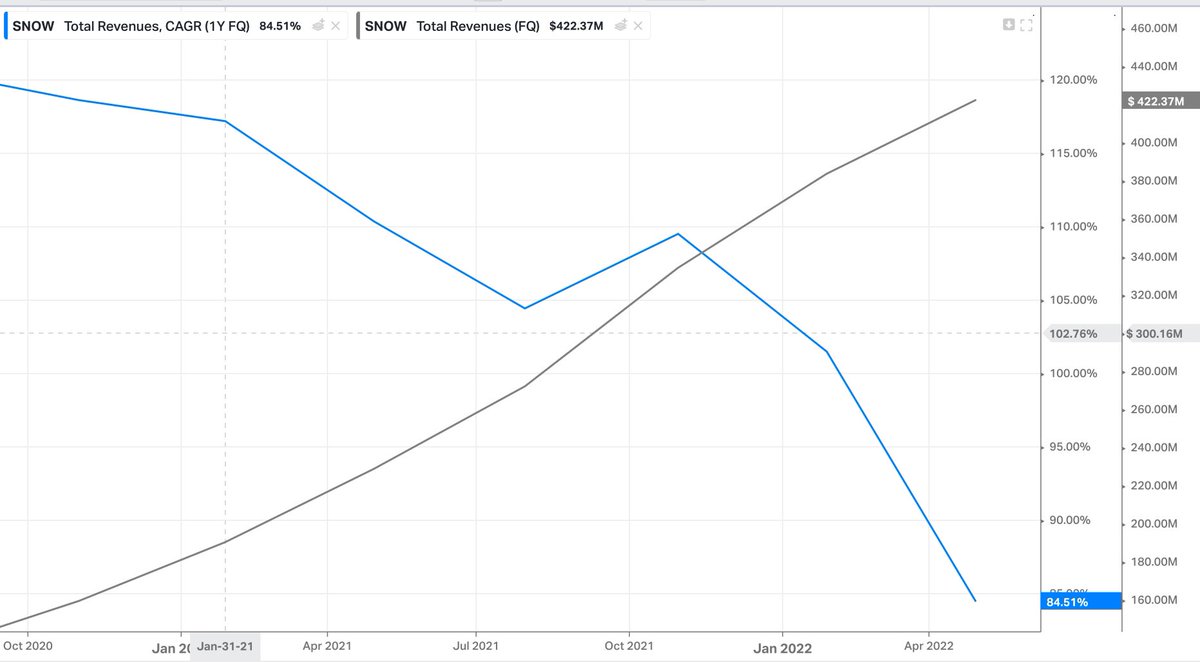

$SNOW

$SNOW

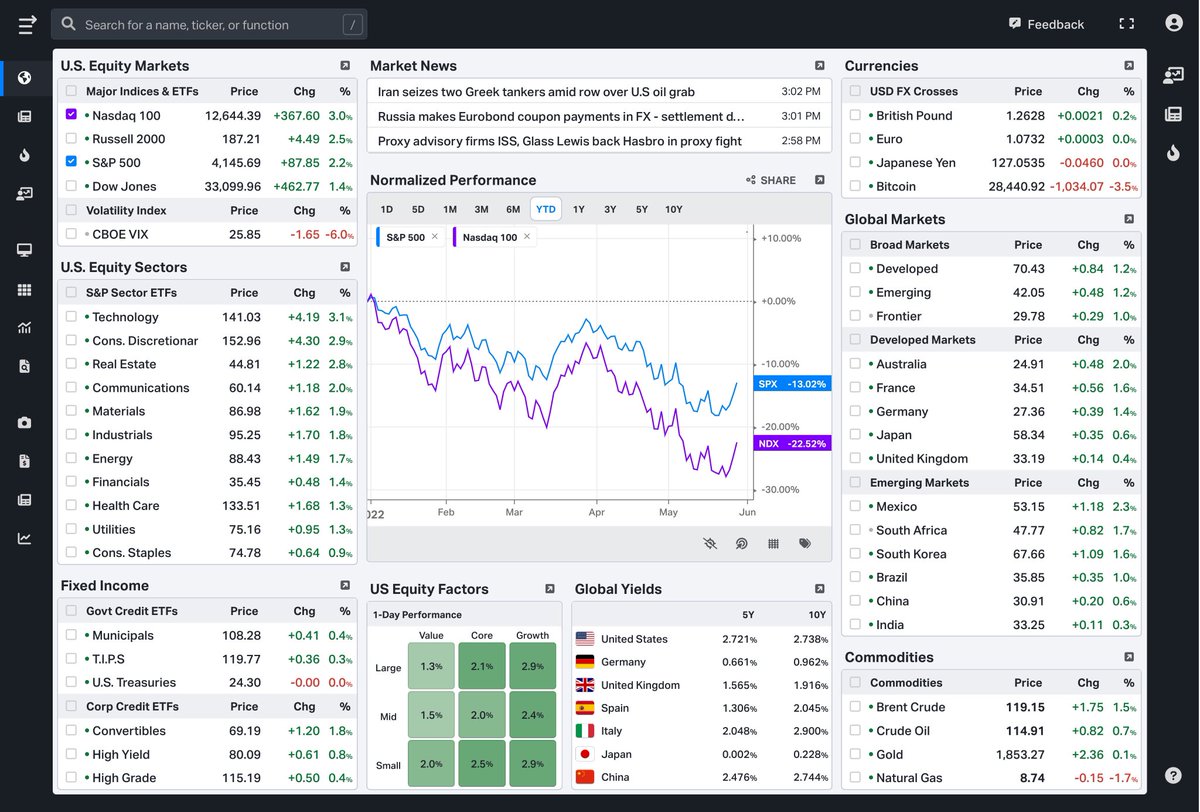

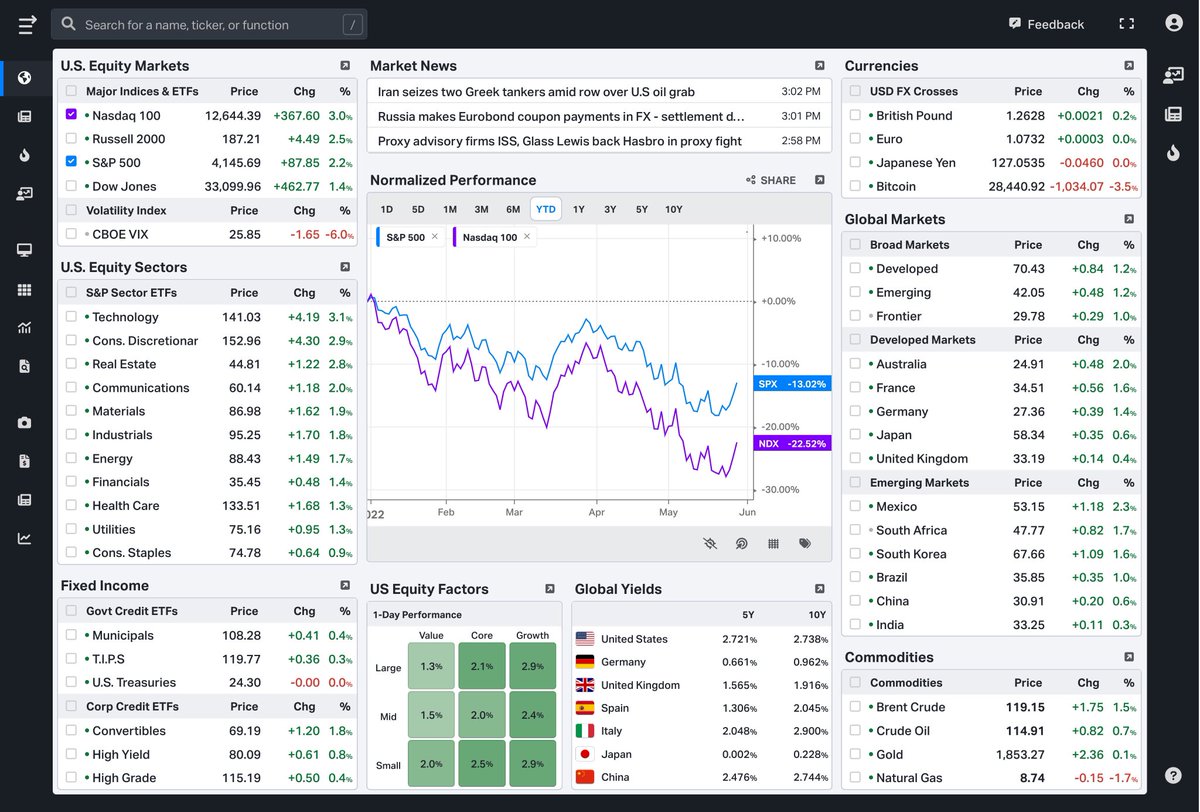

@KoyfinCharts vs @ycharts

@KoyfinCharts vs @ycharts

$SNOW

$SNOW

https://twitter.com/IrnestKaplan/status/1519050704291250176

I’ve split them into three parts based on (FCF-SBC)/Rev

I’ve split them into three parts based on (FCF-SBC)/Rev

What I like about $ROKU is the main metrics are going in the right direction

What I like about $ROKU is the main metrics are going in the right direction

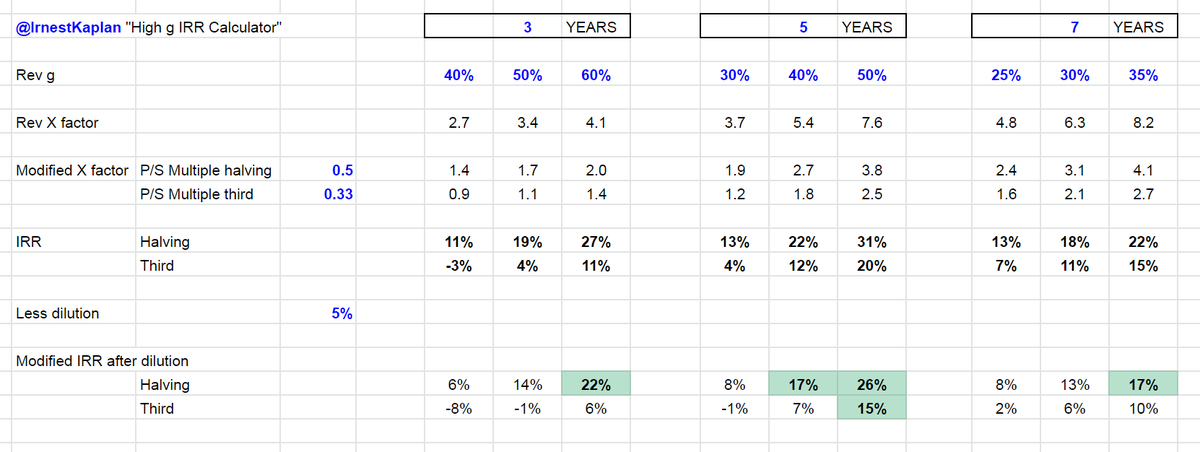

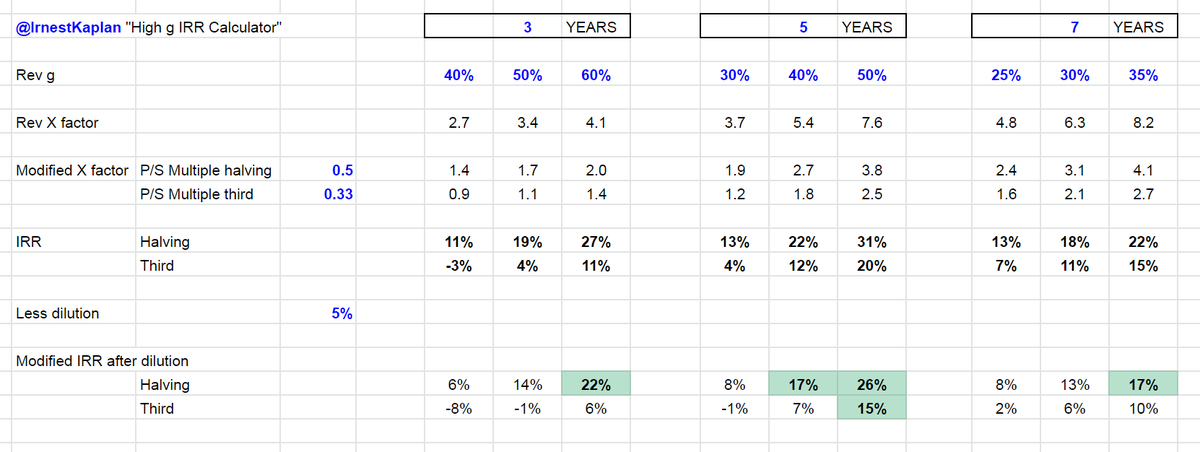

The calculator is simple & self explanatory

The calculator is simple & self explanatory

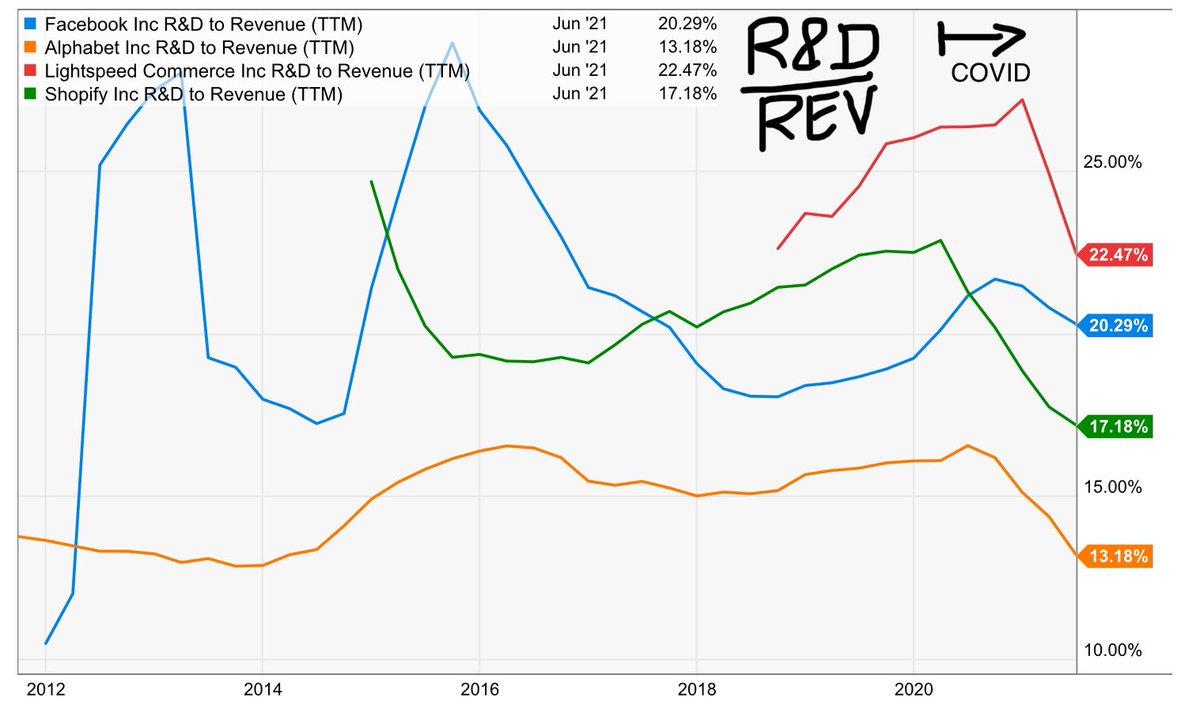

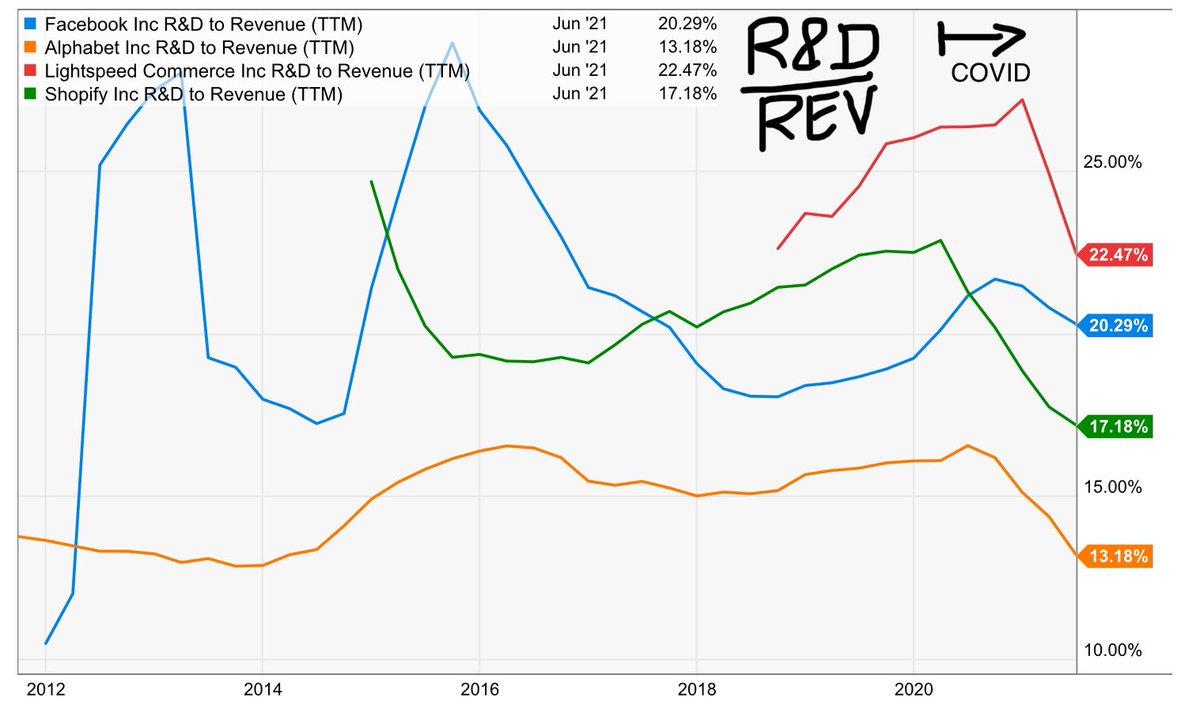

https://twitter.com/tobi/status/1429074479880212493$SHOP R&D/Rev vs $FB, $GOOG, $LSPD (1st chart)

I started at the peak of the dotcom "bubble"

I started at the peak of the dotcom "bubble"

Lets start with sales and go back 4 years

Lets start with sales and go back 4 years

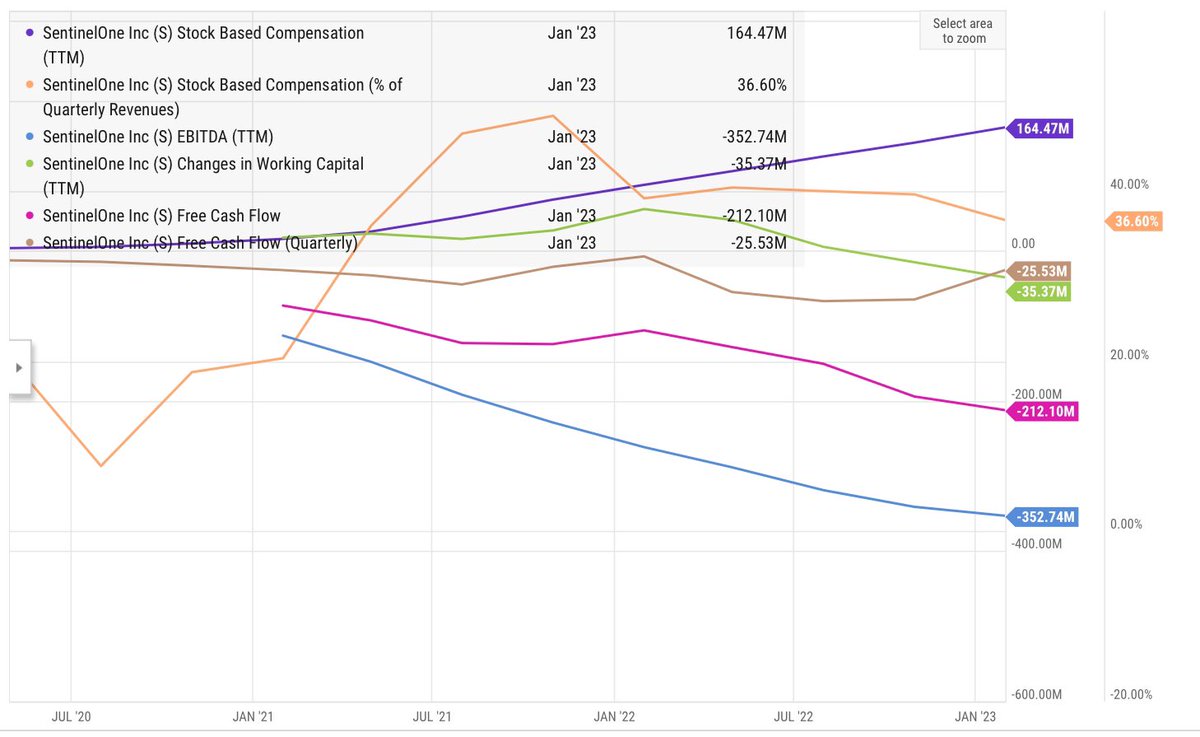

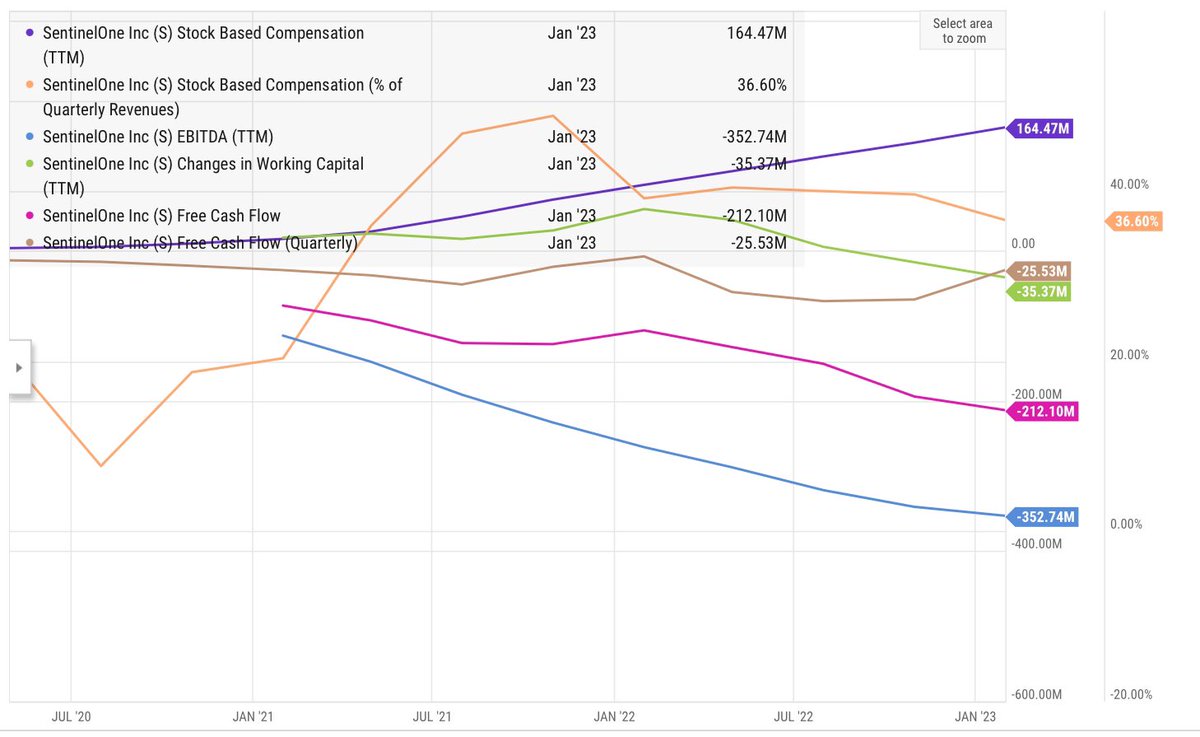

FCF components

FCF components

They’re growing nicely, I think their product is good and they starting to make inroads into the employers and providers (B2B)

They’re growing nicely, I think their product is good and they starting to make inroads into the employers and providers (B2B)

https://twitter.com/clueless_1337/status/1403161469877841925

Why on earth would they put out that (very low) FY29 target if the mkt cap is $70B today?

Why on earth would they put out that (very low) FY29 target if the mkt cap is $70B today?

2

2

@morganhousel was great!

@morganhousel was great!

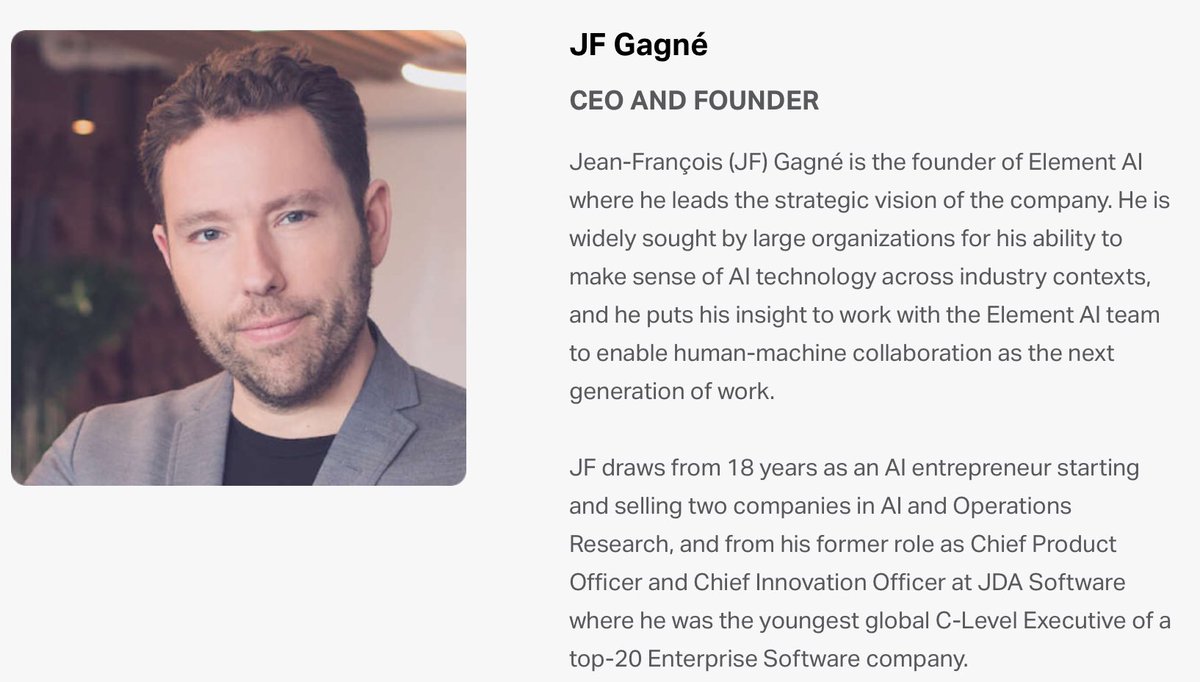

https://twitter.com/techcrunch/status/1333402807135854592

Element AI is a Canadian company founded and run by AI experts. The top skills are staying on at $NOW

Element AI is a Canadian company founded and run by AI experts. The top skills are staying on at $NOW

Interesting, but I wasn’t sure what I was meant to do? Do you just walk around and try chat to other characters?

Interesting, but I wasn’t sure what I was meant to do? Do you just walk around and try chat to other characters?

2/11

2/11