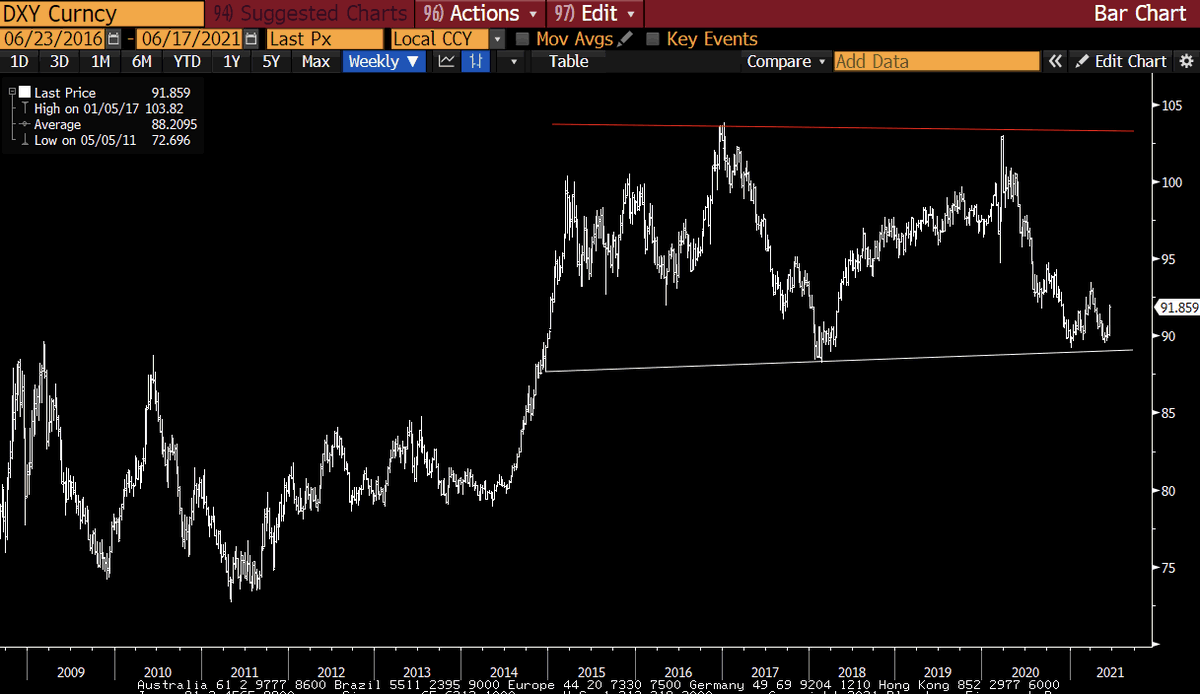

The dollar is always the KEY macro variable.

When it moves, everything moves. If the dollar rises sharply back to the middle of the range, it kills the inflation narrative for now.

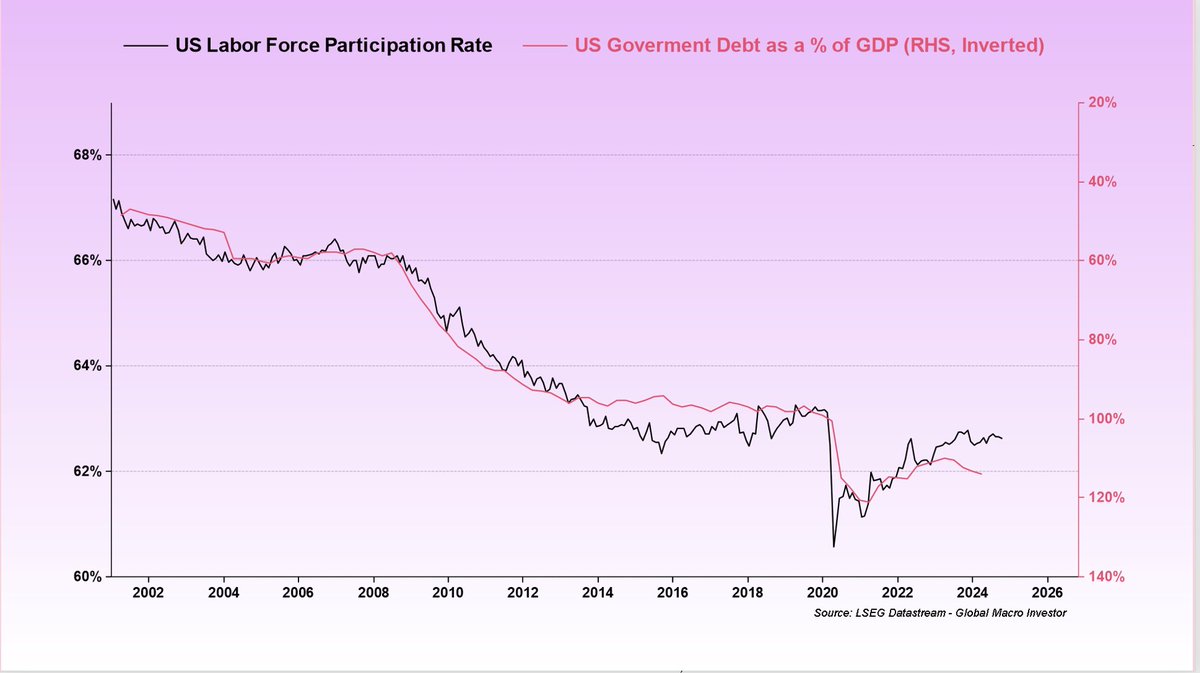

The real guts of the inflation debate is more likely next year's story.

When it moves, everything moves. If the dollar rises sharply back to the middle of the range, it kills the inflation narrative for now.

The real guts of the inflation debate is more likely next year's story.

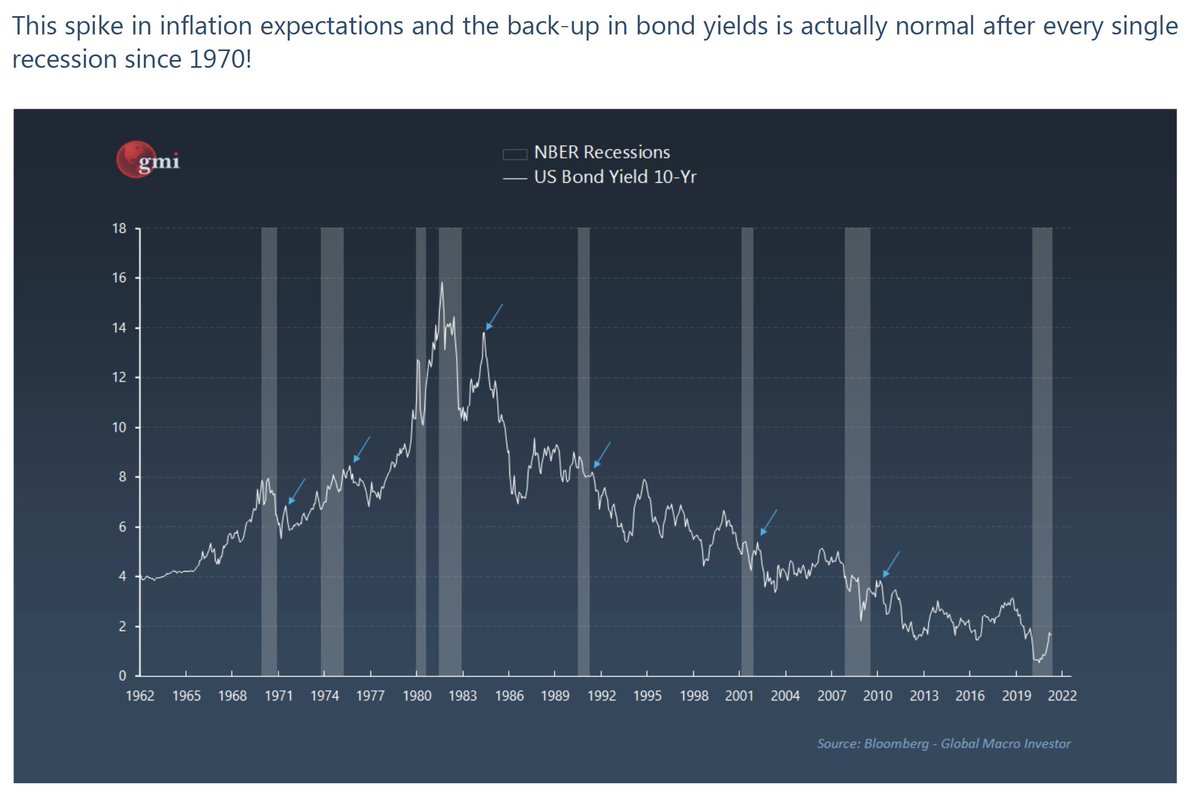

It is normal to see inflation fears immediately after recessions but they tend to ease sharply (or entirely reverse, as do bond yields).

And The Fed always cuts again (for 2 years) after the recession as stimulus and re-bound effects wear off...

The government tends to push through one or two more stimulus (in this case I think they will be massive) and the Fed balance sheet will continue to expand, and bond yields should drop once more...

My view remains that H2 is weaker than expected and inflation fears subside for now, and growth looks patchy. That results in more stimulus (not tightening) in Q4.

What does it mean for markets? Well, the dollar keeps rising for a bit. Commodities correct. Tech and Exponential Age stocks rip higher.

Weaker data will eventually lead to Gold and Crypto moving sharply higher, especially once the dollar stabilises a bit.

Weaker data will eventually lead to Gold and Crypto moving sharply higher, especially once the dollar stabilises a bit.

Let's see how it plays out... but keep your eye on the dollar. It is still the king, and remember 100% of all forecasters on Bloomberg at the beginning of the year suggested it was going to weaken a lot. They are usually wrong when consensus is so high.

But massive infrastructure stimulus that will keep coming will drive up commodities over time as long as the dollar is not ripping. But I think the first wave is possibly done and will correct for a while now.

#Macro.

#Macro.

• • •

Missing some Tweet in this thread? You can try to

force a refresh