Inflation in Brazil from 1980-200 annualized at 250% and yet a Brazilian investor that converted 100% of their assets to gold in 1980 still lost 70% of their purchasing power.

Would seem to cast some doubt on how effective gold is against high inflation in a single country?

Would seem to cast some doubt on how effective gold is against high inflation in a single country?

Arguably, gold worked because an investor holding Brazilian fiat lost ~100% of their purchasing power so losing 70% was better than that.

I would think one consideration here is that Brazil's GDP in 1980 probably a very small % of global GDP so other market forces would be more important for Gold's price than Brazilian demand increasing.

Anecdotally, most of the Brazilians I knew when I lived there were a lot more interested in getting a USD or Euro-denominated bank account than owning gold.

It makes sense to me that for most people, the best inflation hedge against their own curency is owning a couple other fiat currencies rather than gold.

There are regulatory/legal issues with this though.

There are regulatory/legal issues with this though.

I suspect if it was trivially easy for anyone in the world to open a USD bank account then natural demand for gold/bitcoin in most parts of the world would be near zero.

This is probably part of the stablecoin phenomenon as it's effectively a regulatory arb?

This is probably part of the stablecoin phenomenon as it's effectively a regulatory arb?

One obvious observation missing from current data is significant inflation on the scale Brazil experienced in a "major" fiat currency like the Euro or Dollar so hard to comment on that but seems like a reasonable case that gold would do well there.

Though, that's a pretty worst-case scenario and I think generally overestimated (certainly by crypto people...)

Would be curious what the gold peeps takes are on this and what I am missing.

(Src: nber.org/papers/w18706)

Would be curious what the gold peeps takes are on this and what I am missing.

(Src: nber.org/papers/w18706)

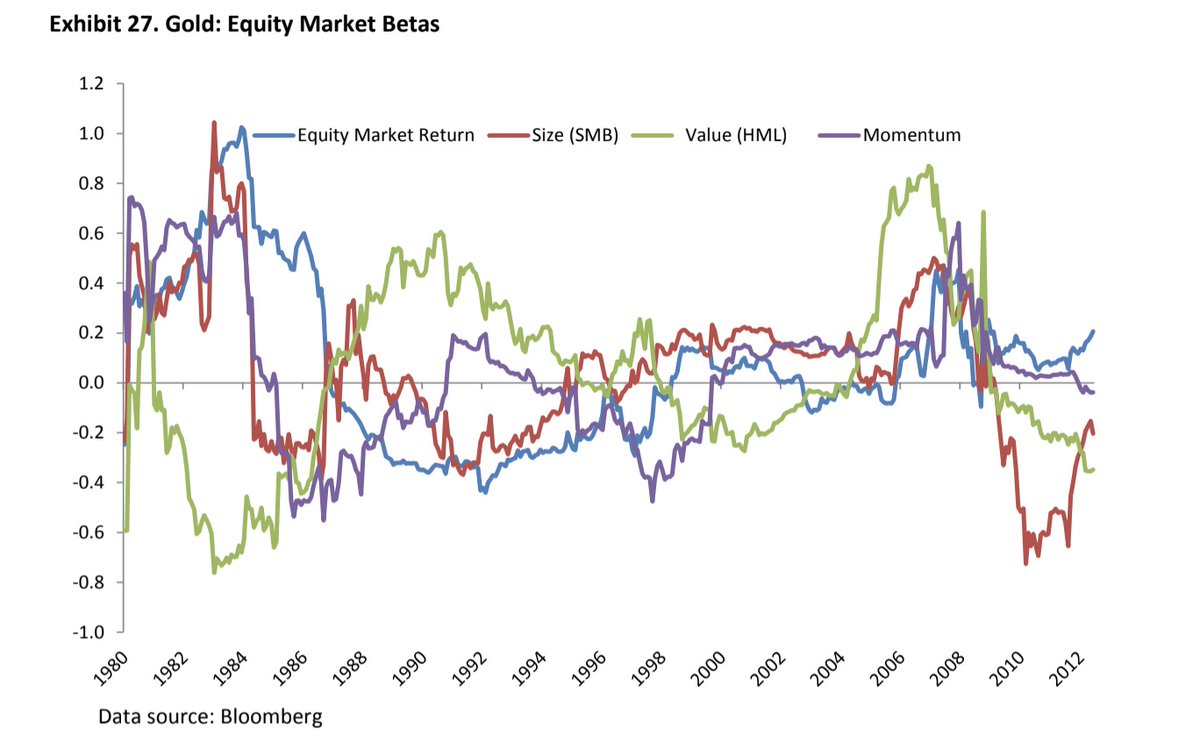

Note that this doesn't imply gold has no role in a portfolio - it's beta to equity markets is historically pretty low so rebalancing it as part of a broader strategy still makes a good deal of sense.

• • •

Missing some Tweet in this thread? You can try to

force a refresh