A thread on the snippets (paragraphs & quotes) from the book ‘Gene Machine’ by Venki Ramakrishnan (a Nobel Laureate)

Talks about a machine that decodes the data in DNA 🧬

This thread will be updated as I read further & further.

Talks about a machine that decodes the data in DNA 🧬

This thread will be updated as I read further & further.

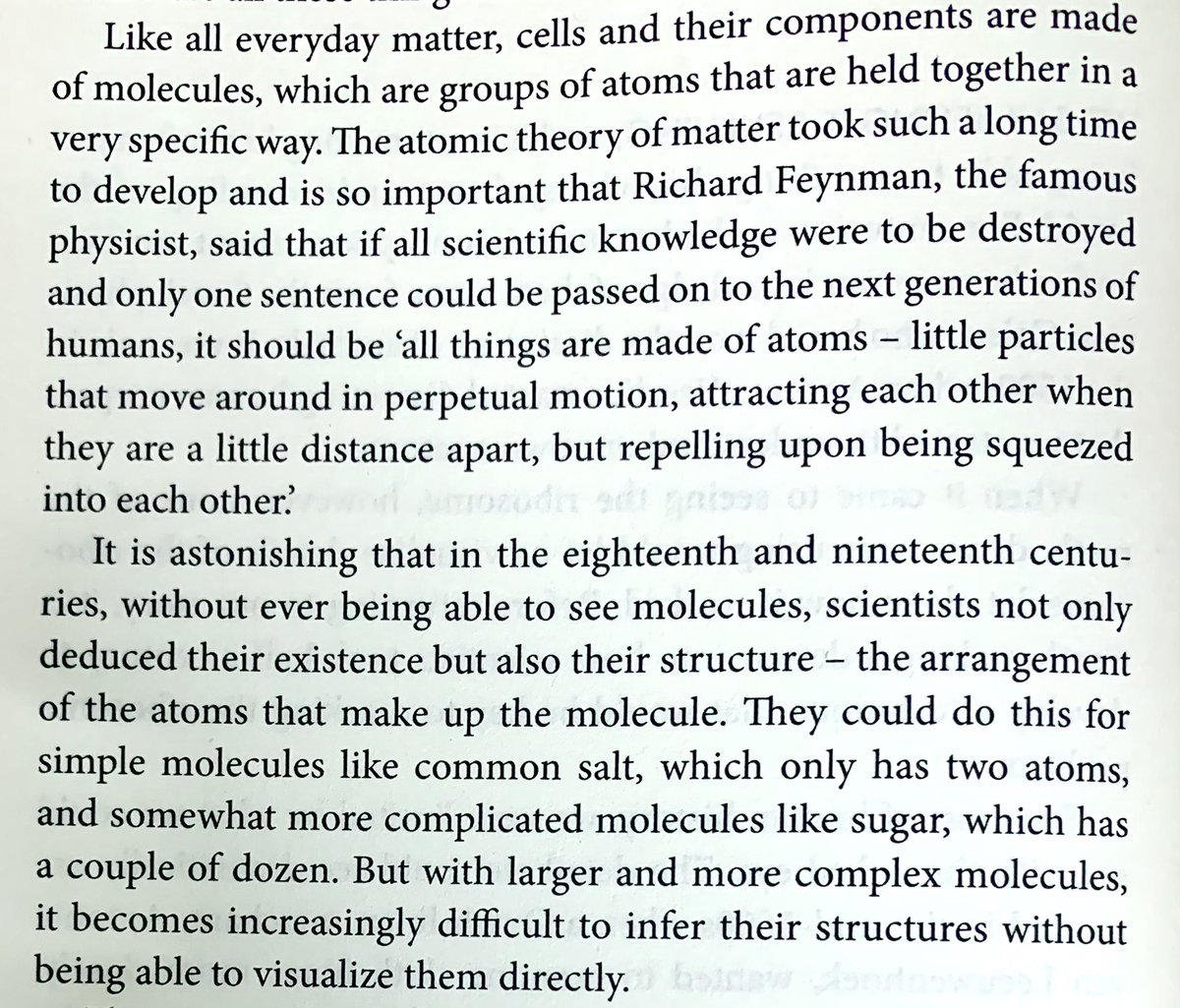

3/ Why discovering the structure of DNA was a start of a revolution?

Also why discovering the ribosome’s led to a Nobel price for the author?

They turn out to the bedrock of multiple new research fields.

Also why discovering the ribosome’s led to a Nobel price for the author?

They turn out to the bedrock of multiple new research fields.

7/ 23-24th century books (?) will say the same about some of the visionary geniuses that roam around us.

• • •

Missing some Tweet in this thread? You can try to

force a refresh