AI projects to PMF @10MinuteGita... more cooking | Writer | All-in on AI | Investor → 10 YoE | Ex Chief of Staff, Hike | IIT KGP | App building process 👇

16 subscribers

How to get URL link on X (Twitter) App

Prompt 1: The Earnings Quality Detector

Prompt 1: The Earnings Quality Detector

📱 iOS App Store (iPhone & iPad): apps.apple.com/tr/app/10-minu…

📱 iOS App Store (iPhone & iPad): apps.apple.com/tr/app/10-minu…

2/ It's hard for a traditional firm to move towards being a Network Orchestrator

2/ It's hard for a traditional firm to move towards being a Network Orchestrator

1/ Madhivanan Balakrishnan, COO

1/ Madhivanan Balakrishnan, COO

1/ History.

1/ History.

1/ From Godrej Properties Q2FY23 concall

1/ From Godrej Properties Q2FY23 concall

1/ They have nearly 2000 crores unsold inventory as of the date

1/ They have nearly 2000 crores unsold inventory as of the date

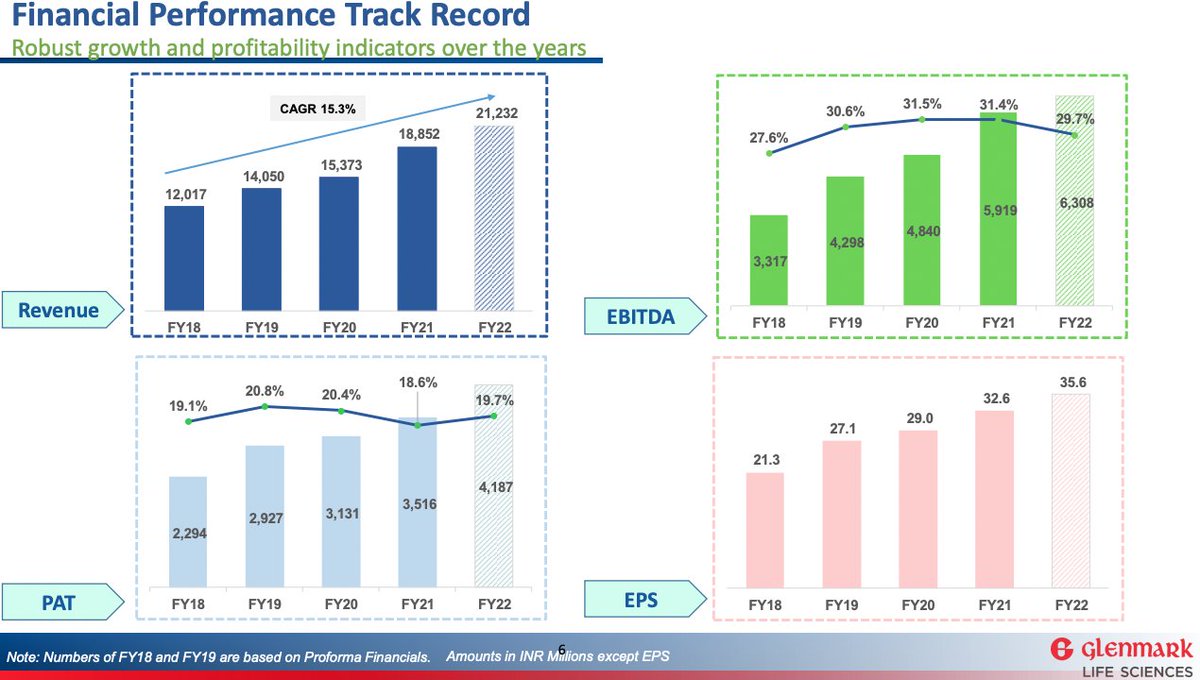

1/ My notes from their IPO.

1/ My notes from their IPO.https://twitter.com/anisha_moonka/status/1419629965788663814

1/ The word that has resonated the most with me, especially post-COVID is humility. Whether it is political leaders, central bankers, business leaders, or the householder, change is on us and at us

1/ The word that has resonated the most with me, especially post-COVID is humility. Whether it is political leaders, central bankers, business leaders, or the householder, change is on us and at us

1/ Before we go deeper, let us understand the LPG Industry better

1/ Before we go deeper, let us understand the LPG Industry better

1/ Interesting Macro talk.

1/ Interesting Macro talk.

1/ Automotive is a cyclical industry, due to a 4W/2W being a high-cost ticket item vs an average consumer’s salary (think booms & busts 👇)

1/ Automotive is a cyclical industry, due to a 4W/2W being a high-cost ticket item vs an average consumer’s salary (think booms & busts 👇)

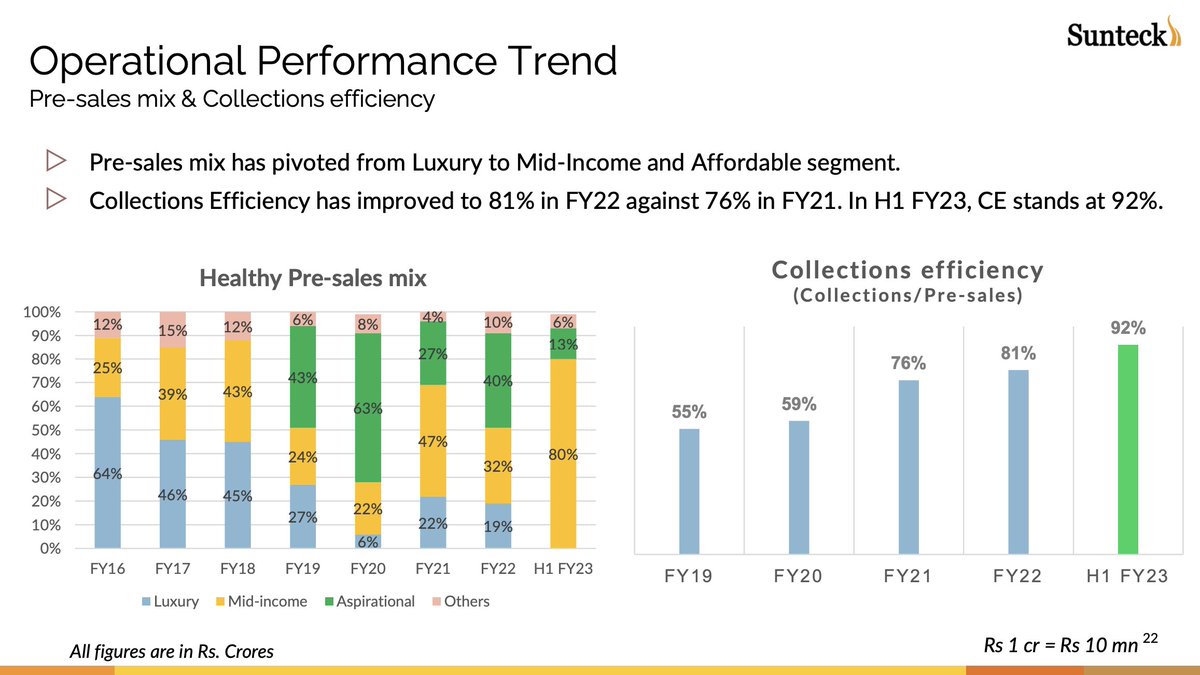

1/ A pristine balance sheet is what brings trust when euphoria doesn't.

1/ A pristine balance sheet is what brings trust when euphoria doesn't.

1/ "We spent Amazon’s first 25 years building a very large fulfillment network, and then had to double it in the last 24 months to meet customer demand."

1/ "We spent Amazon’s first 25 years building a very large fulfillment network, and then had to double it in the last 24 months to meet customer demand."

1/ It all started when the founder Mr. Rajendra Mutha in his earlier avatar as a pharmacist, saw a lady selling all her goods & land to save her son’s life & still was not able to bear the huge expenses of diagnostics.

1/ It all started when the founder Mr. Rajendra Mutha in his earlier avatar as a pharmacist, saw a lady selling all her goods & land to save her son’s life & still was not able to bear the huge expenses of diagnostics.