1/ A thread on @pendle_fi, one of the most understimated projects that recently launched on mainnet. Pendle is a protocol that enables the trading and hedging of yield and currently supports two yield-generating tokens: aUSDC and cDAI, both products expire on December 29th, 2022.

2/ A deposit of aUSDC is separated into OT-aUSDC (OT represents the ownership of the underlying token deposited) and YT-aUSDC (representing the ownership of the future yield generated).

3/ @pendle_fi created a USDC liquidity pool for YT-aUSDC and YT-cDAI to price their markets, this is achieved providing incentives,

4/ a clear example of this is that users can use their YT tokens to provide liquidity into #Pendle's own AMM pool, and get an extra layer of Yield.

5/ Because there are only products with the same expiration date, they are relatively concise (it is not clear when they will launch new products with different expiration dates), and have the basis of composability

6/ such as the price of the YT token at a certain point in time corresponds to the income from that moment to the maturity date

7/ so If you think the APR is going to increase then you can buy YT and profit from the difference between the current APR and the future APR. Theoretically, you can also arbitrage the difference between yields across different yield platforms.

9/ YT and OT have expiration dates so after expiry YT holders won't receive yield anymore, this means YT has a time-decaying property. Its value depreciates over time until reaching zero at expiry which makes it not suitable for Uniswap or Sushi.

10/This bring us to Pendle's AAM which works similar to Uniswap’s constant product curve but as subsequent swaps happen the curve will push the price of the time-decaying token down artificially. This behavior is defined by a time-decaying pricing model.

11/What about redeeming? Redeeming after expiry will convert OT back to the underlying tokens, before expiry both tokens are required to reedem the underlying token.

12/ #Stats after 12H of going live the liquidity of both pools (aUSDC,cDAI) was around $700K, and the trading volume for each account was around 10%

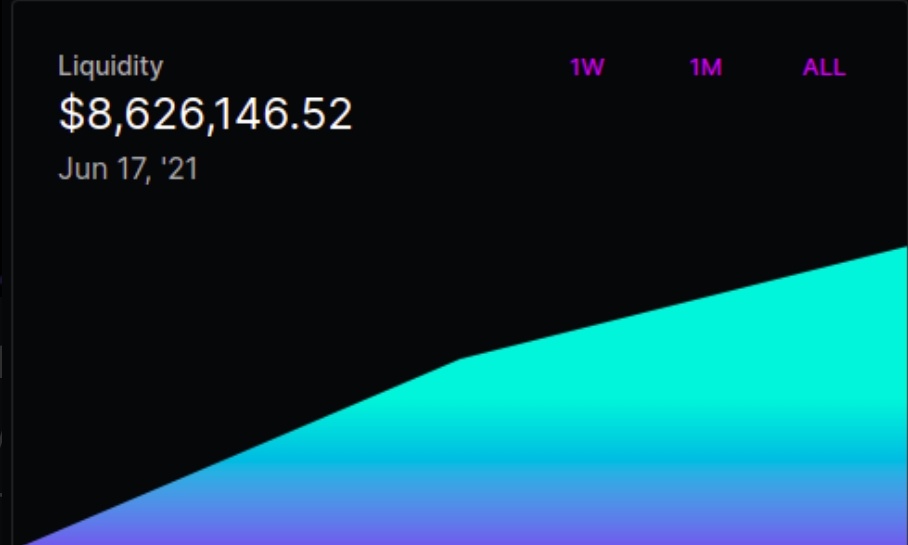

13/ At the time of writing this, the base token (OT-aUSDC/USDC) pool on Sushiswap has around 8.6M TVL.

14/What is next for @pendle_fi? Deployment on other blockchains and L2 solutions, new token pairs and support for new platforms that issue yield-bearing assets.

• • •

Missing some Tweet in this thread? You can try to

force a refresh