1/ So the other day, a thread was started on here that proposed that @binance and their derivatives are potentially a major catalyst for the printing of $USDT.

Many laughed & dismissed this, so this thread will prove those people wrong (empirically) with verifiable fact.

Many laughed & dismissed this, so this thread will prove those people wrong (empirically) with verifiable fact.

1a/ To be clear, this entire thread is operating from the understood premise that Tether is a fraud, full-stop. Whatever is in their "reserves" is irrelevant to this conversation because its clear none of it is legally derived.

If you disagree, stop reading. Thanks.

If you disagree, stop reading. Thanks.

2/ Many have stated that the core purpose of Tether is to simply pump the Bitcoin markets.

In other words, someone wakes up, scratches their ass - yawns, and says..."Hmm. Let's rocket Bitcoin up another $5k".

This is not the case (nor is it responsible for price pumps).

In other words, someone wakes up, scratches their ass - yawns, and says..."Hmm. Let's rocket Bitcoin up another $5k".

This is not the case (nor is it responsible for price pumps).

3/ That's not an exoneration of USDT. Its actually a set up to say that what its really being printed for is much more nefarious (and dangerously harmful to the markets).

Tether is used to counterfeit derivatives via covering naked shorts.

Tether is used to counterfeit derivatives via covering naked shorts.

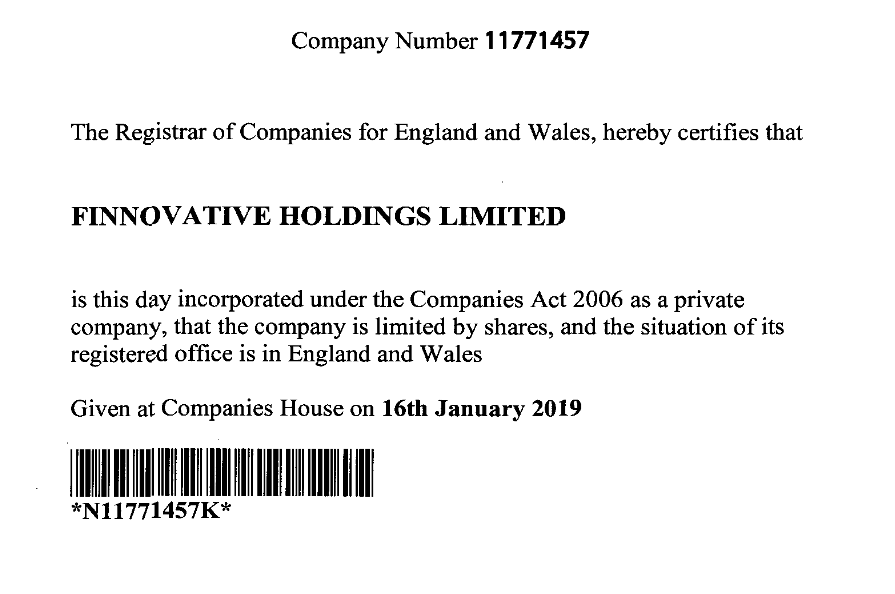

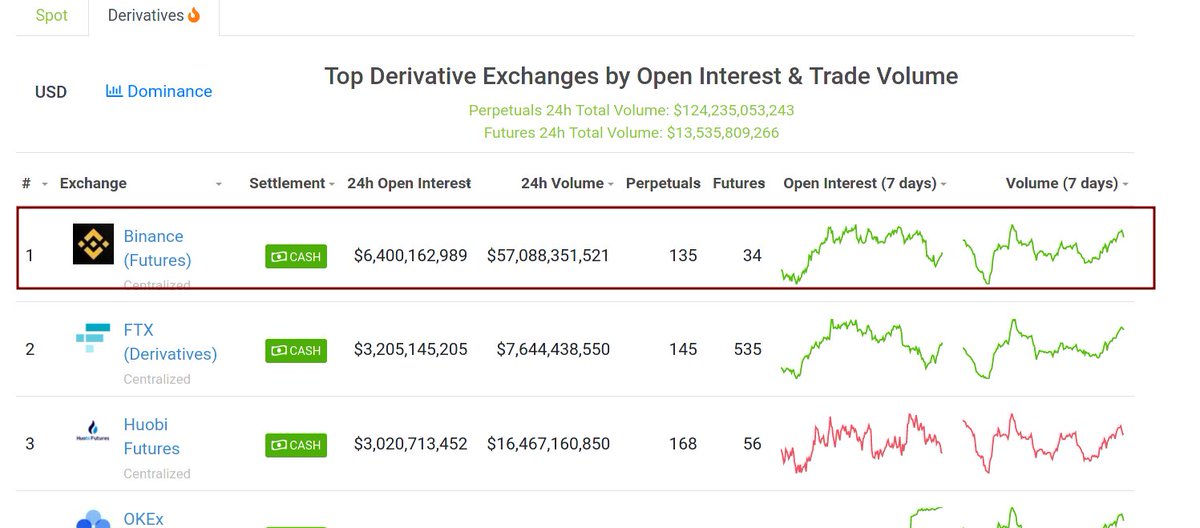

4/ We're going to show this through @binance . Why? They have the most USDT (at least $30B) and they are the #1 exchange in terms of spot trading volume & derivatives volume.

These pictures are from a variety of diff sources around this space.

These pictures are from a variety of diff sources around this space.

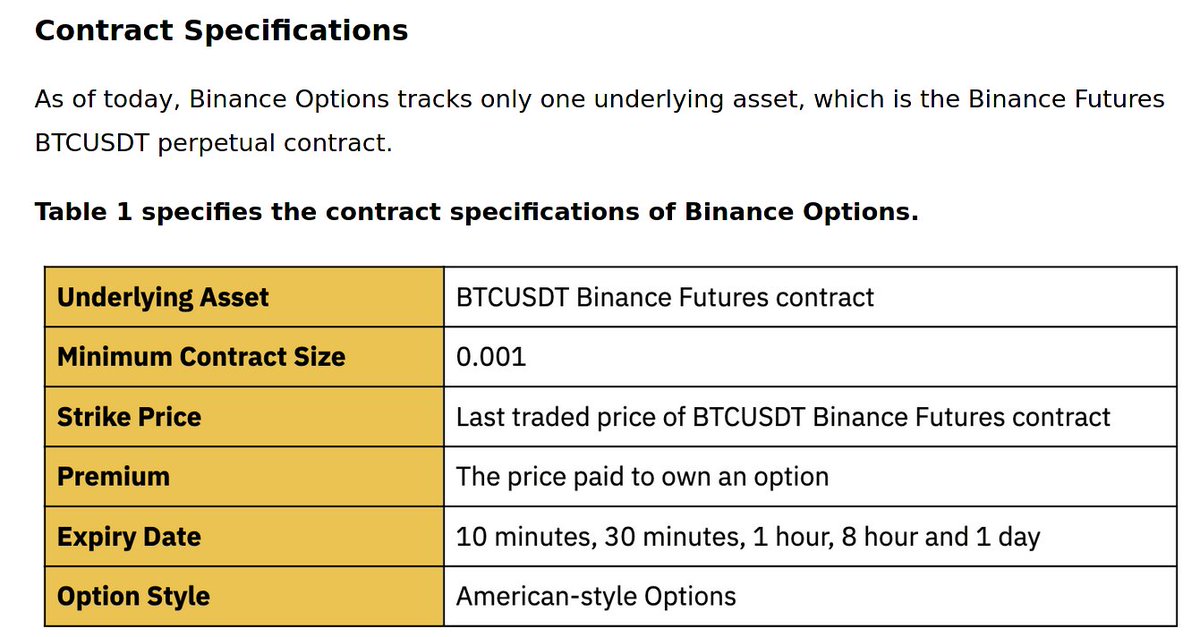

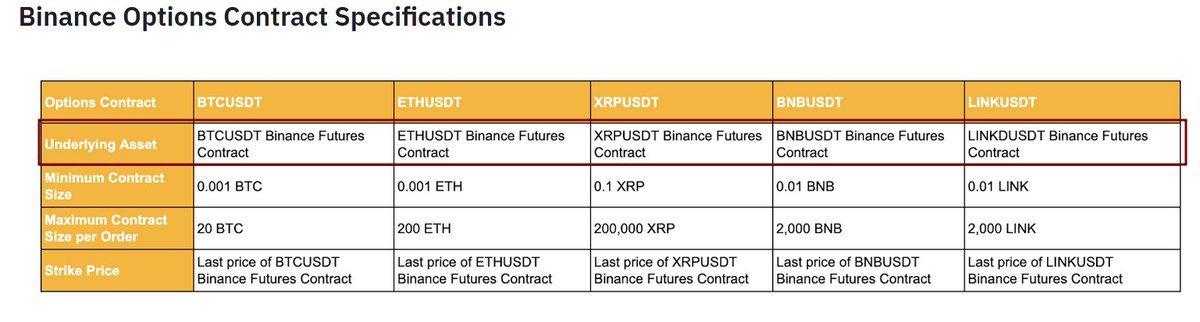

5/ Not sure how many people knew this, but Binance Options deliver *unlimited upside* and are settled in USDT.

Also, Binance is the *sole issuer* of the product.

binance.com/en/blog/421499…

Also, Binance is the *sole issuer* of the product.

binance.com/en/blog/421499…

5a/ To make it more evident that Binance virtually announced that they would cover all options trades as the counter-party (since they're the sole-issuer of the contracts) via naked shorts - they provided this mock chart displaying unlimited upside

6/ Now let's take a look at the markets at the beginning of this bull run (October 2020) to Jan 2021.

We can see that Bitcoin essentially had a 280% gain that was virtually unabated.

We don't have @binance call option data but we can see via Deribit calls > puts by a mile

We can see that Bitcoin essentially had a 280% gain that was virtually unabated.

We don't have @binance call option data but we can see via Deribit calls > puts by a mile

7/ Wondering what the underlying asset is for these Options on Binance?

They're Binance Futures! So let's dig into those for a second.

They're Binance Futures! So let's dig into those for a second.

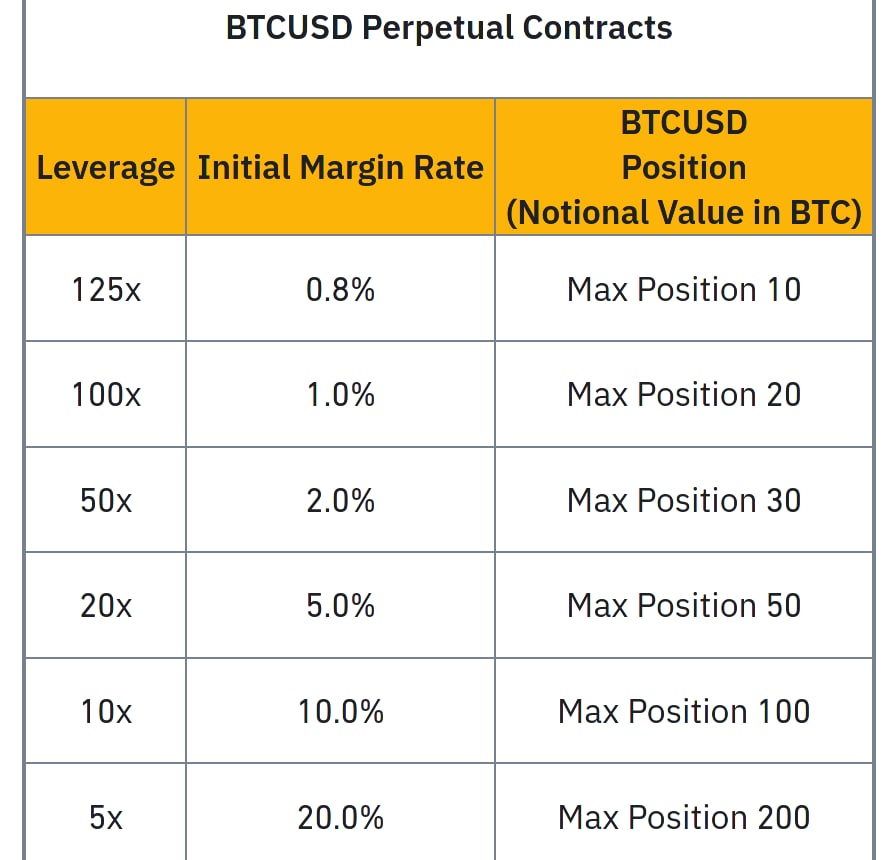

8/ There are two types of Binance futures. COIN-magined and USDT-margined contracts.

Attached to this tweet is a chart (from Binance) th at parses the difference between both (with a focus on the COIN-margined ones).

Attached to this tweet is a chart (from Binance) th at parses the difference between both (with a focus on the COIN-margined ones).

9/ Notably at the 125x leverage bracket, traders used to be able to leverage 10+ bitcoins at that rate.

Recently, that # has adjusted down by 50% (wonder why)

Recently, that # has adjusted down by 50% (wonder why)

10/ Putting it all together, we know that Binance is the counterparty for all options contracts, that those products have unlimited upside, and they're premised on @binance futures where traders could leverage 10 Bitcoin by 125x. And that options are settled in USDT.

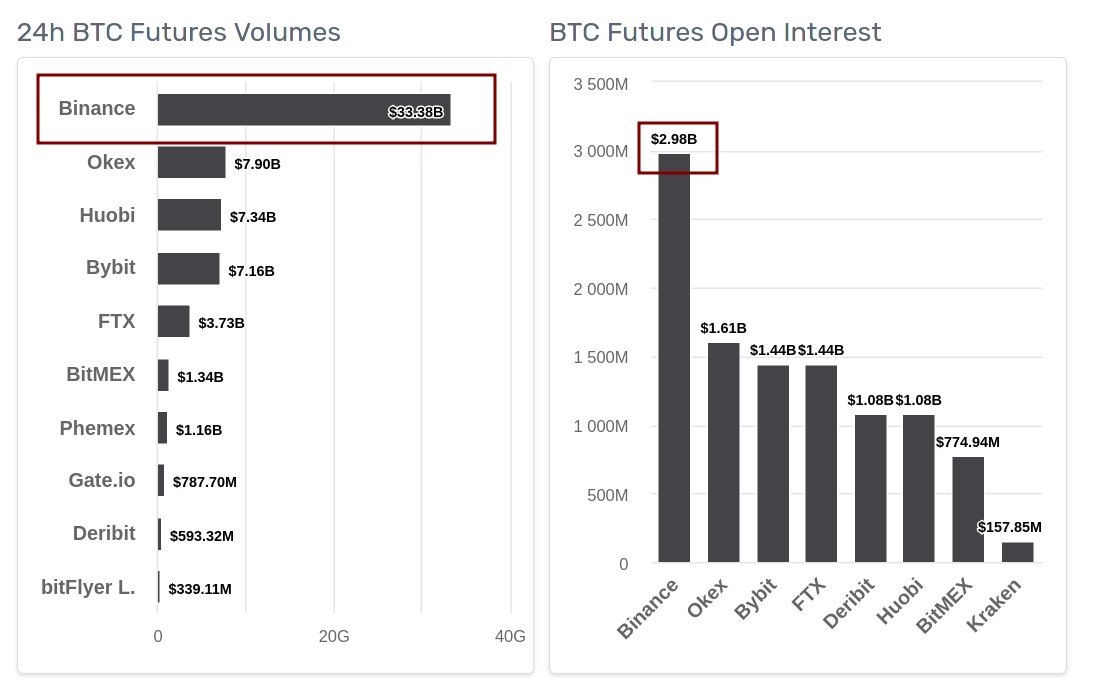

11/ On top of all of that, we know Binance does *billions* in volume.

Does it take a rocket scientist to put it all together and see this is probably a *huge* reason for why we see Tether disbursed in tranches of like 1B / 2B at a time?

Does it take a rocket scientist to put it all together and see this is probably a *huge* reason for why we see Tether disbursed in tranches of like 1B / 2B at a time?

12/ Oh, and notice how USDT is primarily distributed to exchanges with robust derivatives platforms in this space.

These aren't the only Tether exchanges in crypto but they seem to be soaking up nearly 100% of the USDT minted.

These aren't the only Tether exchanges in crypto but they seem to be soaking up nearly 100% of the USDT minted.

• • •

Missing some Tweet in this thread? You can try to

force a refresh