Midway $MWY $MWY.AX is a cyclical play on export soft woodchips. Today it's just a brief update on the market conditions, what to expect in the upcoming report - and why I increased my holdings.

Let's update our deep dive. 👇

Let's update our deep dive. 👇

https://twitter.com/DownunderValue/status/1387609867754504198

Midway provided guidance of $17-19m statutory earnings, and it's going to be at the low end.

This included improving operating conditions in 2H21 and some statutory tailwinds.

This included improving operating conditions in 2H21 and some statutory tailwinds.

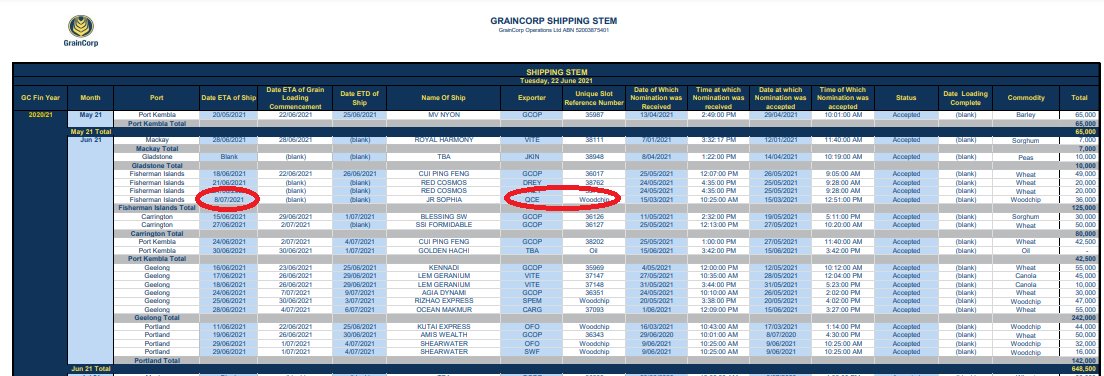

Main reason for the lower end of guidance is that a Brisbane shipment was meant to go in June (FY21) but was pushed back to July (FY22) - and it's 36,000tonnes of wood worth ~$2.5m. You can see it in Graincorps $GNC STEM. In the big scheme, this doesn't matter, but good to know.

The big picture is the global price. To recap, prices were flat at around US$430-450 for past 2 years.. but during that bump in 17-19, Midway paid 18c dividends (20% on current share price) when the global prices went up to US$800 (blue line).

Though that was a bit too hot for the market, and we're at around US$770 right now.

Interesting though, Shanghai Futures are showing prices of US$1000 in 2H22 when Chinese paper manufacturing capacity is set to increase.

Interesting though, Shanghai Futures are showing prices of US$1000 in 2H22 when Chinese paper manufacturing capacity is set to increase.

The increasing global woodchip prices also means their assets are worth more. Compounding this is increasing rural land prices (~13%).

In 1H21 they had impairments of $2m, my reckoning is that they may have +$9m of reevaluations like they did in FY20.

In 1H21 they had impairments of $2m, my reckoning is that they may have +$9m of reevaluations like they did in FY20.

Why does asset price reevaluations matter? Well that goes directly to book value / NAV, which is where the current stock price is trading at.

An additional $10m of NAV = +11.5c per share. Or, trading back at around $1. So I reckon today's price of 88c is a discount of 12%.

An additional $10m of NAV = +11.5c per share. Or, trading back at around $1. So I reckon today's price of 88c is a discount of 12%.

A couple of days back we also saw a significant off-market purchase of 2m shares at 90c - quite substantial for a thinly traded stock.

I don't know what this means - someone was willing to sell, someone willing to buy. But piqued my interest.

I don't know what this means - someone was willing to sell, someone willing to buy. But piqued my interest.

Management are continuing to expand their operations - buying up plantations in a fragmented market; expanding milling and storage capacity at key locations; consolidating their business. But they are doing this with low CAPEX while paying out cash to shareholders. 👍

Overall, I feel comfortable with the low downside risk, and improving market conditions over the next 12-24 months *should* reward shareholders. Should.. not will. Should.

• • •

Missing some Tweet in this thread? You can try to

force a refresh