Part-time researcher and analyst. Value orientated. ASX focused. Turning over unusual stones. I do regular deep dives (see my pinned tweet) and company updates.

2 subscribers

How to get URL link on X (Twitter) App

1. Yesterday I looked at Norway's resource tax and figured it was too difficult to find a good risk/reward bet. Right now the best forecasters of European monetary and fiscal policy seem to be a random number generator. Today I'm looking at Faroe Islands.

1. Yesterday I looked at Norway's resource tax and figured it was too difficult to find a good risk/reward bet. Right now the best forecasters of European monetary and fiscal policy seem to be a random number generator. Today I'm looking at Faroe Islands.https://twitter.com/DownunderValue/status/1575370023559827456

If you don't know what Delorean is, please don't @ me, just look at the original deep dive.

If you don't know what Delorean is, please don't @ me, just look at the original deep dive.https://twitter.com/DownunderValue/status/1385411573951340546

The FY22 results look very strong. Volume growth (3.7kt), ~20% increase in pricing, ~37% revenue increase, 19% reduction in production costs, etc. And for the first time, profitable! 🎯

The FY22 results look very strong. Volume growth (3.7kt), ~20% increase in pricing, ~37% revenue increase, 19% reduction in production costs, etc. And for the first time, profitable! 🎯

But before we jump in, if you want to see the original deep dive you can find it on my pinned tweet along with all the others.

But before we jump in, if you want to see the original deep dive you can find it on my pinned tweet along with all the others.https://twitter.com/DownunderValue/status/1494128519844188166

You can find my original thread here where I outlined TWE as an asset play, with the hope that profits may return in due course.

You can find my original thread here where I outlined TWE as an asset play, with the hope that profits may return in due course. https://twitter.com/DownunderValue/status/1359704968551231488

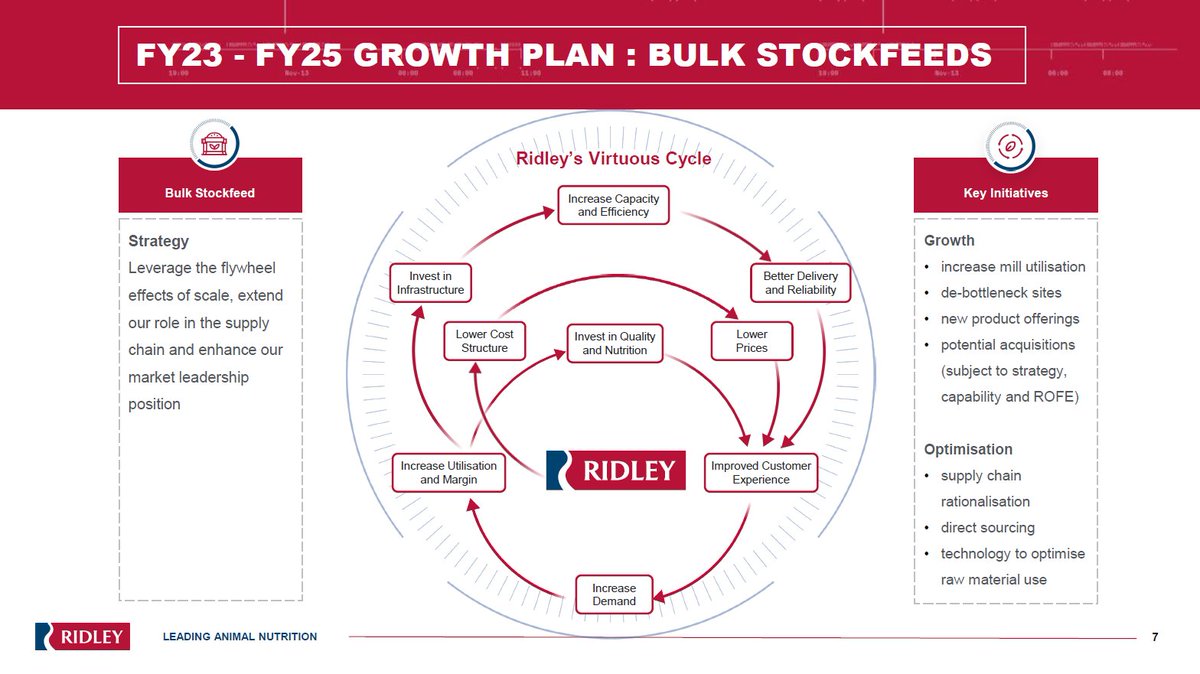

The P&L has some very good results in there for Ridley. The fact they are benefiting from commodity prices and the previous CAPEX cycle shows. 🤠

The P&L has some very good results in there for Ridley. The fact they are benefiting from commodity prices and the previous CAPEX cycle shows. 🤠

https://twitter.com/DownunderValue/status/1521645236682096641

The adjustments make things look a lot better. But to be honest, the 4Q was heavily impacted by the Russian aggression to Ukraine and the subsequent impact on Amcor's Russia's operations (withdrawing?)

The adjustments make things look a lot better. But to be honest, the 4Q was heavily impacted by the Russian aggression to Ukraine and the subsequent impact on Amcor's Russia's operations (withdrawing?)

The investment thesis is simple: buy renewable energy assets that are cheaper than the market's current acquisition price. Genex has risks, but it's also been de-risking.

The investment thesis is simple: buy renewable energy assets that are cheaper than the market's current acquisition price. Genex has risks, but it's also been de-risking. https://twitter.com/DownunderValue/status/1450610717908819970

1. Investment thesis: Stalwart

1. Investment thesis: Stalwart

1. Investment thesis: Stalwart.

1. Investment thesis: Stalwart.

Terragen is an ag-tech company focused on improving dairy outcomes for the environment and farmers.

Terragen is an ag-tech company focused on improving dairy outcomes for the environment and farmers.

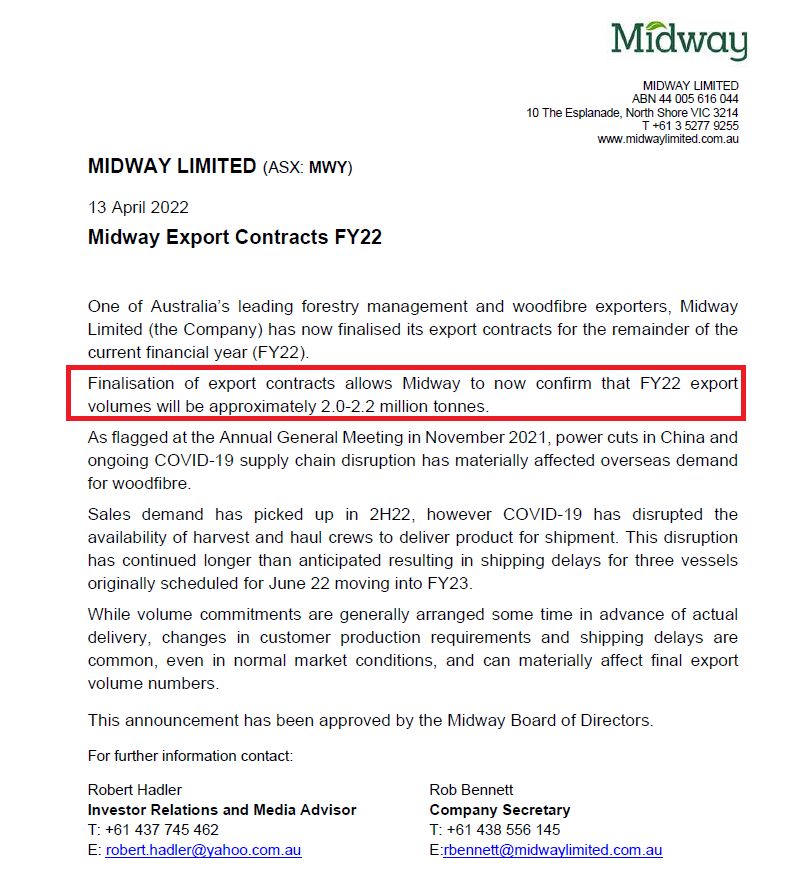

1. Investment thesis: Cyclical

1. Investment thesis: Cyclical

1. Investment thesis: Cyclical or Stalwart?

1. Investment thesis: Cyclical or Stalwart?

You may be aware that Midway has been queried by the ASX for not disclosing trading updates (results pending). During the query they flagged to ASX that the outlook for FY22 won't be met. At least they now are aware that is the case, and are disclosing it.

You may be aware that Midway has been queried by the ASX for not disclosing trading updates (results pending). During the query they flagged to ASX that the outlook for FY22 won't be met. At least they now are aware that is the case, and are disclosing it.https://twitter.com/DownunderValue/status/1511534012476854274

1. Investment Thesis: Basket of stalwarts

1. Investment Thesis: Basket of stalwarts

@iancassel recently discussed with @TreyLockerbie his strategy to microcap investing, which I am butchering here in my investment research process. Worth the listen.

@iancassel recently discussed with @TreyLockerbie his strategy to microcap investing, which I am butchering here in my investment research process. Worth the listen.

You can find the original deep dive and updates here.

You can find the original deep dive and updates here.https://twitter.com/DownunderValue/status/1438317805833621506

1. Investment thesis: Asset play.

1. Investment thesis: Asset play.