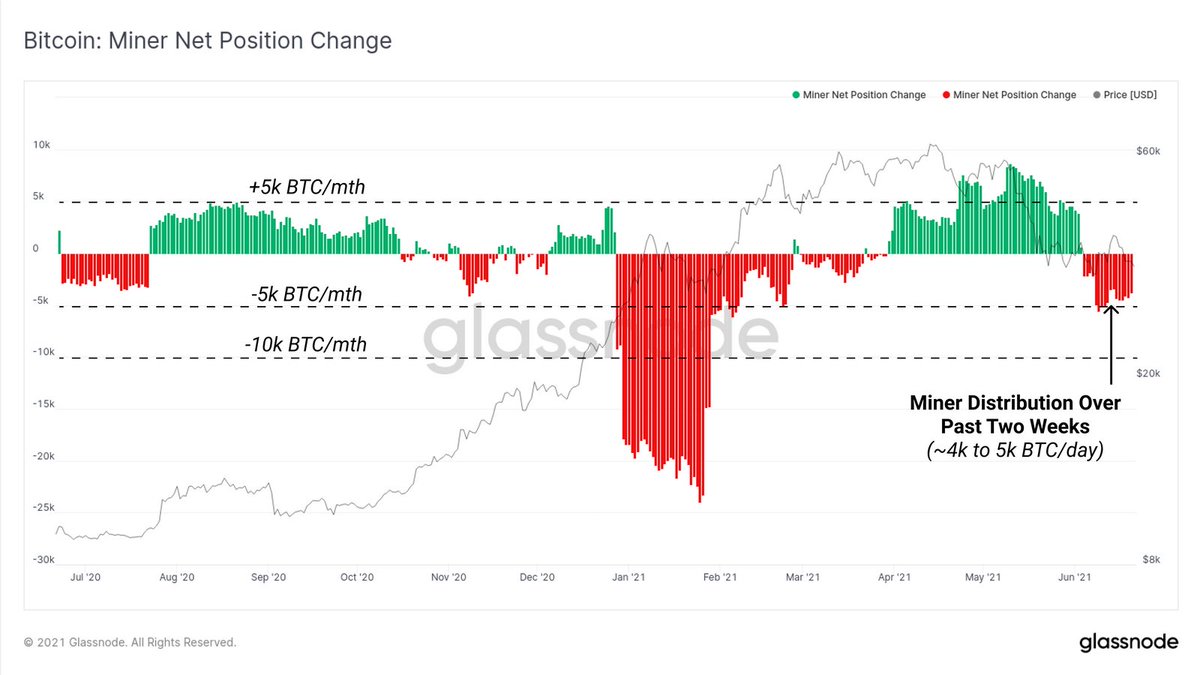

Q: did the miners selling approx 2.5k BTC total over the past 2 weeks tank the market? (possibly to finance their relocation out of China)

A: most likely no. Saylor bought 5x as much and he is just one guy.

On any bearish/bullish day, >100k BTC will change hands *per day*

A: most likely no. Saylor bought 5x as much and he is just one guy.

On any bearish/bullish day, >100k BTC will change hands *per day*

P.S. the screenshot is wrong, it shouldn’t say 4k-5k BTC/day but per month. cc: @glassnode

miners mine 900 BTC/day and could only sell 4k+/day for multiple days in a row if they’d been hoarding (not the case here)

miners mine 900 BTC/day and could only sell 4k+/day for multiple days in a row if they’d been hoarding (not the case here)

Generally speaking, miner selling behaviors are not able to absorb the slightest wind in sentiment. A bullish day doesn’t even notice miners measly sell pressure.

This is the same reason why the next halving isn’t going to do shit. 450 BTC/day less is a joke.

This is the same reason why the next halving isn’t going to do shit. 450 BTC/day less is a joke.

This is also why S2F is a joke. Sentiment moves the market. Rest is just noise.

Sorry to say but most detailed charts and analyses trying to peg the BTC price evolution down to these types of metrics—it’s good for newsletters and viral posts but it is not how the market works

Sorry to say but most detailed charts and analyses trying to peg the BTC price evolution down to these types of metrics—it’s good for newsletters and viral posts but it is not how the market works

The market, the overwhelmning market, is primarily driven by broad brush psychology. If you speak to enough traders and investors and are able to gauge their sentiment, their fears, their hopes, their stamina... you get a much better grip of what’s going on.

People don’t like this because it is too vague. People want simple charts with numbers. NVT ratios. Hodler net inflows/outflows. Onchain data. Exchange balances. Bitcoin days destroyed. Yeah even funding rates is useless for anyone except day traders.

I wish it was easy like that too but it just isn’t. Intra-month moves are just a super messy phenomenon with tons of unreasonable biases and unfounded fears and ideas floating around and crushing into each other. Special numbers that give people panic. Exhaustion. Headlines. FOMO

The only proper guesses we can make are ones like ”oh yeah bitcoin could totally reach gold’s market cap within the next 10 years”. As that happens, our journey there is going to look more like the scribblings of a retarded child than anything academic or quantifiable.

I’m pretty convinced that the only way to learn to trade the market is by learning to understand how it breathes. Or rather, how we breathe. Because the bitcoin price, with all the misinfo and confusion, isn’t a reflection of anything that has anything to do with bitcoin.

It’s just a reflection of us. We look at the price but the price is just a reflection of *our* aggregate emotional state.

I tell you the bitcoin price doesn’t give a shit if the public LN capacity is 1500 BTC or 15,000 BTC. Only how we feel about it is important.

I tell you the bitcoin price doesn’t give a shit if the public LN capacity is 1500 BTC or 15,000 BTC. Only how we feel about it is important.

Ok to be fair: ever since COVID hit, bitcoin has been acting a global macro asset. It has now started to respond to FOMC, interest rate expectations, QE expectations, liquidity of cash in the financial system just like any other risk-on/risk-off financial asset

There are ofc other things that will move markets too on the long time horizon.. capital being passed down from baby boomers to millenials ($70t next 3 decades). On-ramps being built. Better investment instruments. Improved UX. Demographics changes. Improved regs & tax treatment.

Any way not sure where I’m going with this but most of you are looking at pretty silly metrics/irrelevant charts that look cool

You include them in your pitch decks & marketing materials to look smart and data-driven

And it’s interesting & cute

But it doesn’t move the market

You include them in your pitch decks & marketing materials to look smart and data-driven

And it’s interesting & cute

But it doesn’t move the market

• • •

Missing some Tweet in this thread? You can try to

force a refresh