Healthia $HLA $HLA.AX has a vision to be Australia’s leading diversified allied healthcare provider by rolling-up a fragmented industry.

Today, @Tristanwaine and @DownunderValue team up to assess this investment prospect.

Let’s take a deep dive. 👇

Today, @Tristanwaine and @DownunderValue team up to assess this investment prospect.

Let’s take a deep dive. 👇

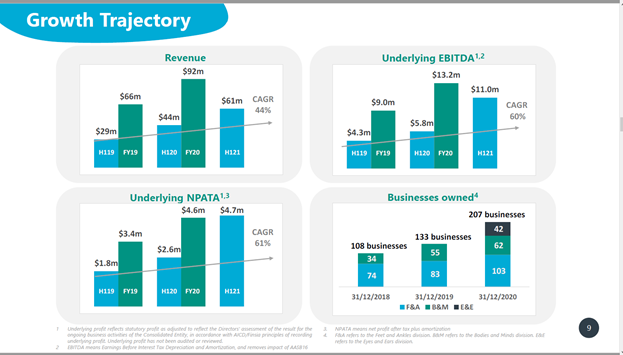

1.Investment thesis: A fast growing company; operating in a growing industry; a fragmented market with lots of potential for roll-ups; horizontal and vertical integration opportunities; aggressive management.

2.Healthia’s business model is a roll-up platform operating across allied health. Put simply, they want to acquire smaller “mum and dad” businesses to expand their geographic footprint, as well as expand into new areas of healthcare.

3.Healthia started in the podiatry clinics of Queensland, and have since expanded from ‘feet and ankles’ (they have orthotics 3D manufacturing capacity too) to ‘bodies and minds’ (physio, OT) and into ‘eyes and ears’ (optical, audio)

4.Healthia has expanded quite rapidly their footprint (pun intended), and as you can see below have a long runway in terms of potential expansion.

5.They report their TAM at ridiculous levels of $9.8bn – which increased by $3.3bn or 50% because of one optical acquisition?

To frame it, consider Specsavers in optical perhaps the most ubiquitous example which has only 40% market share!

To frame it, consider Specsavers in optical perhaps the most ubiquitous example which has only 40% market share!

6.Organic growth is not a major focus – part of the reason is that medicare / private insurance sets limits on their potential revenue, so unless they expand the number of hours per medical professional or increase GAP payments, organic growth is unlikely.

7.So that’s the rub. They’re in a growing market of mid single digits, and the main plan is acquisition growth.

So let’s turn our attention to the main question: are they profitable, and are they creating or destroying shareholder value?

So let’s turn our attention to the main question: are they profitable, and are they creating or destroying shareholder value?

9....Jobkeeper was obtained in March 2020, enabling 6 months of subsidised wages, despite returning to regular working conditions in 3 months.

As such Jobkeeper received from Jul-Sep is ‘Free’ from the government ($4.5m) which leads to $0.4m NPAT. 🤯

As such Jobkeeper received from Jul-Sep is ‘Free’ from the government ($4.5m) which leads to $0.4m NPAT. 🤯

10.Acquisitions have also been getting more expensive.

While they have a stated target price of 3-4.5xEBTDA, over time this has crept up to as high as x8.2.

While they have a stated target price of 3-4.5xEBTDA, over time this has crept up to as high as x8.2.

11.... and the acquisitions have actually added little to no value on a per share basis.

They have been raising debt & issuing ‘Clinical Class Shares’ which dilutes parent shareholders.

The businesses themselves are barely profitable on a real earnings basis.

They have been raising debt & issuing ‘Clinical Class Shares’ which dilutes parent shareholders.

The businesses themselves are barely profitable on a real earnings basis.

12.Tristan broke down the maths of value destruction:

oListed with ~63m shares + ~13m net debt (20c/share) on ~70m of revenue (1.10/share) with 14.4% clinic class

oNow ~90m shares + ~3m rights + ~38.6m net debt (41c/share) on ~110-120m (1.27/share) with 17% clinic class

oListed with ~63m shares + ~13m net debt (20c/share) on ~70m of revenue (1.10/share) with 14.4% clinic class

oNow ~90m shares + ~3m rights + ~38.6m net debt (41c/share) on ~110-120m (1.27/share) with 17% clinic class

13.The balance sheet could spell disaster.

They currently have a deficit of ~$55m (net working capital + fixed assets + debt) whilst continuing to overpay for acquisitions.

They currently have a deficit of ~$55m (net working capital + fixed assets + debt) whilst continuing to overpay for acquisitions.

14.As of 31-Dec the covenants were stretched to their limits - threatening another capital raise.

Only with additional EBITDA can they continue to increase their leverage, more likely to pay down debt in the future, likely with a capital raise.

Only with additional EBITDA can they continue to increase their leverage, more likely to pay down debt in the future, likely with a capital raise.

15.Management is doing what’s in their best interest, and that’s nowhere near aligned with shareholders.

They have issued a further 3.2m performance rights based on 10% *underlying* EPS growth from 2020-23. Let’s break that down.

They have issued a further 3.2m performance rights based on 10% *underlying* EPS growth from 2020-23. Let’s break that down.

16.Underlying EPS is defined as Underlying NPATA (Which adds back acquisition costs, current year share grants & bad debts) divided by Basic shares outstanding (Not including un-exercised rights).

17.Further using 2020 as the base when performance was so poor.. well they have already had 78% growth in 1H20 so no further incentives required until 2023 to get their performance rights.

18.Overall, red flags across the balance sheet. The industry lends itself to the roll-up strategy, but the manner in which it is being implemented completely undermines shareholder capital.

It’s a ‘sell’ for us.

It’s a ‘sell’ for us.

It’s been fun to do joint research with @Tristanwane and @downundervalue – so if you’ve enjoyed it, bash the like / retweet / follow buttons.

Questions and feedback always welcome.

DYOR. Disclaimer, neither of us hold a position in HLA.

Questions and feedback always welcome.

DYOR. Disclaimer, neither of us hold a position in HLA.

Oops! Don't follow @tristanwane with no tweets and 1 follower.

I strongly recommend following @Tristanwaine who's posts are mildly more informative 😉

I strongly recommend following @Tristanwaine who's posts are mildly more informative 😉

• • •

Missing some Tweet in this thread? You can try to

force a refresh