A thread on the snippets (paragraphs & quotes) from the book ‘Why We Sleep’ by Matthew Walker 💤

One third of our lives, better read about it.

This thread will be updated as I read further & further.

One third of our lives, better read about it.

This thread will be updated as I read further & further.

1/ “Two-thirds of adults throughout all developed nations fail to obtain the recommended eight hours of nightly sleep.”

Imagine if you don’t have that rare ‘short sleep’ genes 🧬 that allows you to do will less than 5 hours of sleep 🛌.

Imagine if you don’t have that rare ‘short sleep’ genes 🧬 that allows you to do will less than 5 hours of sleep 🛌.

5/ ‘Are there any biological functions that do not benefit by a good night’s sleep? so far, the results of thousands of studies insist that no, there aren’t.’

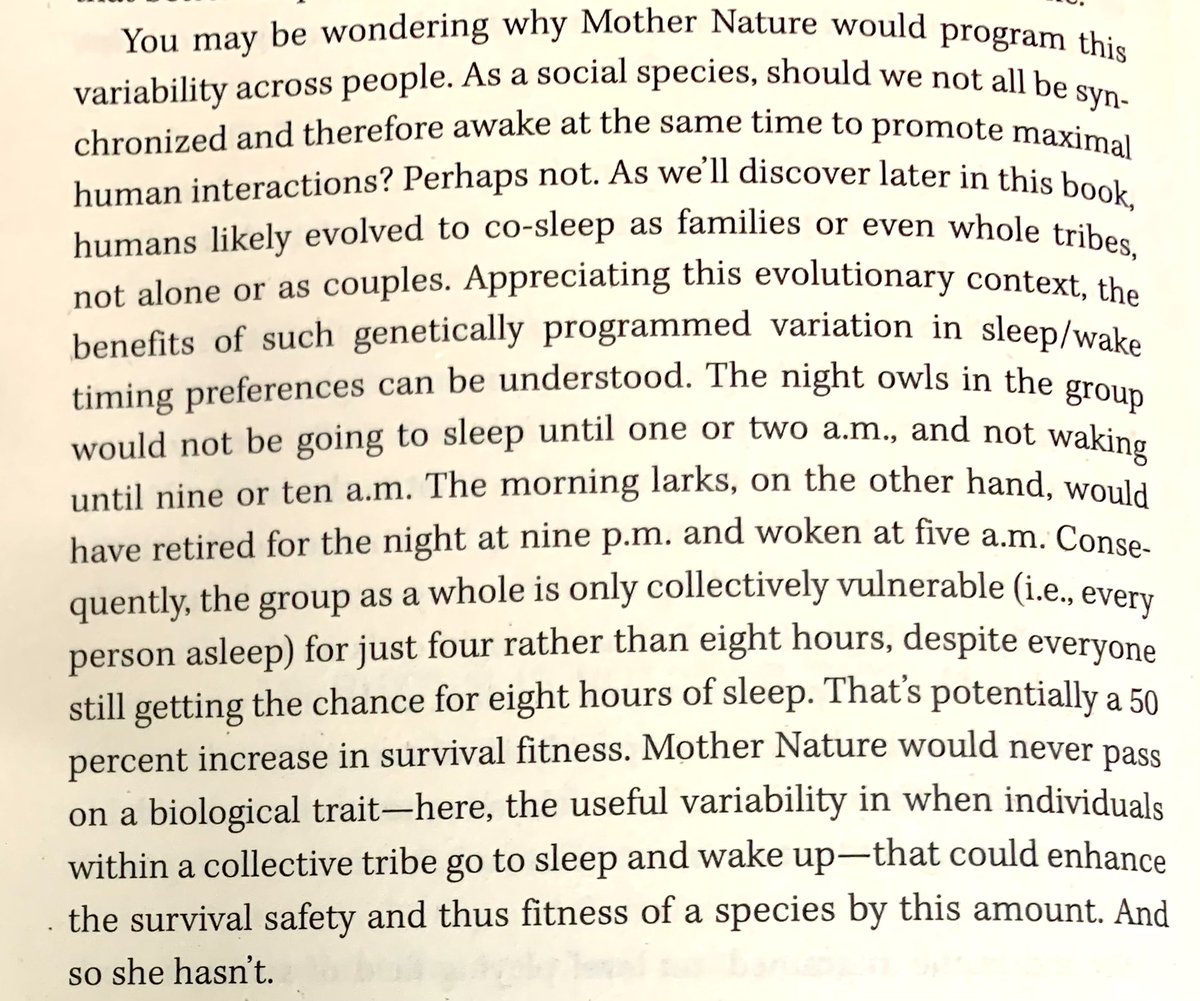

Nature, the most magnificent architect.

Nature, the most magnificent architect.

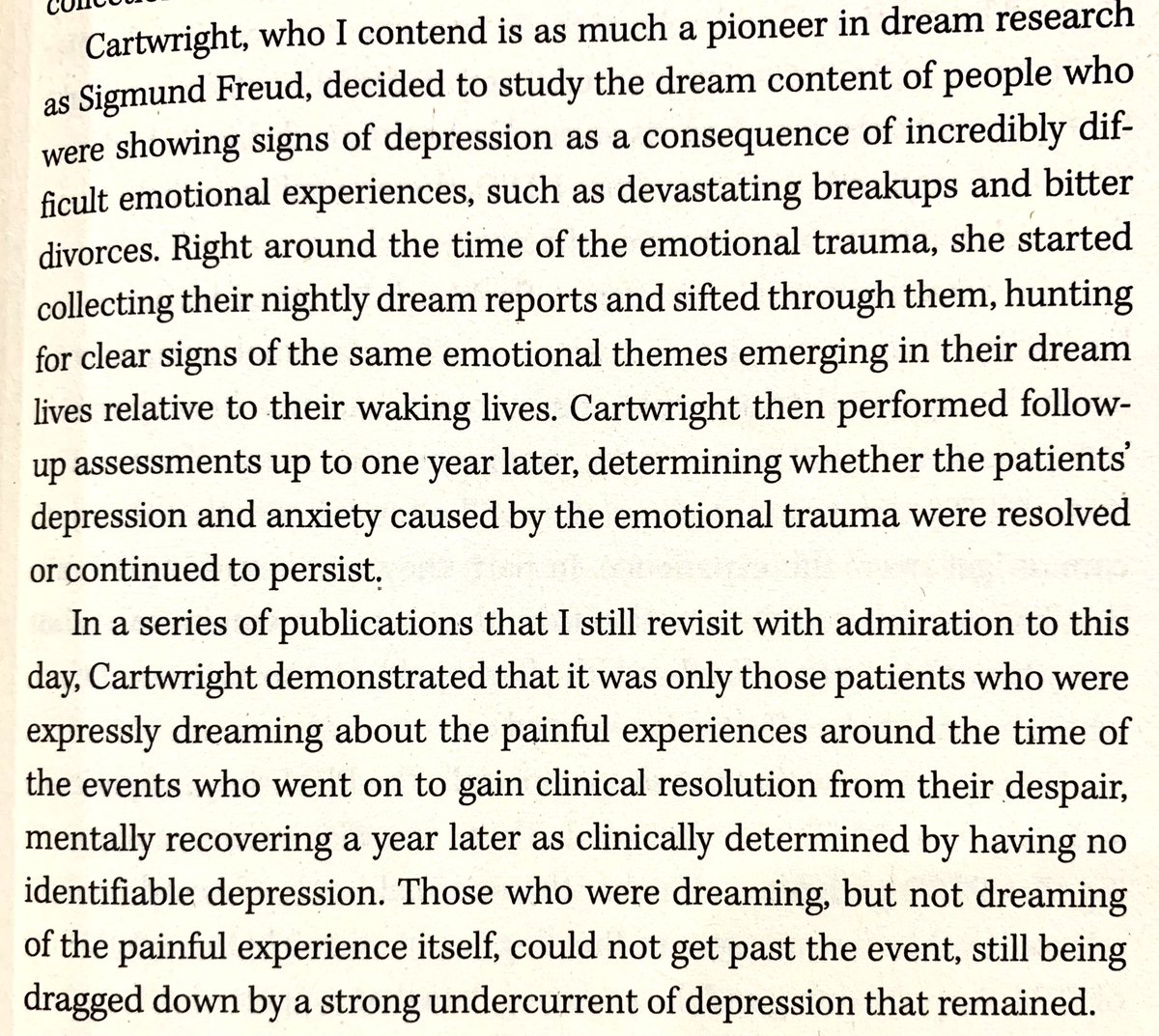

18/ Macbeth: Act two, scene two (1611)

Shakespeare prophetically states

“Sleep that knits up the raveled sleave of care,

The death of each day’s life, sore labor’s bath,

Balm of hurt minds, great nature’s second course,

Chief nourisher in life’s feast.”

Shakespeare prophetically states

“Sleep that knits up the raveled sleave of care,

The death of each day’s life, sore labor’s bath,

Balm of hurt minds, great nature’s second course,

Chief nourisher in life’s feast.”

In simpler words:

Sleep that soothes away all our worries. Sleep that puts each day to rest. Sleep that relieves the weary laborer and heals hurt minds. Sleep, the main course in life’s feast, and the most nourishing.

Sleep that soothes away all our worries. Sleep that puts each day to rest. Sleep that relieves the weary laborer and heals hurt minds. Sleep, the main course in life’s feast, and the most nourishing.

24/ In USA, Vehicles accidents (12 lakhs per year) caused by drowsy driving exceed those caused by alcohol & drugs combined 🤯

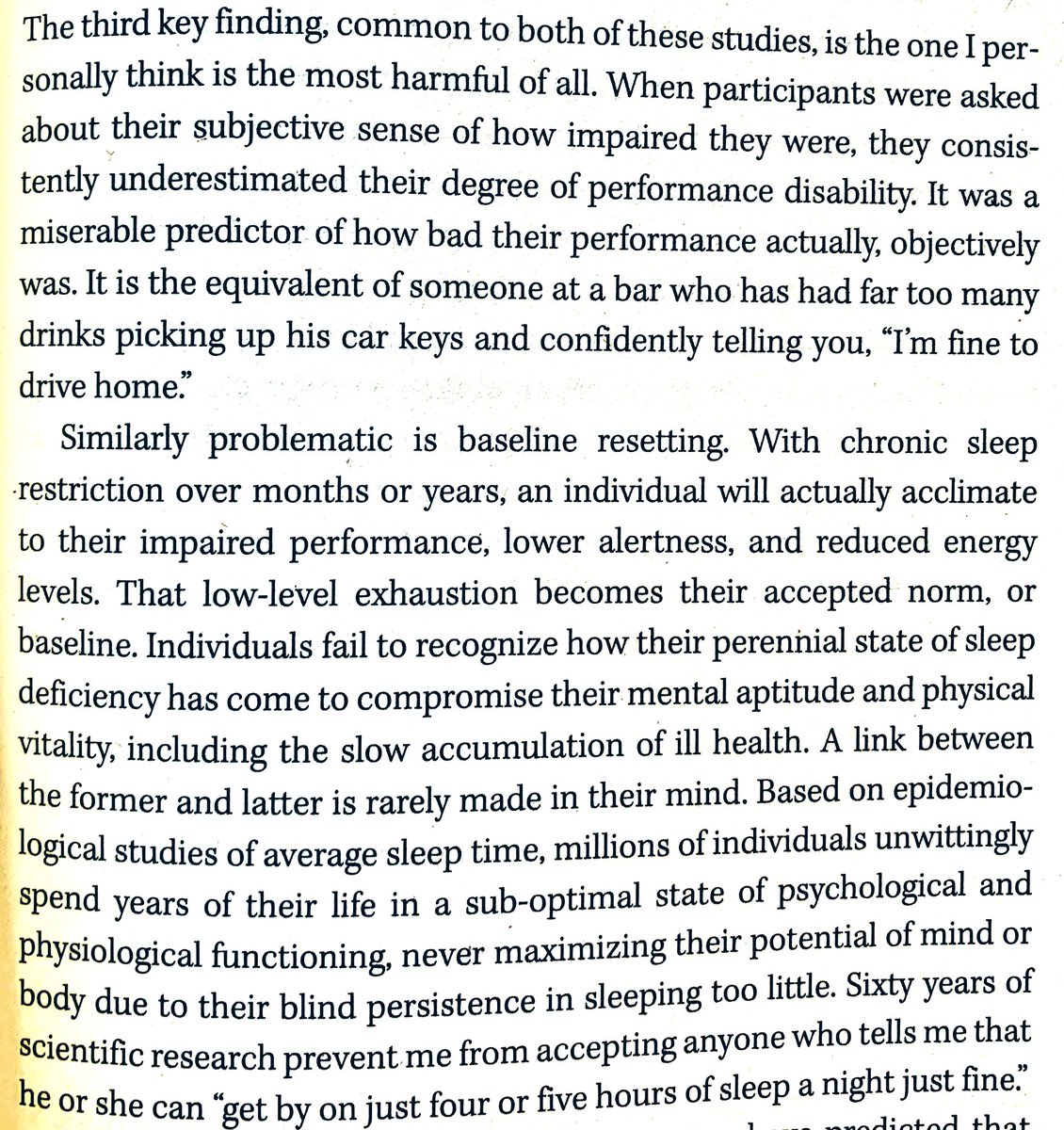

26/ “The recycle rate of a human being is around sixteen hours. After sixteen hours of being awake, the brain begins to fail. Humans need more than seven hours of sleep each night to maintain cognitive performance.”

• • •

Missing some Tweet in this thread? You can try to

force a refresh