The world’s cargo ships can’t get their act together:

🚢There were the lines at the ports of Los Angeles and Long Beach

🚢The Ever Given got stuck in the Suez Canal for a week

🚢The port of Yantian in the Chinese city of Shenzhen is joining the fun

trib.al/DcTs1TB

🚢There were the lines at the ports of Los Angeles and Long Beach

🚢The Ever Given got stuck in the Suez Canal for a week

🚢The port of Yantian in the Chinese city of Shenzhen is joining the fun

trib.al/DcTs1TB

If you think this issue will smooth itself out, you might be in for a shock.

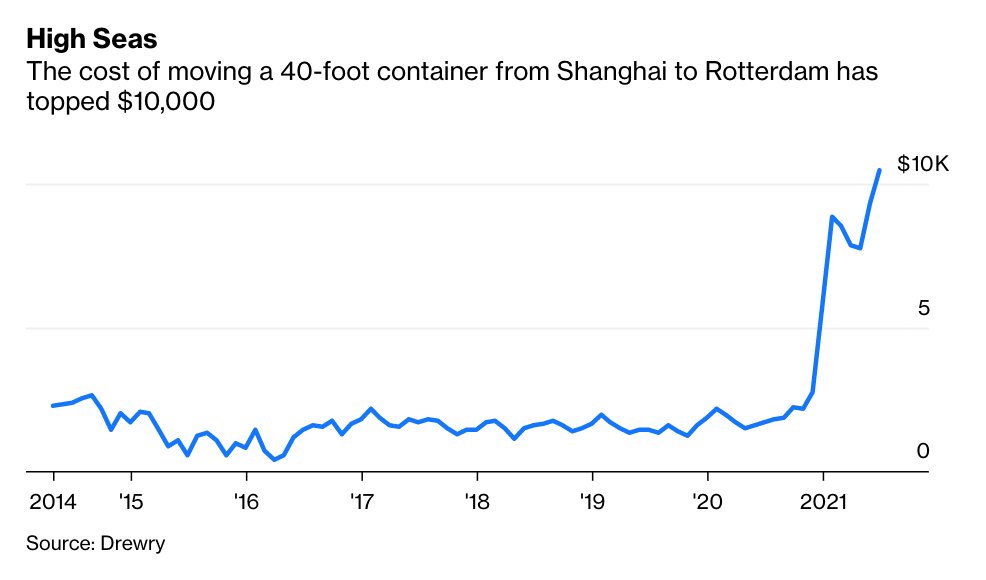

The factors that have driven Asia-Europe container rates to record levels of more than $10,000 per 40-foot box aren’t a temporary problem. Returning to normality could take years twitter.com/i/broadcasts/1…

The factors that have driven Asia-Europe container rates to record levels of more than $10,000 per 40-foot box aren’t a temporary problem. Returning to normality could take years twitter.com/i/broadcasts/1…

The container shipping industry is usually such a well-oiled machine that we barely notice it. In 2016, you could shift a metric ton of goods from Shanghai to Rotterdam for $10.

The flip side of that is that when things go wrong, they go seriously wrong trib.al/DcTs1TB

The flip side of that is that when things go wrong, they go seriously wrong trib.al/DcTs1TB

Containers aren’t in the right places.

By September 2020, volumes were already running ahead of their seasonally adjusted levels in January and February, as demand for medical equipment and spending on durable goods picked up in rich countries trib.al/DcTs1TB

By September 2020, volumes were already running ahead of their seasonally adjusted levels in January and February, as demand for medical equipment and spending on durable goods picked up in rich countries trib.al/DcTs1TB

Vessels started making their return journeys empty trying to make all those deliveries on time.

That’s resulted in a glut of containers in European and North American ports and a shortage in Asia, pushing freight rates to astronomical levels trib.al/DcTs1TB

That’s resulted in a glut of containers in European and North American ports and a shortage in Asia, pushing freight rates to astronomical levels trib.al/DcTs1TB

High prices can be seen as signals that will push the industry to rebalance itself.

That already seems to be having an effect. More than 360,000 empty containers were shipped from the port of Los Angeles last month, roughly double usual seasonal rates trib.al/DcTs1TB

That already seems to be having an effect. More than 360,000 empty containers were shipped from the port of Los Angeles last month, roughly double usual seasonal rates trib.al/DcTs1TB

The bigger issue is yet to come.

Covid dealt a hammer-blow to global merchandise volumes, but the slowdown had been going on for some time before that, thanks to Trump’s trade wars. As a result, the freight industry has been cutting back on investment trib.al/DcTs1TB

Covid dealt a hammer-blow to global merchandise volumes, but the slowdown had been going on for some time before that, thanks to Trump’s trade wars. As a result, the freight industry has been cutting back on investment trib.al/DcTs1TB

Since March 2019, Maersk’s capital investment has come to just $2.9 billion.

That’s a problem that will take years of building new ships, berths and port loading cranes to fix trib.al/DcTs1TB

That’s a problem that will take years of building new ships, berths and port loading cranes to fix trib.al/DcTs1TB

Analysts expect Maersk to make more profits in 2021 than in the previous seven put together.

That will lead to another orgy of shipbuilding.

At some point down the line, the world will face a glut of container capacity like it did in 2016 trib.al/DcTs1TB

That will lead to another orgy of shipbuilding.

At some point down the line, the world will face a glut of container capacity like it did in 2016 trib.al/DcTs1TB

A world economy where trade is booming will be dependent on a shipping industry that never expected such luck.

The chaos and costs on the high seas will eventually turn around.

But it’s going to take a while trib.al/DcTs1TB

The chaos and costs on the high seas will eventually turn around.

But it’s going to take a while trib.al/DcTs1TB

• • •

Missing some Tweet in this thread? You can try to

force a refresh