Risk is a nuanced topic, so let's run down the list of possible risks a user would be exposed to in our previously mentioned strategy.

Price Risk

1. Using a and c tokens as the base denomination, the user is taking 0 price risk.

2. This is what we refer to when describing the strategy as no risk.

3. Regardless of market volatility, the returns have been fixed in aUSDC and cDAI terms. There is no price risk.

1. Using a and c tokens as the base denomination, the user is taking 0 price risk.

2. This is what we refer to when describing the strategy as no risk.

3. Regardless of market volatility, the returns have been fixed in aUSDC and cDAI terms. There is no price risk.

Smart Contract Risk

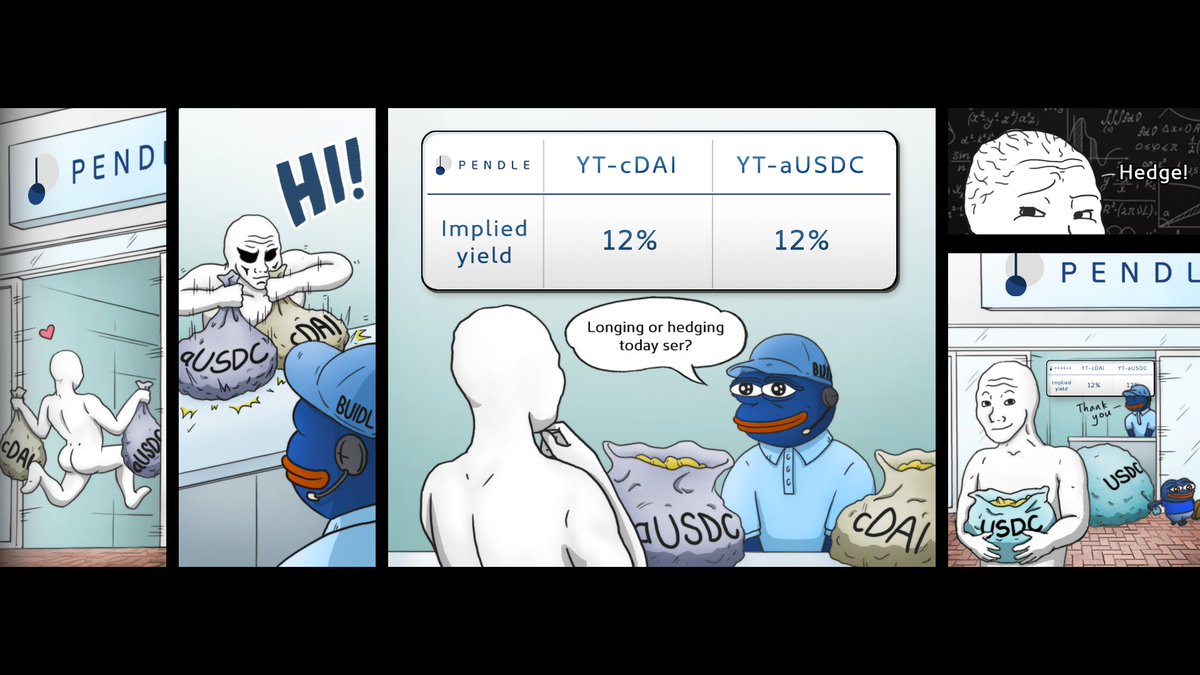

1. User takes smart contract risk of Pendle .

2. As a holder of a and c tokens, user takes smart contract risk of the underlying protocols.

3. This applies to any future protocol integrations.

Users uncomfortable with this should NOT use the protocol.

1. User takes smart contract risk of Pendle .

2. As a holder of a and c tokens, user takes smart contract risk of the underlying protocols.

3. This applies to any future protocol integrations.

Users uncomfortable with this should NOT use the protocol.

We're working to reduce smart contract risk. Help us out by taking part in our bug bounty with @immunefi!

immunefi.com/bounty/pendle/

immunefi.com/bounty/pendle/

• • •

Missing some Tweet in this thread? You can try to

force a refresh