1. In light of the Mr. Carwash IPO ( $MCW ), here's a case study I did a couple years ago pitching a carwash roll-up strategy: 35% IRR / 4.4x MOIC as modeled assuming a modest 10x EBITDA exit. Was always partial to the idea (didn't get the job) so figured I'd share with you all!

2. There's a couple different kinds of car wash. Express (conveyor belt) carwashes are the best and growing segment.

3. Underlying trends are good -> growing fleet of cars, more people using professional carwashes vs washing at home, and conveyor express carwashes taking share from older carwash styles

4. The industry is highly fragmented, mostly regional with a ton of medium or bite size acquisition opportunities, MCW is by the far the largest chain and made up just 4% of total market (in 2017).

5. Locations have good unit economics with solid cash flow; a well utilized carwash making >30% EBITDA margin.

6. But of course with a roll-up its all about multiple arbitrage... Buy mom and pops for 4x and sell a portfolio to a consolidator for >10x. $MCW is trading above 20x forward...

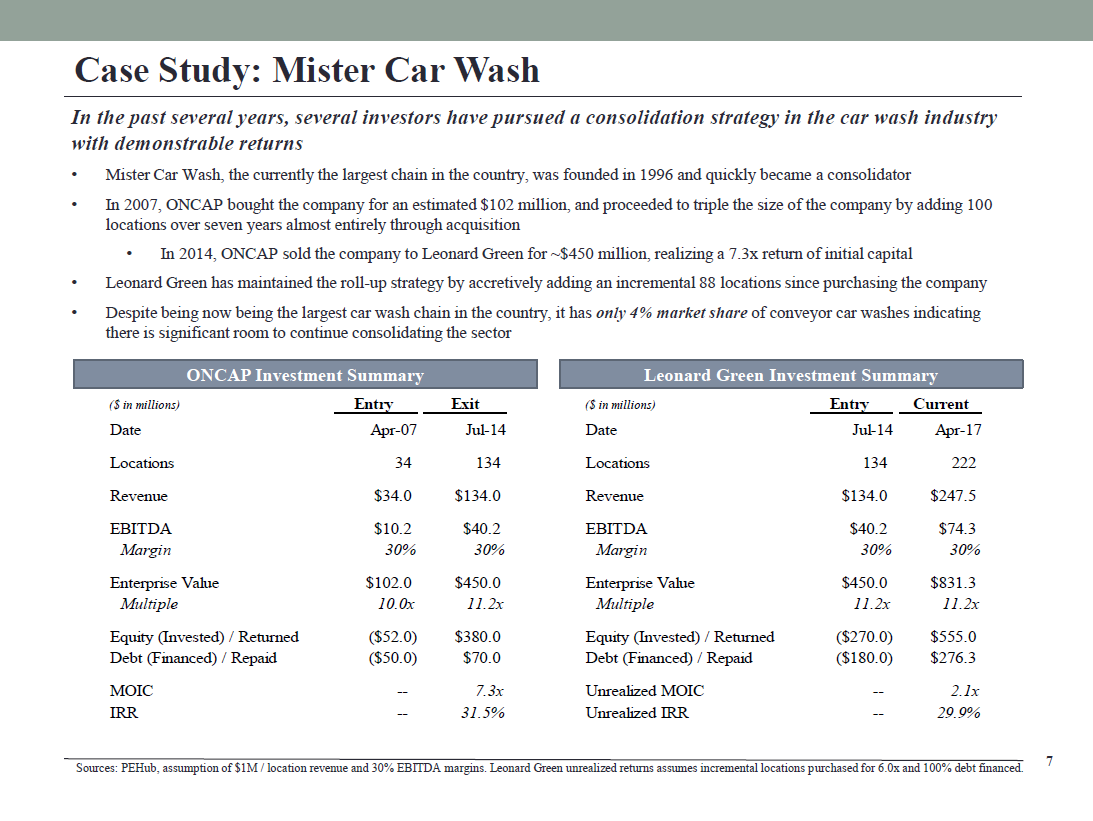

7. Prior P/E owner Oncap and Leonard Green both made >30% returns over a total 10yr period with Mr Carwash... Today's IPO means those returns are likely understated.

8. Key merits: Solid growing business, highly fragmented, perfect for a rollup

Key considerations: The space was already getting crowded with PE money which would bid up the mid-size chains and compress the multiple arb

Key considerations: The space was already getting crowded with PE money which would bid up the mid-size chains and compress the multiple arb

9. Buying a midsize chain at 10x with 4.5x leverage, rolling 15 locations a year at 6x, and exiting at a modest 10x gets you a 35% IRR / 4.4x on a five year hold. Again, $MCW is trading above 20x...

11. Fun blast from the past! Can't speak at all to $MCW today... but sure the roll-up economics still makes sense for lower market P/E whose willing to get their hands dirty

UPDATE: Since some people have asked - I uploaded the full deck here: …stbearstandingcom.files.wordpress.com/2021/06/2017.0…

• • •

Missing some Tweet in this thread? You can try to

force a refresh