#HDFCLIFE has come up with its first integrated report ever for the year 2020-21

Tried to cover some insights from the report in this thread 😊🧵

Report link:

bseindia.com/xml-data/corpf…

@soicfinance @ishmohit1 @suru27 @aditya_kondawar @dmuthuk @itsTarH @HDFCLIFE

Retweet pls 👍🏼

Tried to cover some insights from the report in this thread 😊🧵

Report link:

bseindia.com/xml-data/corpf…

@soicfinance @ishmohit1 @suru27 @aditya_kondawar @dmuthuk @itsTarH @HDFCLIFE

Retweet pls 👍🏼

REFLECT :: RESHAPE :: RESURGE

Vision to be the most successful and admired life insurance company, which means that we are the most trusted Company, the easiest to deal with, offer the best value for money and set the standards for the industry. “THE MOST OBVIOUS CHOICE FOR ALL”.

Vision to be the most successful and admired life insurance company, which means that we are the most trusted Company, the easiest to deal with, offer the best value for money and set the standards for the industry. “THE MOST OBVIOUS CHOICE FOR ALL”.

🖊 First private insurance company to get license from IRDA in 2000. Later commenced business in 2001.

🖊 Key strengths include customer centric approach, diversified distribution, balanced product portfolio, Robust risk management and digital capabilities.

🖊 Key strengths include customer centric approach, diversified distribution, balanced product portfolio, Robust risk management and digital capabilities.

🖊 It has a bouquet of innovative protection, pension, saving, investment and health solutions

🖊 20636 employees, 390 branches, 300+ partners and 1lac fin consultants

🖊 4 cr lives insured, new business sum assured 5.76 lac cr, AUM 1.74 lac cr, indian embedded value 26.6 k cr

🖊 20636 employees, 390 branches, 300+ partners and 1lac fin consultants

🖊 4 cr lives insured, new business sum assured 5.76 lac cr, AUM 1.74 lac cr, indian embedded value 26.6 k cr

🖊 Key 2021 figures - Total premium 38.5 lac crore, value of new business 2185 crore, PAT 1360 crore and solvency 201%

🖊 See powerful growth drivers in one of largest and under penetrated market like India. Expect Protection and Retiral segments to grow faster than Savings

🖊 See powerful growth drivers in one of largest and under penetrated market like India. Expect Protection and Retiral segments to grow faster than Savings

🖊 Capitals that power the business.

1/ Financial Capital

2/ Manufactured Capital

3/ Intellectual Capital

4/ Human Capital

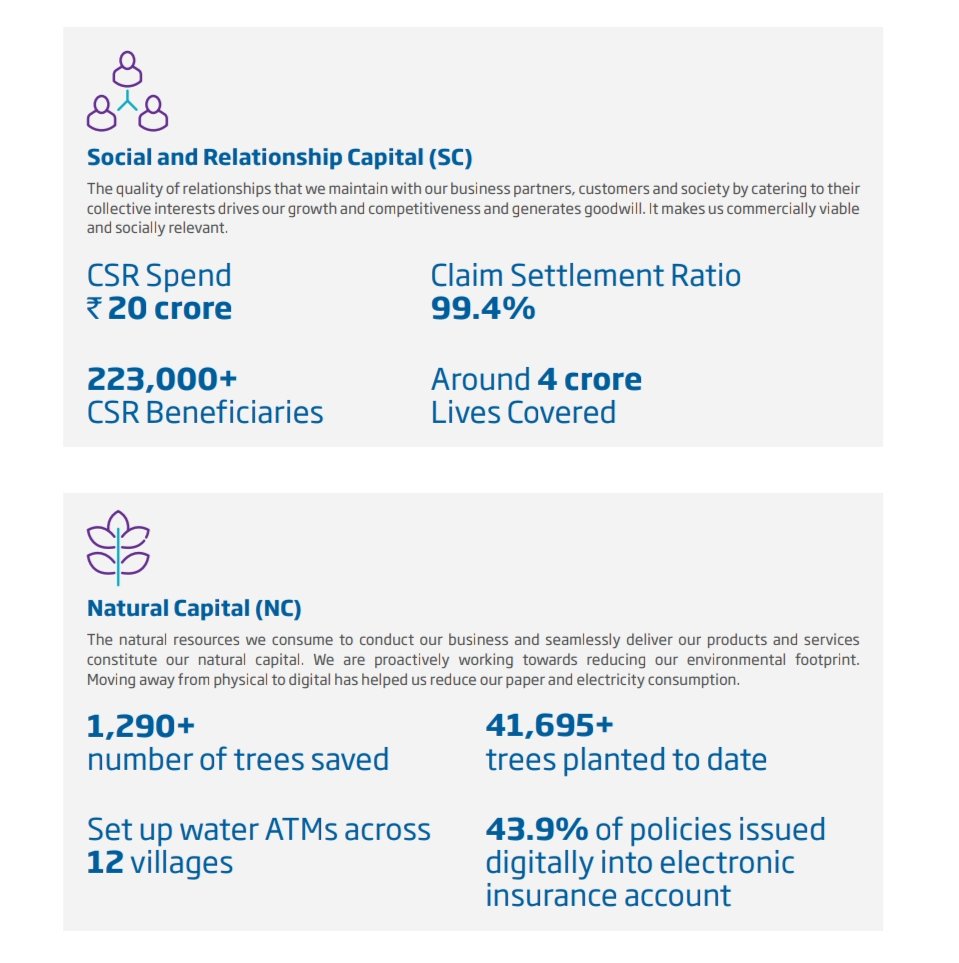

5/ Social and Relationship Capital

6/ Natural Capital

🖊 Strategy: 5 pillars of our strategy

1/ Financial Capital

2/ Manufactured Capital

3/ Intellectual Capital

4/ Human Capital

5/ Social and Relationship Capital

6/ Natural Capital

🖊 Strategy: 5 pillars of our strategy

🖊 Reimagining insurance: Digital world

95% renewals made digitally

97.62% non investigation claims in 1 day

100% claims intimated via Life Easy settled in 1 day

280+ Robotic Process Automation (RPAs)

95% renewals made digitally

97.62% non investigation claims in 1 day

100% claims intimated via Life Easy settled in 1 day

280+ Robotic Process Automation (RPAs)

🖊 Quality of Board and Management: Our Board consists of 11 Directors, including 6 Independent Directors. Providing a good mix

🖊 Industry Environment:

🔸Life Insurance industry grew by 7% garnering 2.78 lac crore vs 2.59 lac crore new business premiums.

🔸Private insurers grew by 8% and 20% in individual and group business respectively.

🔸LIC de-grew by 3% in individual and grew by 1% in group business.

🔸Life Insurance industry grew by 7% garnering 2.78 lac crore vs 2.59 lac crore new business premiums.

🔸Private insurers grew by 8% and 20% in individual and group business respectively.

🔸LIC de-grew by 3% in individual and grew by 1% in group business.

🔸Development of alternate channels and product innovation resulted in growth in individual business of pvt players to 60% in 2020-21 vs 37% in 2011-12.

🔸Total of 24 pvt players in industry out of which top 10 accounted for 88% share in individual business premiums in 2020-21

🔸Total of 24 pvt players in industry out of which top 10 accounted for 88% share in individual business premiums in 2020-21

🖊 HDFC Life FY21 market share:

15.5% Individual Business

27.6% Group Business

21.5% Total New Business

15.5% Individual Business

27.6% Group Business

21.5% Total New Business

Disc: Invested

My view:

Life Insurance is a necessity which is seldom realised in our country. Many people are either not insured or not adequately insured. But during such unprecedented times of pandemic people are gradually accepting its importance.

Cont...

My view:

Life Insurance is a necessity which is seldom realised in our country. Many people are either not insured or not adequately insured. But during such unprecedented times of pandemic people are gradually accepting its importance.

Cont...

Size of opportunity is large in India still being so under penetrated. Not one but multiple companies can eat into LIC's share and come out winning. Bancassurance & digital push via e-commerce should help them thrive.

Hope to have added value. Always keen to learn. 🙏🏼

Hope to have added value. Always keen to learn. 🙏🏼

• • •

Missing some Tweet in this thread? You can try to

force a refresh