1/x I decided to pick apart and share my favorite pieces from Rob Vinall's wonderful letter "More Accuracy" that he wrote earlier this year, who I believe deserves more attention. The two main components in the letter is 'Value vs. Growth' & Adaptability. 🧵👇🏼

2/x In the first part he implicitly writes that he himself, and perhaps many others from his generation, maybe put a little too much emphasis on a company's history, and too little on their future.

Is some of reversion to the mean investing being arbitraged away by computers?

Is some of reversion to the mean investing being arbitraged away by computers?

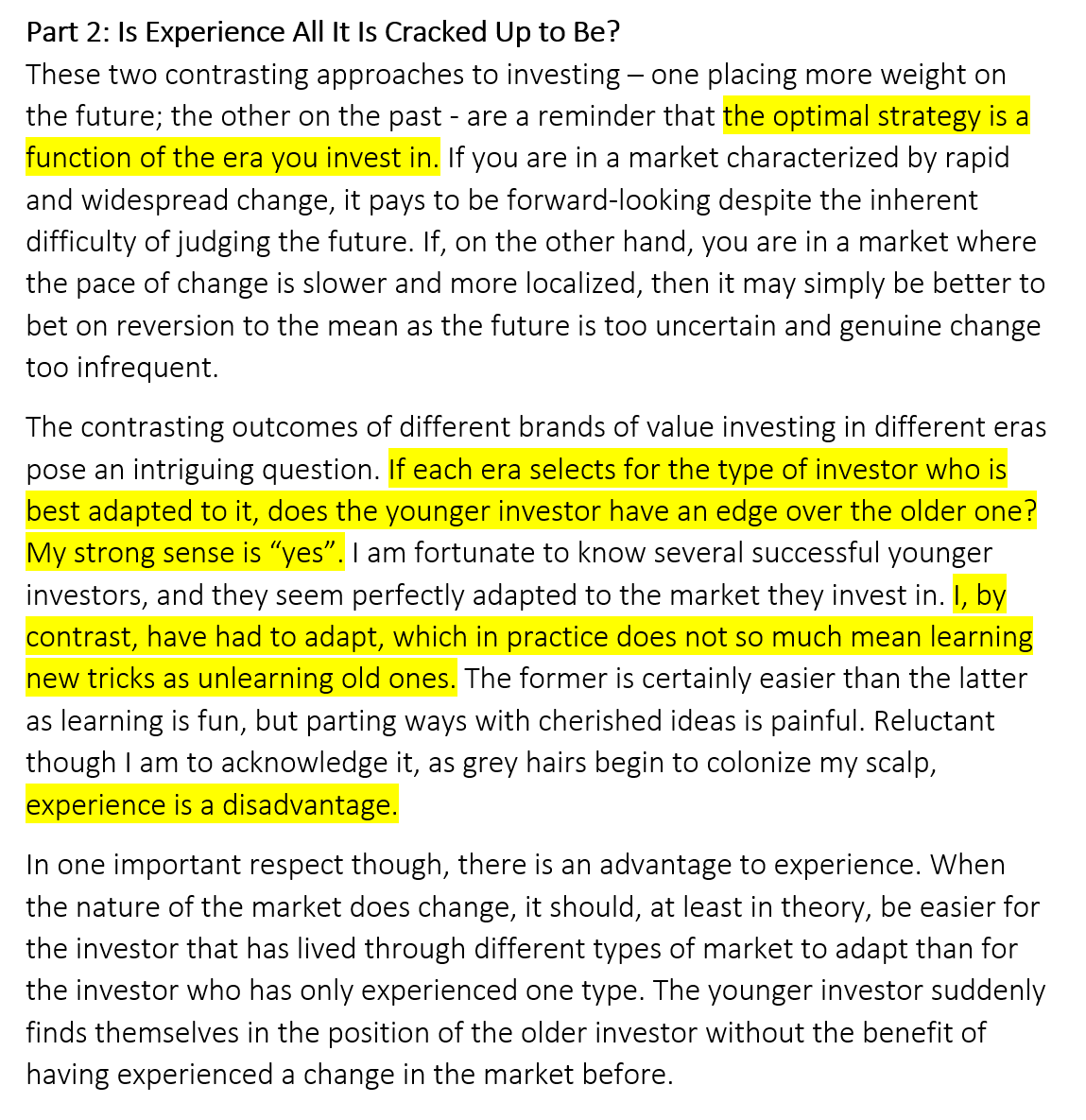

3/x The second part is my favorite. The first and last highlighted sentences together is perhaps one of the most important insights you could have as an investor. And it takes guts for a guy like Rob to admit that experience might actually be a disadvantage.

4/x Like many times before, Buffett's huge $AAPL purchase by the age of ~85, despite being afraid of technology stocks all his life, is used as a way to show how incredibly adaptive he is.

"The single biggest thing they should do is commit do adapt"

"The single biggest thing they should do is commit do adapt"

5/x The third part is on technological innovation. Has the purely digital business models changed capitalism and investing for good? Rob argues that might be the case, since companies now can grow both faster and larger with greater predictability.

6/x Part four makes me think of two quotes. Munger's "Take a simple idea and take it seriously" and Einstein's “Everything should be made as simple as possible, but no simpler" (which later shows up in the letter). Strive to be accurate, but don't get hung up on decimal points.

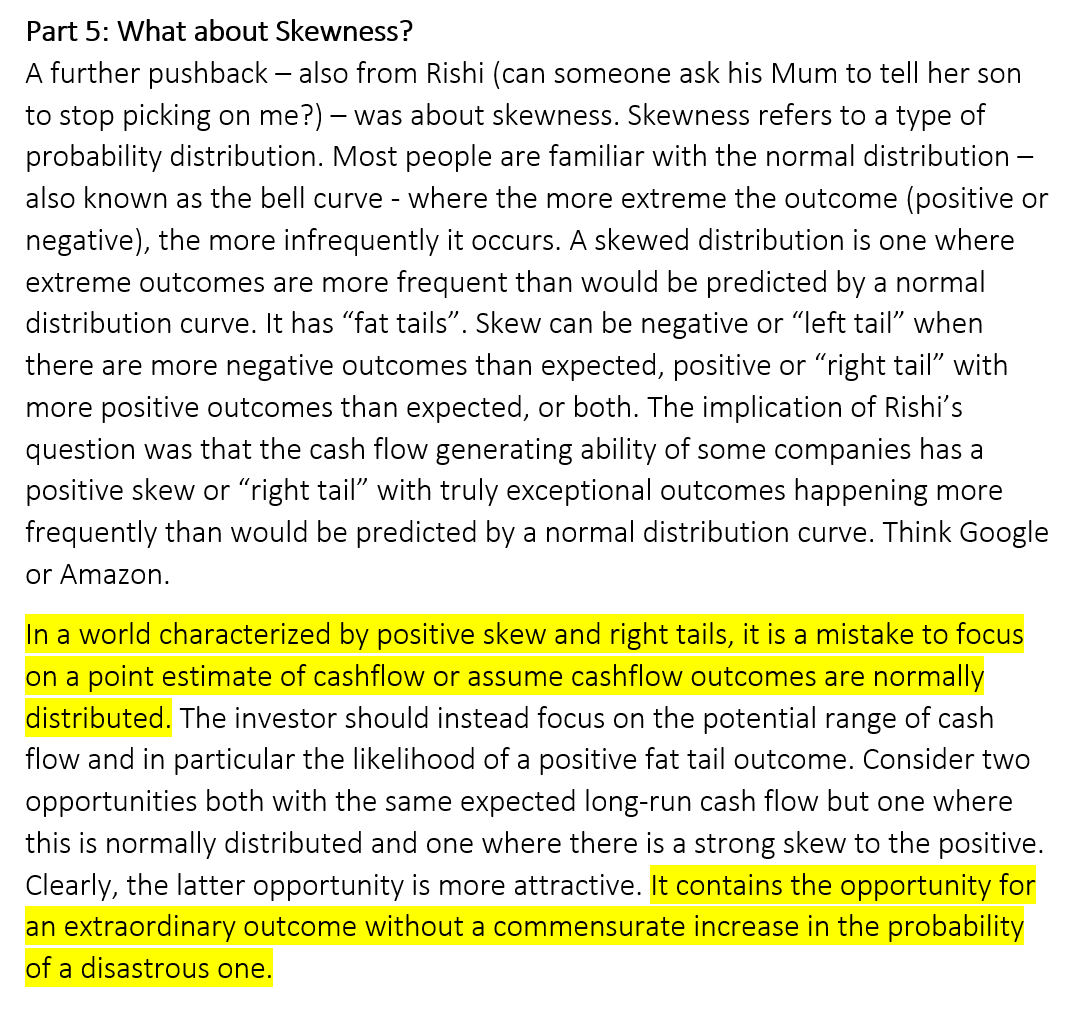

8/x In part five Rob basically comes back to the power of technology, by mentioning both $AMZN and $GOOG as companies that has been extremely positively skewed in terms of their cash flow generation. Software is eating the world.

9/x To not let us get completely carried away with "the visionary approach", in part six Rob takes us down to earth by bashing the $SHOP valuation. Although, he at the same time compliments the underlying business a lot. Bottom line: valuation still matters.

10/x Part seven feeds back to the fat tail discussion earlier. Again, pressing the importance of valuation.

11/x In the sum-up Rob recognizes that focusing on positive skews (the visionary approach) might be a valid long-term strategy, but that some sort of intrinsic value (i.e. future cash flow generation) calculation *must* be done.

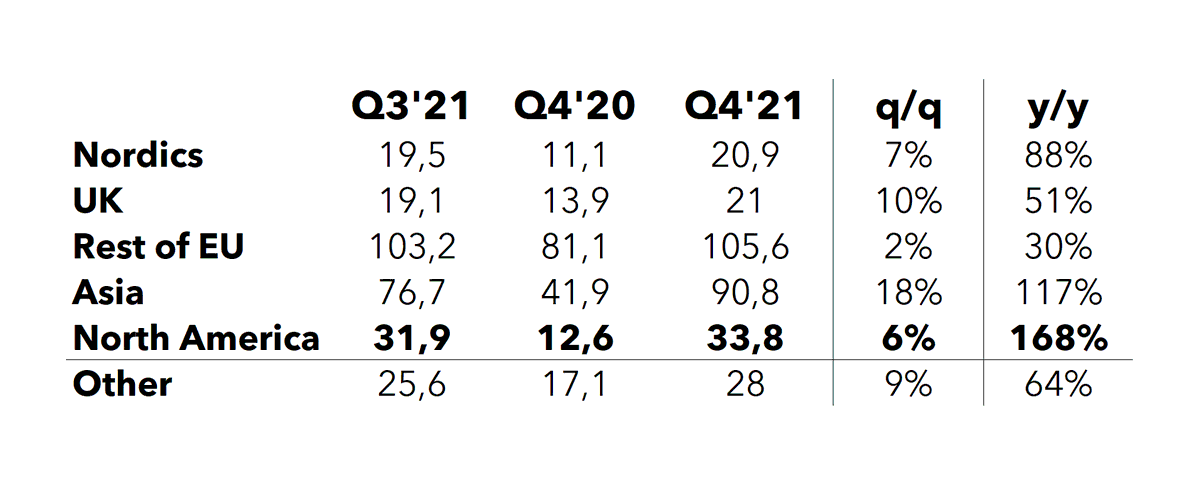

12/12 And btw, Rob actually records his letters as a podcast too, just like Howard Marks. I'll link it below. Lastly, here's a table showing RV Capital's fantastic performance since 2008 (19.4% CAGR).

📧Letter: bit.ly/3xXDI6t

🎙️Podcast: spoti.fi/2Ua0Vn6

📧Letter: bit.ly/3xXDI6t

🎙️Podcast: spoti.fi/2Ua0Vn6

• • •

Missing some Tweet in this thread? You can try to

force a refresh