Globally, 80% of Wealth is held by 20% of the population.

Does Wealth equality really exist or is it just a flawed concept?

The 80/20 Rule

Decoded!🕵️

@iRadhikaGupta @FI_InvestIndia @Kuntalhshah @AvadhMaheshwar2 @caniravkaria

🧵👇

Does Wealth equality really exist or is it just a flawed concept?

The 80/20 Rule

Decoded!🕵️

@iRadhikaGupta @FI_InvestIndia @Kuntalhshah @AvadhMaheshwar2 @caniravkaria

🧵👇

God plays dice with the universe. But they’re loaded dice. And the main objective is to find out by what rules they were loaded and how we can use them for our ends.

- Joseph Ford

- Joseph Ford

Have you ever noticed?

Approximately,

- 80% of wealth is held by 20% of the population

- 80% of your success is attributed to 20% of your efforts

- 80% happiness comes from 20% of the relationships

- 80% of portfolio returns are contributed by 20% of your stock ideas.

Approximately,

- 80% of wealth is held by 20% of the population

- 80% of your success is attributed to 20% of your efforts

- 80% happiness comes from 20% of the relationships

- 80% of portfolio returns are contributed by 20% of your stock ideas.

These imbalances occur due to an axiom known as Pareto Principle that asserts that 80% of outcomes come from 20% of actions. It is also known as the 80/20 rule.

It was named after an esteemed economist Vilfredo Pareto, who in 1906 noted that 20% of the pea pods in his garden were responsible for 80% of the peas.

He expanded his idea at the macroeconomic level by showing that 80% of the land in Italy was owned by 20% of the population.

He expanded his idea at the macroeconomic level by showing that 80% of the land in Italy was owned by 20% of the population.

We've all grown up with the belief that the amt. of effort we put in today will result in an equal amt. of reward into the future. But does it really happen?

Perhaps not, in majority of the situations the 50-50 rule is a fallacy or an incorrect method of predicting the outcome.

Perhaps not, in majority of the situations the 50-50 rule is a fallacy or an incorrect method of predicting the outcome.

This is where the 80/20 principle comes into the picture with its counterintuitive approach.

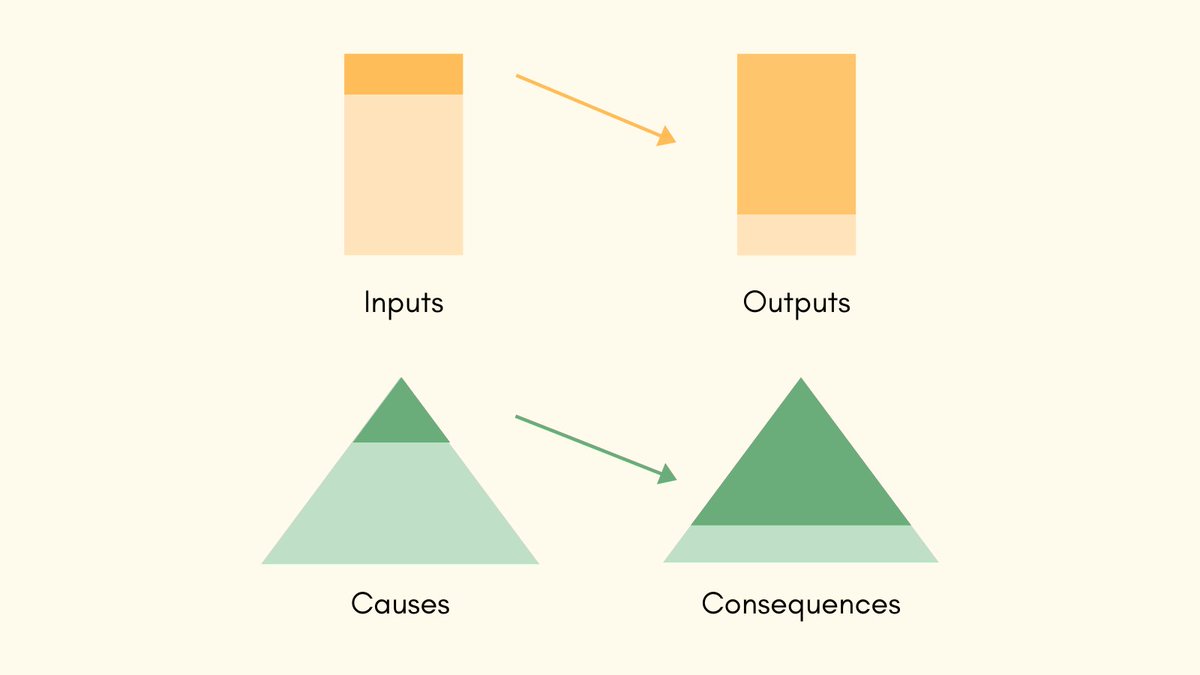

It states that whenever a variable is available in limited quantities in nature, then there would always be an imbalance in its distribution.

It states that whenever a variable is available in limited quantities in nature, then there would always be an imbalance in its distribution.

What is the reason for this imbalance?

This imbalance is the result of a feedback loop, wherein even small initial differences can multiply over time to produce extraordinary outcomes.

This imbalance is the result of a feedback loop, wherein even small initial differences can multiply over time to produce extraordinary outcomes.

For example, if you put multiple goldfish of approximately equal size in the same pond, then they will still grow into differently sized fish.

This happens when some of the fish are slightly larger than the others, which gives them a minuscule advantage.

This happens when some of the fish are slightly larger than the others, which gives them a minuscule advantage.

These fish manage to catch more food which propels them to grow faster than the other fish. This advantage allows them to catch even more food and the cycle amplifies with each loop, eventually producing substantial differences in their size.

The 80/20 rule is an extremely powerful guiding principle in making business strategies. By ranking the products on the basis of profit and sales figures, a company can identify those 20% of products that generate 80% of profits.

Once identified, the second step is to leverage & amplify the potential of those profitable 20% products.

Prioritize the products & focus your energies & resources in selling more of them. This may help in proper allocation of resources thereby enhancing the business efficiency.

Prioritize the products & focus your energies & resources in selling more of them. This may help in proper allocation of resources thereby enhancing the business efficiency.

The rule is widely used and abused in marketing as well.

We tend to expect that all causes will have roughly the same significance. That all customers are equally valuable.

We tend to expect that all causes will have roughly the same significance. That all customers are equally valuable.

On experimenting, it was stated that around 80% of business comes from 20% of customers. In other words, 20% of all customers generate 4/5th of company's total business

Thus, a company must ensure their loyalty by providing great customer services to those gainful 20% customers.

Thus, a company must ensure their loyalty by providing great customer services to those gainful 20% customers.

By finding out these vital components in the process that produces maximum outcome and putting the time and energy into those works, one can exponentially increase their desired outcome.

The other pioneer of this principle was the great quality guru, Joseph Moses Juran. He coined the rule as the ‘Rule of the Vital Few’ to refer to those few contributions, which account for the bulk of the effect.

He applied this rule in a manufacturing segment to do quality-check of products.

It was later found that 80% of product defects were caused by 20% of the problems in production methods

By focusing on those problems, the business would be able to enhance its production process.

It was later found that 80% of product defects were caused by 20% of the problems in production methods

By focusing on those problems, the business would be able to enhance its production process.

Whether a person realizes it or not, the principle applies to their life.

We believe that efforts we put in are directly proportional to the outcomes, which is not entirely true. In our jam-packed schedule, few crucial components contribute to maximum happiness and results.

We believe that efforts we put in are directly proportional to the outcomes, which is not entirely true. In our jam-packed schedule, few crucial components contribute to maximum happiness and results.

By cutting out the time spent on wasteful activities and replacing it with the things we do during the efficient 20%, we can exponentially increase our results.

There is a tragic amount of waste everywhere, in the way that nature operates, in business, in society, and our own lives.

If a typical pattern exhibits that 80% of the results come from 20% of the inputs, then it also implies that a great majority of inputs (i.e. 80%) only have a marginal (i.e. 20%) impact on the overall outcome.

The rule says that channelize more energy and resources to highly productive activities and rest to the other activities.

Hence, prioritizing your schedule based on the 80/20 rule can help you become exponentially efficient.

Hence, prioritizing your schedule based on the 80/20 rule can help you become exponentially efficient.

Pareto Principle, thus, finds itself in every aspect of our lives ranging from our business to relationships to even our health.

Success isn’t as hard as we think it is, all we need to do is play by the right rules.

Success isn’t as hard as we think it is, all we need to do is play by the right rules.

• • •

Missing some Tweet in this thread? You can try to

force a refresh