Perhaps the most entertaining story on governance this year comes from your neighborhood gas station, Exxon Mobil.

Exxon's story also shares an example of how the value of governance will evolve in crypto.

A Thread on Proxy Wars, Exxon, Crypto, and Governance 👇🏻

Exxon's story also shares an example of how the value of governance will evolve in crypto.

A Thread on Proxy Wars, Exxon, Crypto, and Governance 👇🏻

Exxon Mobil – one of the largest oil producers in the world with a market capitalization of $270 billion – has recently entered the proxy fight of its life.

Special thanks to @HayleyMcCurdy17 for providing expert insight into ESG focused investing.

messari.io/article/the-la…

Special thanks to @HayleyMcCurdy17 for providing expert insight into ESG focused investing.

messari.io/article/the-la…

Activist fund, Engine No 1 bought 0.02% of Exxon with the intent of pressuring Exxon to adopt a greater ESG focus.

The argument is that Exxon’s unwillingness to divest from oil and gas has resulted in the underperformance of the company which is management’s (the board’s) fault.

The argument is that Exxon’s unwillingness to divest from oil and gas has resulted in the underperformance of the company which is management’s (the board’s) fault.

As part of its strategy to persuade Exxon to shift its global business strategy, Engine No. 1 filed a proxy statement, a proposal requesting shareholders to cast their vote for new board members that have a history of sustainable value creation in clean energy.

Because the oil and gas conglomerate clearly didn’t want to replace its pro oil and gas board members with less pro oil and gas members, a proxy war ensued where each side had to compete for votes in order to ensure their candidates got elected onto the board.

Engine No. 1 and Exxon’s proxy war cost $65 million combined and the small activist fund was able to win 3 out of 12 seats because it was able to convince larger shareholders like BlackRock and pension funds to vote on its behalf and elect its clean-tech-focused nominees.

How Exxon's Proxy War Parallels to Crypto:

1. Governance is more valuable in times of war than peace.

Crypto is in an era of peace. The value of governance is latent, but ever-present, waiting to get activated.

1. Governance is more valuable in times of war than peace.

Crypto is in an era of peace. The value of governance is latent, but ever-present, waiting to get activated.

2. Don't Underestimate Macro Trends

The influence of ESG( environmental, social, and governance) is tremendous and shouldn't be overlooked.

The influence of ESG( environmental, social, and governance) is tremendous and shouldn't be overlooked.

3. The Flow of Governance Power

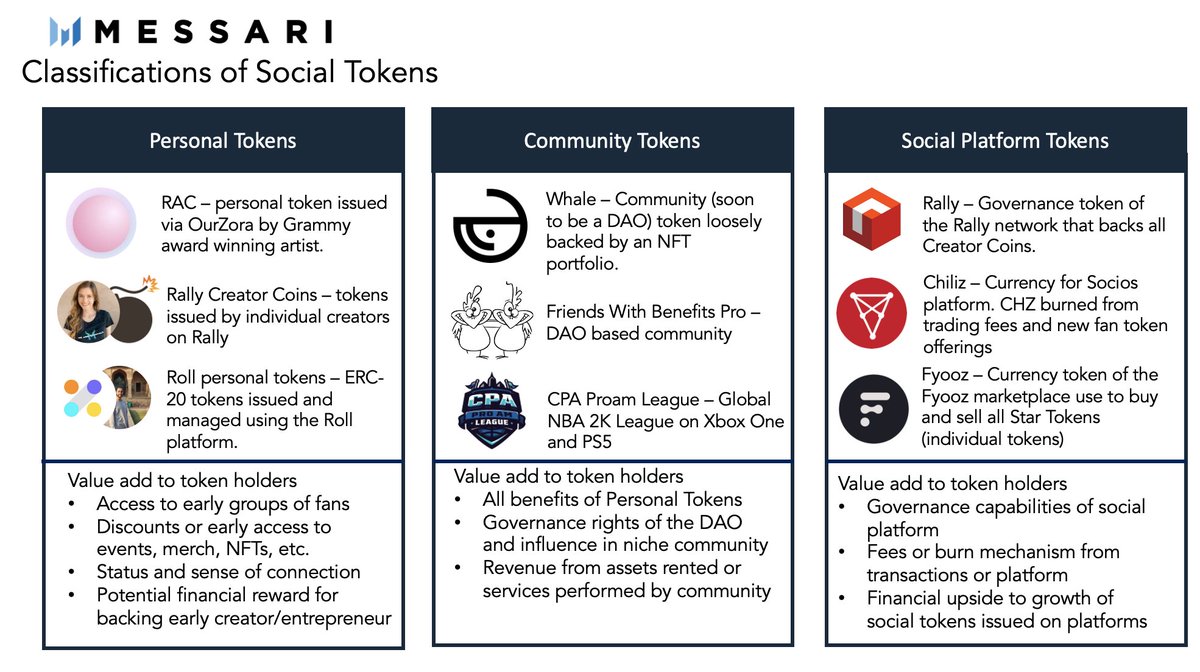

In crypto, governance may follow capital to a greater degree than it does in the equities market.

In the equities market, large power lies within index portfolio managers whereas in crypto the voting power likely accrues to the token holders.

In crypto, governance may follow capital to a greater degree than it does in the equities market.

In the equities market, large power lies within index portfolio managers whereas in crypto the voting power likely accrues to the token holders.

Crypto is at a stage where the ability to govern isn’t as valuable. Taking insight from Exxon's recent proxy war, the latent power of governance becomes aptly clear.

messari.io/article/the-la…

messari.io/article/the-la…

• • •

Missing some Tweet in this thread? You can try to

force a refresh