In coming weeks it is very likely USDT’s share of the stablecoin supply on Ethereum will fall below 50% for the first time.

USDC is quickly emerging as the dominant stablecoin on Ethereum in large part due to its growing role in DeFi.

1/

USDC is quickly emerging as the dominant stablecoin on Ethereum in large part due to its growing role in DeFi.

1/

Over 50% of the USDC supply now sit in smart contracts - equivalent to ~$12.5 billion.

Although this percentage is not as high as DAI, USDC leads by a wide margin in dollar terms and has become the preferred stablecoin in DeFi for now.

Although this percentage is not as high as DAI, USDC leads by a wide margin in dollar terms and has become the preferred stablecoin in DeFi for now.

Unsurprisingly lending protocols MakerDAO, Compound, and Aave are the largest consumers of USDC, holding ~23% of the USDC supply.

USDC in MakerDAO is primarily used to support the DAI peg via the Peg Stabilization Module.

USDC in Compound and Aave is deposited to earn yield.

USDC in MakerDAO is primarily used to support the DAI peg via the Peg Stabilization Module.

USDC in Compound and Aave is deposited to earn yield.

With the pending launch of Compound Treasury and a swath of initiatives centered around Circle’s DeFi API it is very likely this trend will continue meaning more dollar liquidity will funnel into DeFi.

https://twitter.com/compoundfinance/status/1409590399794962435

While this will certainly dilute yields for depositors it will be incredibly valuable in driving adoption of DeFi lending protocols which have historically faced a shortage of dollar liquidity (primary reason rates have been so high).

https://twitter.com/scott_lew_is/status/1409868571782664196

The question from here on out is how much DeFi will continue to rely on centralized stablecoins as it continues to grow.

Centralized stablecoins have always been a nice gateway for bringing liquidity into DeFi and avoiding the volatility problem, but never the long-term solution

Centralized stablecoins have always been a nice gateway for bringing liquidity into DeFi and avoiding the volatility problem, but never the long-term solution

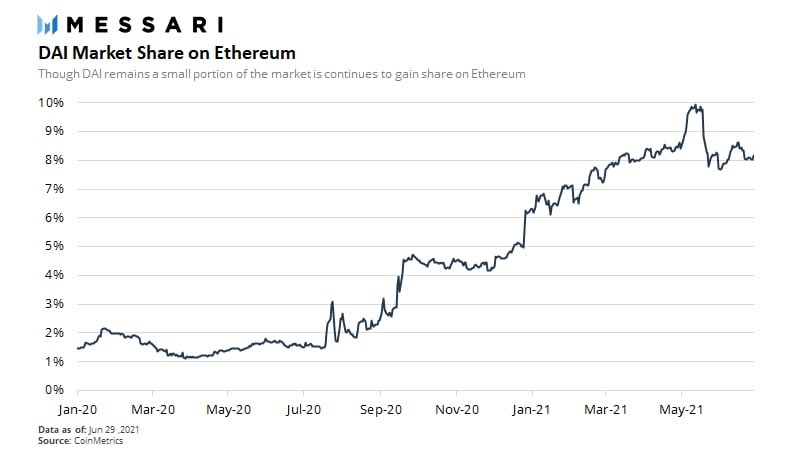

DAI’s progress towards this is promising, but even still only has ~8% market share.

Ironically it’s also becoming increasingly reliant on USDC via its peg stabilization module.

Ironically it’s also becoming increasingly reliant on USDC via its peg stabilization module.

There’s still no decentralized stablecoin project that’s come close to the success of MakerDAO, but there’s a ton exploring the design space of decentralized stablecoins in search of alternative solutions.

The most interesting of this batch aim to eliminate dollar dependency altogether.

https://twitter.com/RyanWatkins_/status/1375078200980742153

In any case, decentralized stablecoins, led my DAI, continue to be one of if not the most important building blocks in DeFi to get right long-term.

• • •

Missing some Tweet in this thread? You can try to

force a refresh