As a @duolingo user, i'm really excited of its upcoming IPO. So i decided to dig into the S-1 filing, and found several interesting things.

Here it is ...

Here it is ...

The revenue growth is amazing. It's on pace to get $200+ million this year.

The gross margin is around 70%, because the only cost of revenue that it has to pay is the fee to App Store and Google Play.

#Duolingo

The gross margin is around 70%, because the only cost of revenue that it has to pay is the fee to App Store and Google Play.

#Duolingo

Most of Duolingo's revenue (72%) is coming from subscription, but its English test also show huge potential.

The increment of sales & marketing expense is alarming (more than 3x yoy in Q1 2021), but the company expect these costs to grow at a slower pace than revenue over time.

The increment of sales & marketing expense is alarming (more than 3x yoy in Q1 2021), but the company expect these costs to grow at a slower pace than revenue over time.

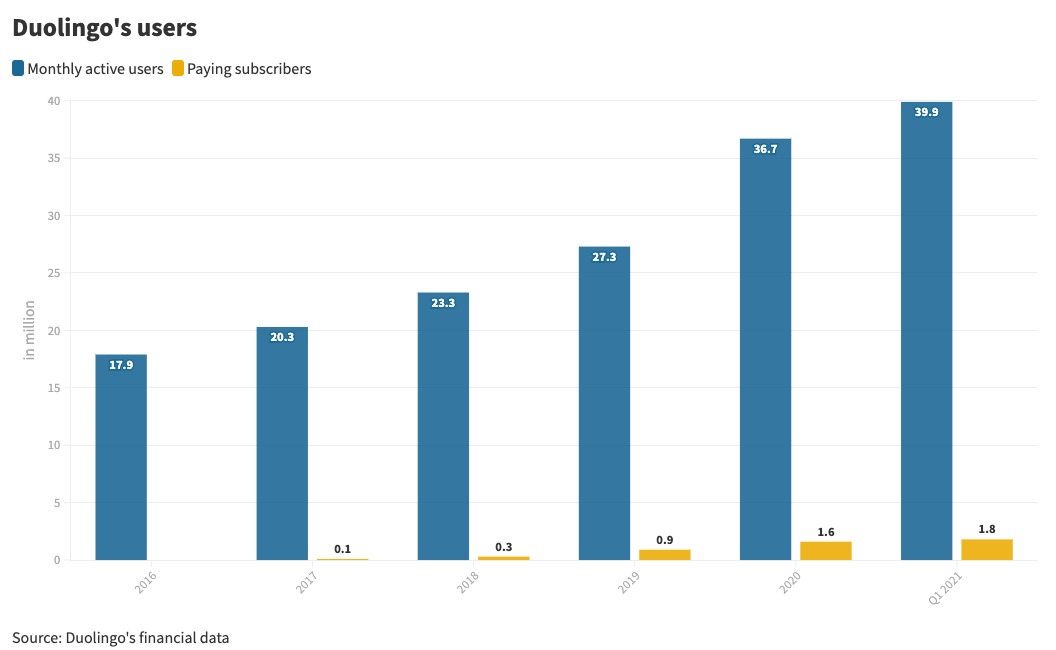

Paying subscribers continue to grow, along with the MAU (around 4.5% in Q1 2021).

Interestingly, more people are subscribing for longer period, increasing the lifetime value of the users.

#Duolingo

Interestingly, more people are subscribing for longer period, increasing the lifetime value of the users.

#Duolingo

Duolingo got an additional $35.6m and $60.7m in cash/equivalent in 2019 and 2020, but most of them are coming from issuance of convertible preferred stock.

The company has $117.5m in cash/equivalent after Q1 2021.

The company has $117.5m in cash/equivalent after Q1 2021.

• • •

Missing some Tweet in this thread? You can try to

force a refresh