The ‘How to’ Invest Guide.

• Investor or Trader

• Property Investment

• Commodities

• Investing in Equities

• How to Research

• My 5 Top Shares

A Read and a Retweet is in Order.

(Thread) ⬇️

• Investor or Trader

• Property Investment

• Commodities

• Investing in Equities

• How to Research

• My 5 Top Shares

A Read and a Retweet is in Order.

(Thread) ⬇️

• Intro

The content is from live seminars that took place between 19-27th June.

(Video links at the end) #Livestream

If you would like to be kept in the loop for future seminars - sign up below. 👇🏽

We bring gems straight to your inbox-every Monday

davidketh.substack.com/p/coming-soon

The content is from live seminars that took place between 19-27th June.

(Video links at the end) #Livestream

If you would like to be kept in the loop for future seminars - sign up below. 👇🏽

We bring gems straight to your inbox-every Monday

davidketh.substack.com/p/coming-soon

• Investor Or Trader

We opened the discussions with some things to ponder.

1. Risk Averse

2. Risk Tolerant

-Less risk= Less Reward

-More risk= More Reward

Carefully consider where you find yourself on this spectrum?

Why?

• Protect Capital

• Go all in

• In-between

We opened the discussions with some things to ponder.

1. Risk Averse

2. Risk Tolerant

-Less risk= Less Reward

-More risk= More Reward

Carefully consider where you find yourself on this spectrum?

Why?

• Protect Capital

• Go all in

• In-between

- finished pondering?

Now, you’ll need to allocate capital into asset classes that are aligned with your risk appetite.

Factors like:

• Age

• Time

• Fear Factor

• Experience

• Financial Resources

will all play into decision making.

Here are some asset examples 👇🏽

Now, you’ll need to allocate capital into asset classes that are aligned with your risk appetite.

Factors like:

• Age

• Time

• Fear Factor

• Experience

• Financial Resources

will all play into decision making.

Here are some asset examples 👇🏽

•Property Investment

We discussed:

- Interest rates

- Inflation

- South African Reserve Bank

Buying Property? Read this first👇🏽

We discussed:

- Interest rates

- Inflation

- South African Reserve Bank

Buying Property? Read this first👇🏽

https://twitter.com/talkcentss/status/1404769088652541956

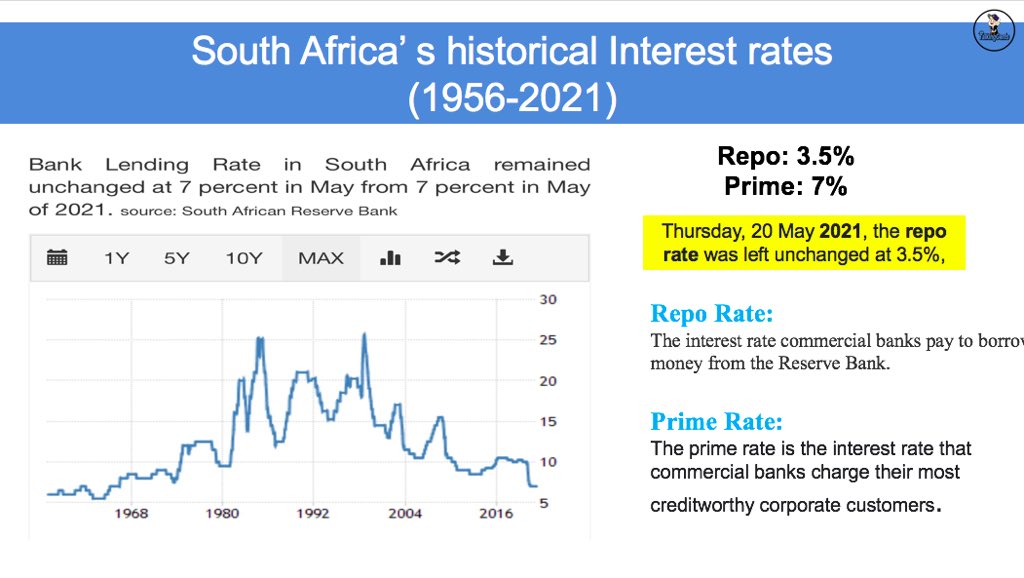

-interest rates

Remember, SA is reactory, and macro-economics will dictate our interest rates.

Interest rates have been trending down the last 20 years, but yet our GDP is shrinking. Why?

The big guns are doing something wrong. @SAReserveBank

Keep reading to find out. 👇🏽

Remember, SA is reactory, and macro-economics will dictate our interest rates.

Interest rates have been trending down the last 20 years, but yet our GDP is shrinking. Why?

The big guns are doing something wrong. @SAReserveBank

Keep reading to find out. 👇🏽

-Inflation

interest rates have been able to come down because inflation has been ⬇️. It’s what happens when millions lose their jobs and there is no money to spend. (Velocity dries up)

SA has been increasing tax because they love austerity and fiscus is under pressure.

interest rates have been able to come down because inflation has been ⬇️. It’s what happens when millions lose their jobs and there is no money to spend. (Velocity dries up)

SA has been increasing tax because they love austerity and fiscus is under pressure.

-South African Reserve Bank

Interest rates is a monetary tool central banks use to stimulate an economy. Something @SAReserveBank has failed to do.

Central -Commercial bank - You

The working class is what gives #ZAR value, your productivity gets plundered by bankers.

Interest rates is a monetary tool central banks use to stimulate an economy. Something @SAReserveBank has failed to do.

Central -Commercial bank - You

The working class is what gives #ZAR value, your productivity gets plundered by bankers.

• Understanding Commodities

Hedging against inflation was the primary concern here. We didn’t spend much time talking about commodities because we focused on Property and Equity mainly.

But check this out,

Dollar strength = weakness in commodities + vice versa

Hedging against inflation was the primary concern here. We didn’t spend much time talking about commodities because we focused on Property and Equity mainly.

But check this out,

Dollar strength = weakness in commodities + vice versa

• Investing in Equity

This was the focal point of the presentation.

We focused on:

- Index vs single stock investment

- Growth vs Value

- Case studies

- Compound interest

- Risk management

This was the focal point of the presentation.

We focused on:

- Index vs single stock investment

- Growth vs Value

- Case studies

- Compound interest

- Risk management

- Case study 1: Index Investment

SA TOP 40

Look at the power of staying investing. My bud @ric_gouveia made an excellent observation, Naspers heavily influenced this index’s return. Taking them out of this picture would have looked a whole lot different.

#safety #risky

SA TOP 40

Look at the power of staying investing. My bud @ric_gouveia made an excellent observation, Naspers heavily influenced this index’s return. Taking them out of this picture would have looked a whole lot different.

#safety #risky

-Case study 2: Single stock

NASPERS

Probably the darling of the JSE, without exposure to this stock many South Africans wouldn’t be as well off as they are today.

I’m just drawing a comparison between index and single stock investing. To demonstrate risk appetite.

NASPERS

Probably the darling of the JSE, without exposure to this stock many South Africans wouldn’t be as well off as they are today.

I’m just drawing a comparison between index and single stock investing. To demonstrate risk appetite.

- Real Returns

Local returns doesn’t equate to real return when the currency depreciates.

Devaluation is detrimental to Rand denominated assets. The Nominal value rises, yes, but real return is not what you see.

Look at the long term trend of the #ZAR . It is weaker. ⬇️

Local returns doesn’t equate to real return when the currency depreciates.

Devaluation is detrimental to Rand denominated assets. The Nominal value rises, yes, but real return is not what you see.

Look at the long term trend of the #ZAR . It is weaker. ⬇️

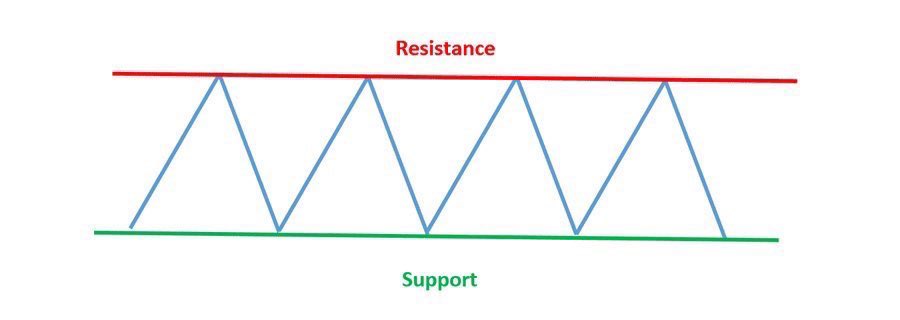

- The ZAR goes through cyclical periods of strength and weakness, creating higher lows along the way.

Rand strength is temporary, especially in an economy that is shedding jobs like crazy.

There is no doubt in my mind - you want offshore exposure.

Real return formula ⬇️

Rand strength is temporary, especially in an economy that is shedding jobs like crazy.

There is no doubt in my mind - you want offshore exposure.

Real return formula ⬇️

- Compound interest

No doubt - staying invested is the best thing to do in the long run. Time in the market beats timing the market every single time.

Look at the power of compound interest.

R100 invested @ 10%

=R417 after 15 years, and this grows exponentially over time.

No doubt - staying invested is the best thing to do in the long run. Time in the market beats timing the market every single time.

Look at the power of compound interest.

R100 invested @ 10%

=R417 after 15 years, and this grows exponentially over time.

-Managing risk

Okay, buy and hold works, but buy-hold and forget is not a strategy.

Risk management involves checking in on your portfolio once and awhile.

Why?

• Protect your gains

• Minimize losses.

No emotional attachments.

Look what I mean.👇🏽

Okay, buy and hold works, but buy-hold and forget is not a strategy.

Risk management involves checking in on your portfolio once and awhile.

Why?

• Protect your gains

• Minimize losses.

No emotional attachments.

Look what I mean.👇🏽

• How to research

The next picture is a real scary one, and you should retweet this 1000 times over, and tag every government official you know.

Yes, you @CyrilRamaphosa @KganyagoLesetja @SAReserveBank

The GDP still hasn’t recovered since 08/09

Say no to austerity.

The next picture is a real scary one, and you should retweet this 1000 times over, and tag every government official you know.

Yes, you @CyrilRamaphosa @KganyagoLesetja @SAReserveBank

The GDP still hasn’t recovered since 08/09

Say no to austerity.

-Job losses

From Q1 2020 - Q1 2021

Every sector, except finance, lost jobs, in fact, 1.387million jobs were cut.

This means:

• Less tax collection

• More Fiscal Pressure

• Higher unemployment

And here Twitter is arguing over jobs and entrepreneurs.

Guys, what jobs?

From Q1 2020 - Q1 2021

Every sector, except finance, lost jobs, in fact, 1.387million jobs were cut.

This means:

• Less tax collection

• More Fiscal Pressure

• Higher unemployment

And here Twitter is arguing over jobs and entrepreneurs.

Guys, what jobs?

• Data

@SAReserveBank released some Q2 2021 stats yesterday. Go give it a read.

@SAReserveBank released some Q2 2021 stats yesterday. Go give it a read.

https://twitter.com/SAReserveBank/status/1409821710430478336

•Top 5 Shares

Even a struggling economy has money flowing around. Follow it, and you can get your hands on some.

Includes global players

-MTN

-Grand Canyon Education

See the rest here👇🏽 #BuyShares2021

Even a struggling economy has money flowing around. Follow it, and you can get your hands on some.

Includes global players

-MTN

-Grand Canyon Education

See the rest here👇🏽 #BuyShares2021

https://twitter.com/talkcentss/status/1409359086932557824

• Final Thoughts

Financial knowledge equips you with the ammunition you need to protect your wealth. It’s not always only about investing, but also looking for ways to grow your income.

Investing in the 8th asset class- YOU- is the best investment you can actually make.

Financial knowledge equips you with the ammunition you need to protect your wealth. It’s not always only about investing, but also looking for ways to grow your income.

Investing in the 8th asset class- YOU- is the best investment you can actually make.

• Shout-Out

Watch the #Video below

Don’t forget to subscribe 🙂

Video 1

Video 2

Video 3

Video 4

Video 5

Video 6

Watch the #Video below

Don’t forget to subscribe 🙂

Video 1

Video 2

Video 3

Video 4

Video 5

Video 6

• • •

Missing some Tweet in this thread? You can try to

force a refresh