We sat down with Superhuman founder @rahulvohra who gave a masterclass on his fundraising playbook.

Here are 12 strategies that enabled him to raise over $45M:

🔽

acquired.fm/episodes/maste…

Here are 12 strategies that enabled him to raise over $45M:

🔽

acquired.fm/episodes/maste…

/1 There are 2 types of fundraises:

1️⃣ pre-empted: investors actively seek out the founder to invest.

2️⃣ marketed: the founder signals they're raising & seeks out investors.

Rahul's advice: always try to be pre-empted. Don't be in the market for too long, not at all if you can.

1️⃣ pre-empted: investors actively seek out the founder to invest.

2️⃣ marketed: the founder signals they're raising & seeks out investors.

Rahul's advice: always try to be pre-empted. Don't be in the market for too long, not at all if you can.

/2 The best way to be pre-empted is to be perpetually in a state of "not raising":

making great progress on your company while also being open-minded enough to pre-emption.

To pull that off, you need runway. Any conversation you have with an investor needs to feel super causal

making great progress on your company while also being open-minded enough to pre-emption.

To pull that off, you need runway. Any conversation you have with an investor needs to feel super causal

/3 Be willing (and able!) to walk away from any deal. That's how you get the best deal.

So, always have a BATNA:

the best alternative to a negotiated agreement.

This gives you time, room to make mistakes, room for external changes (like Covid), and room for market volatility.

So, always have a BATNA:

the best alternative to a negotiated agreement.

This gives you time, room to make mistakes, room for external changes (like Covid), and room for market volatility.

/4 Get into the rhythm of raising one round ahead of traction.

Raise your seed when you're a pre-seed company, raise your Series A when you're a seed company etc...

This will forever put you into a position of being able to walk away since you should have 4-5 years of runway.

Raise your seed when you're a pre-seed company, raise your Series A when you're a seed company etc...

This will forever put you into a position of being able to walk away since you should have 4-5 years of runway.

/5 Old & almost inaccurate rule of thumb: only raise venture capital if you can build a billion dollar company.

Rahul's heuristic: don't raise VC unless you can see your business growing to 10x your valuation

E.g. only raise at $10M, if you see a path towards $100M.

Rahul's heuristic: don't raise VC unless you can see your business growing to 10x your valuation

E.g. only raise at $10M, if you see a path towards $100M.

/6 It's almost always safe when raising at valuations in the low $10m's.

Most software businesses can grow to $10M ARR and a great founder can position such a business to the right buyer for a $100M exit.

But as valuation goes beyond the 10s your startup needs a path to >$100M.

Most software businesses can grow to $10M ARR and a great founder can position such a business to the right buyer for a $100M exit.

But as valuation goes beyond the 10s your startup needs a path to >$100M.

/7 Instead of being dictated by the markets, create a market. Get the flywheel going, momentum will give you leverage.

As a 2nd-time founder, you get to do this a bit differently. Case in point:

Rahul raised his first $1M for Superhuman with a screenshot of Gmail + a few notes.

As a 2nd-time founder, you get to do this a bit differently. Case in point:

Rahul raised his first $1M for Superhuman with a screenshot of Gmail + a few notes.

/8 Early on, you'll likely look insane.

Otherwise your idea is probably not interesting enough.

Even as a successful founder, it's helpful to have a board that can give guidance. It's also a signal to the outside world that you're not completely insane, someone believes in you.

Otherwise your idea is probably not interesting enough.

Even as a successful founder, it's helpful to have a board that can give guidance. It's also a signal to the outside world that you're not completely insane, someone believes in you.

/10 Raise from other founders and operators in the earliest stages.

They're often the most "active" checks.

They can help you create distribution, find PMF faster and support you when sh*t hits the fan.

They're often the most "active" checks.

They can help you create distribution, find PMF faster and support you when sh*t hits the fan.

/11 Institutional buy-in can be crucial to attract key hires.

It's bat signal that indicates confidence in your company.

Money from top-tier investors serves as a signal, especially for leadership and exec recruiting.

It's bat signal that indicates confidence in your company.

Money from top-tier investors serves as a signal, especially for leadership and exec recruiting.

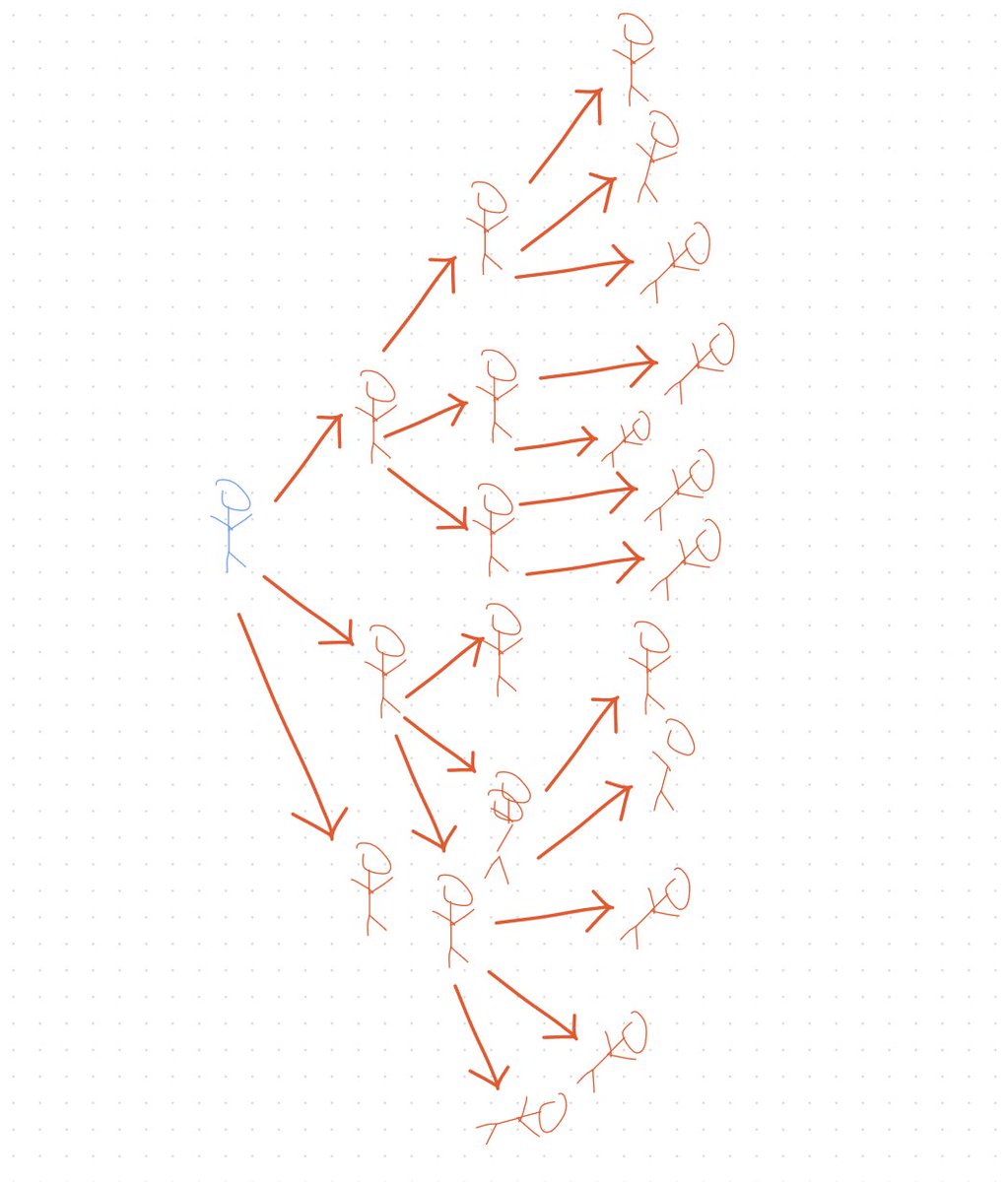

/12 As soon as someone commits, ask them to name 3 other investors you can talk to.

Once this graph starts building itself, it takes a life of its own.

This is why rounds become oversubscribed. Towards the end, there will be people who just want to pile in due to the momentum.

Once this graph starts building itself, it takes a life of its own.

This is why rounds become oversubscribed. Towards the end, there will be people who just want to pile in due to the momentum.

Shoutout to Rahul who's been on our show 3 (!) times now.

If you're an ambitious founder who's looking to raise, get in touch with @rahulvohra, @toddg777 and @brandonmyint!

They just announced their new $24M fund backed by some of the best founders and operators in the space.

If you're an ambitious founder who's looking to raise, get in touch with @rahulvohra, @toddg777 and @brandonmyint!

They just announced their new $24M fund backed by some of the best founders and operators in the space.

• • •

Missing some Tweet in this thread? You can try to

force a refresh