Let’s talk a bit about #Bitcoin, the dollar, and gold

In this thread I will touch on highly complex topics & hope to tie it all together

Please stick to the end, it will be worth it 🥐

Before we dive in too deep, I’ll have to give you some quick background info on the topic...

In this thread I will touch on highly complex topics & hope to tie it all together

Please stick to the end, it will be worth it 🥐

Before we dive in too deep, I’ll have to give you some quick background info on the topic...

Sound money...

What is it? Certainly not the dollar as we know it today.

The concept of “sound money” is best explained as a currency which has intrinsic value.

That is, if it weren’t a currency it would have inherent value whether as a means of trade, or store or value.

What is it? Certainly not the dollar as we know it today.

The concept of “sound money” is best explained as a currency which has intrinsic value.

That is, if it weren’t a currency it would have inherent value whether as a means of trade, or store or value.

Think of things like #Bitcoin, Gold, Silver, & other fixed supply assets

Metals have been valuable for many years. This is because of their historical use for trade, purposes of hedging against inflation, & more

A long time ago, money was actually denominated in gold or silver.

Metals have been valuable for many years. This is because of their historical use for trade, purposes of hedging against inflation, & more

A long time ago, money was actually denominated in gold or silver.

How did this work?

The dollar bill originally represented a certificate which could be turned in for a silver dollar from the United States treasury, guaranteeing that a deposit had been made & the funds were backed (by silver or gold)

This worked out pretty well for everyone..

The dollar bill originally represented a certificate which could be turned in for a silver dollar from the United States treasury, guaranteeing that a deposit had been made & the funds were backed (by silver or gold)

This worked out pretty well for everyone..

because, the currency itself was essentially backed by another commodity of inherit value

So ultimately your original deposit was relatively safer no matter what happens

This is where the term and idea of “sound money” was coined from

So ultimately your original deposit was relatively safer no matter what happens

This is where the term and idea of “sound money” was coined from

Think about this even deeper:

Right now to hedge against inflation people use the dollar to purchase assets like silver.

Before 1971, you didn’t need to do this because you could just claim the silver equivalent from the treasury

This model is especially useful during...

Right now to hedge against inflation people use the dollar to purchase assets like silver.

Before 1971, you didn’t need to do this because you could just claim the silver equivalent from the treasury

This model is especially useful during...

Something known as a bank run.

A bank run results from a mass panic of any origin, and people demand their deposits from banks out of fear of the currency losing value. ( $IRON? )

With sound money, depositors know they will get their silver equivalent from the treasury.

A bank run results from a mass panic of any origin, and people demand their deposits from banks out of fear of the currency losing value. ( $IRON? )

With sound money, depositors know they will get their silver equivalent from the treasury.

Looking at the system today you’ll notice that is not exactly the case at all.

Banks run on fractional reserves often lending to other banks with constant money in circulation.

The lender of last resort is the federal reserve.

Banks run on fractional reserves often lending to other banks with constant money in circulation.

The lender of last resort is the federal reserve.

In 1971, President Nixon set about a series of changes to monetary policy, ending convertibility of dollars to gold & enacting “fiat money”

Fiat money, originally derived from the Latin word “fiat,” quite literally means “let it be done”

Fiat money, originally derived from the Latin word “fiat,” quite literally means “let it be done”

NOTE:

What Nixon did was essentially a change in the common denominator of exchange.

The dollar went from being backed by gold, to virtually nothing or just faith.

Pay special attention to this “denominator” as it comes in to play later in the thread

What Nixon did was essentially a change in the common denominator of exchange.

The dollar went from being backed by gold, to virtually nothing or just faith.

Pay special attention to this “denominator” as it comes in to play later in the thread

In other words if the gov says the dollar is worth a dollar, then it is worth a dollar.

So yes, the very own currency which dominates usage across the entire world has no value other than our absolute faith

But I know what you may be thinking...

So yes, the very own currency which dominates usage across the entire world has no value other than our absolute faith

But I know what you may be thinking...

How is Gold any better? Surely it’s value is based on faith, at least to a large extent right?

This would be true, but the key difference here is you don’t have the fed (or others) printing money out of thin air

The gold supply, just like #Bitcoin, is fixed to miners.

This would be true, but the key difference here is you don’t have the fed (or others) printing money out of thin air

The gold supply, just like #Bitcoin, is fixed to miners.

Nixon’s change from gold allowed for tons of bad policies, putting monetary supply at the hands a certain few in power.

Since 2008, this emphasized the endless infinite printing of money, but they have just gotten unique in their ways to hide it

Introducing modern debasement...

Since 2008, this emphasized the endless infinite printing of money, but they have just gotten unique in their ways to hide it

Introducing modern debasement...

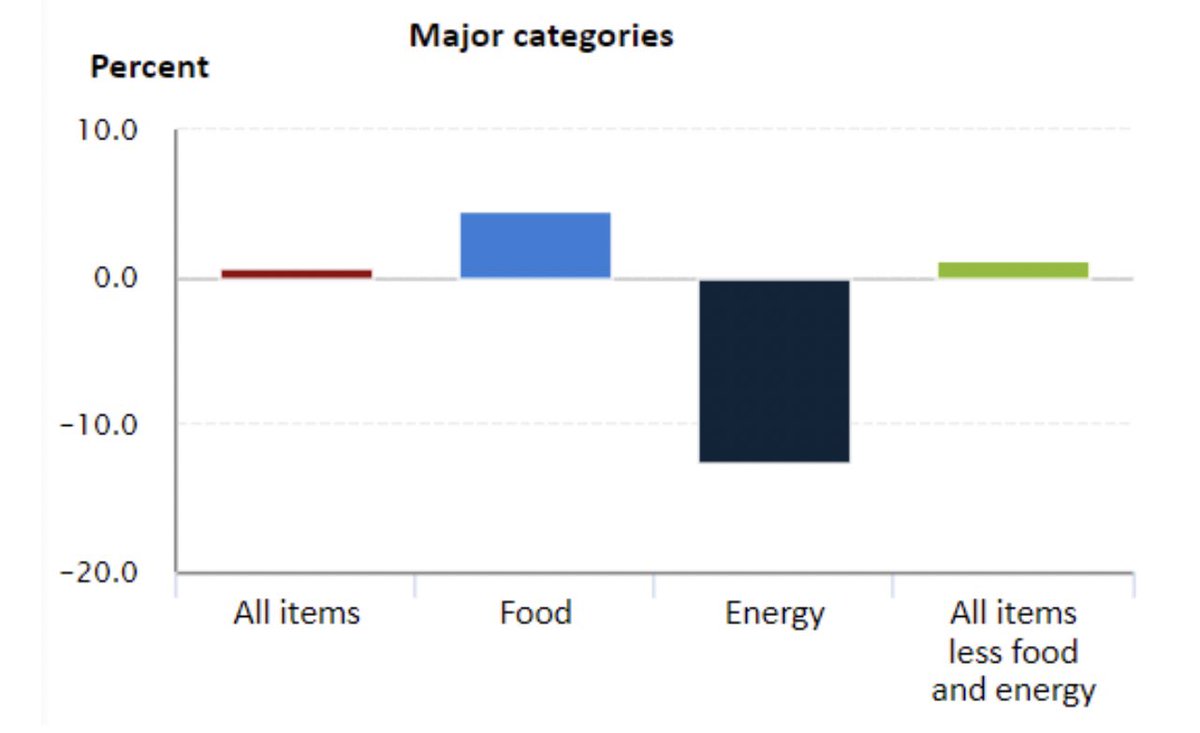

Inflation is popularly measured by CPI (consumer price inflation)

But are consumer prices a good measure of inflation?

People look at the strength of the dollar by its value in ratio to other currency

But why do we ignore the fact that other currencies are ALSO being debased?

But are consumer prices a good measure of inflation?

People look at the strength of the dollar by its value in ratio to other currency

But why do we ignore the fact that other currencies are ALSO being debased?

The actions by many today are blatantly similar to those of the Roman Empire

A very long time ago, Romans used metals in the form of coins to exchange value

Once leaders figured out they could melt down the purity of the coins & essentially make more, inflation became rampant

A very long time ago, Romans used metals in the form of coins to exchange value

Once leaders figured out they could melt down the purity of the coins & essentially make more, inflation became rampant

I’m now going to attempt to wrap all of this up as best as possible now.

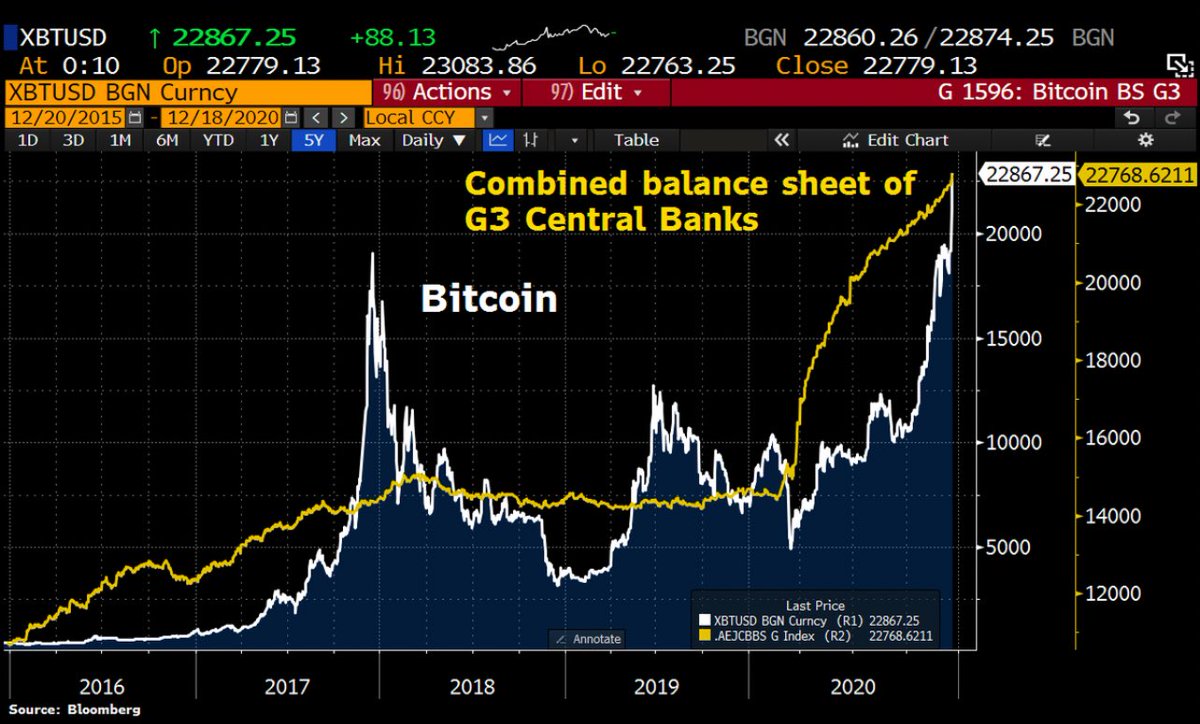

There have been no assets in the world to outperform #Bitcoin, but when you take a closer look at why this is, it all becomes clear.

Crypto is not the bubble, the bubble is in the fed balance sheet.

There have been no assets in the world to outperform #Bitcoin, but when you take a closer look at why this is, it all becomes clear.

Crypto is not the bubble, the bubble is in the fed balance sheet.

Don’t believe me? Just take a look at this chart of the S&P 500 vs the federal reserve’s balance sheet:

There is an obvious correlation between the two.

& this makes sense with the stock market at all time highs, just after a pandemic.

There is an obvious correlation between the two.

& this makes sense with the stock market at all time highs, just after a pandemic.

So, this begs the question: are these stocks on the S&P 500 really going up, or are they really only offsetting the debasement of fiat currency?

Does this explain why #Bitcoin outperforms the fed balance sheet, because it is both a fixed supply asset AND currency?

Does this explain why #Bitcoin outperforms the fed balance sheet, because it is both a fixed supply asset AND currency?

To expand on this thought a little deeper and fully understand what I’m about to go over, let’s see a real life example

The denominator is key.

Looking at the Venezuelan stock market, things look fantastic in terms of the Venezuelan Bolivar, but it is dead flat in terms of USD.

The denominator is key.

Looking at the Venezuelan stock market, things look fantastic in terms of the Venezuelan Bolivar, but it is dead flat in terms of USD.

& it gets more interesting when taking a look at gold (which measures usd strength) then comparing IT to the currency basket...

Changing the denominator to gold we see it significantly outperforming all currencies.

Changing the denominator to gold we see it significantly outperforming all currencies.

Now, when we change the denominator from gold just how we did but to #Bitcoin, you’ll notice that not only does $BTC outperform the feds balance sheet, but it actually outperforms gold.

Let’s attempt to explore why this is a little...

Let’s attempt to explore why this is a little...

#Bitcoin is what Gold sought to be and more.

Realistically, not even Gold can challenge the widespread use of the dollar.

You can’t send .001567 ounces of Gold across the world in a matter of minutes, or even very securely store it with self custody

#Bitcoin changes this.

Realistically, not even Gold can challenge the widespread use of the dollar.

You can’t send .001567 ounces of Gold across the world in a matter of minutes, or even very securely store it with self custody

#Bitcoin changes this.

In essence, everything but gold and #Bitcoin only ever revalue prices to debased fiat

Other assets are things you use to preserve wealth with wages that you earn in the dollar, but they significantly underperform it all in reality

I hope this all made sense....

Other assets are things you use to preserve wealth with wages that you earn in the dollar, but they significantly underperform it all in reality

I hope this all made sense....

But there is an incredible amount of info I’ll point towards in a video from @RaoulGMI, & the main point is:

#Bitcoin serves as a black hole sucking in the worlds value at a pace we can’t even comprehend...

I also highly recommend reading this thread

#Bitcoin serves as a black hole sucking in the worlds value at a pace we can’t even comprehend...

I also highly recommend reading this thread

https://twitter.com/raoulgmi/status/1367140929992351750

$BTC is the only thing outperforming the feds balance sheet by a wide margin because it succeeds as both an asset AND currency

Everything else (besides gold) just offsets the debasement of different modern fiat currencies

Pristine.

Let this sink in for a moment & enjoy! 🥐

Everything else (besides gold) just offsets the debasement of different modern fiat currencies

Pristine.

Let this sink in for a moment & enjoy! 🥐

• • •

Missing some Tweet in this thread? You can try to

force a refresh