1/ About the Industry

Sugarcane & Sugar are crucial for the Indian economy

5 cr farmers involved in cultivation

50L hectares area of land involved in cultivation

India is the largest consumer & 2nd largest producer of sugarcane

Covered under Essential Commodities Act, 1955

Sugarcane & Sugar are crucial for the Indian economy

5 cr farmers involved in cultivation

50L hectares area of land involved in cultivation

India is the largest consumer & 2nd largest producer of sugarcane

Covered under Essential Commodities Act, 1955

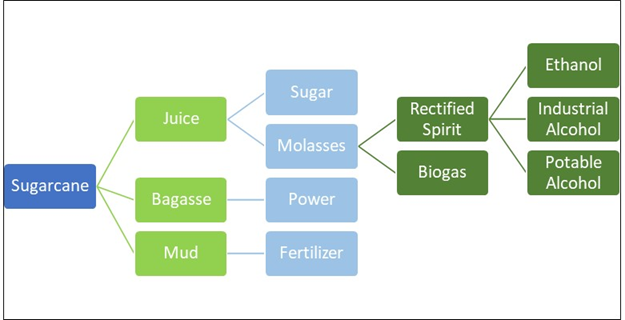

2/ Process

Sugar is produced from sugarcane (1-1.5 yr growth)

Crushed under rollers to produce Juice, Bagasse & Mud

Bagasse & Mud separated to produce power & fertilizers

Juice is heated to make syrup

Boiling residue left is called molasses

Molasses give ethanol & alcohol

Sugar is produced from sugarcane (1-1.5 yr growth)

Crushed under rollers to produce Juice, Bagasse & Mud

Bagasse & Mud separated to produce power & fertilizers

Juice is heated to make syrup

Boiling residue left is called molasses

Molasses give ethanol & alcohol

3/ Regulations

Minimum Selling Price of sugar was Rs 31 2019

Discussions underway to increase to Rs 33

Fair and Remunerative Price & State Advisory Prices in place for sugarcane

Regulations in place to manage the volume of sugarcane

A % of molasses to be given to alcohol industry

Minimum Selling Price of sugar was Rs 31 2019

Discussions underway to increase to Rs 33

Fair and Remunerative Price & State Advisory Prices in place for sugarcane

Regulations in place to manage the volume of sugarcane

A % of molasses to be given to alcohol industry

4A/ Growth – Ethanol Policy

Ethanol blending with petrol has been made mandatory for India’s Oil Marketing Companies

Blending target of 10% by CY22 and 20% for CY25

Allow sugar companies to sell more profitable ethanol

Address oversupply situation of sugar

Ethanol blending with petrol has been made mandatory for India’s Oil Marketing Companies

Blending target of 10% by CY22 and 20% for CY25

Allow sugar companies to sell more profitable ethanol

Address oversupply situation of sugar

4B/ Growth – Using grains for ethanol

OMCs have achieved 7.2% ethanol blending in the present scenario

To achieve targets production of ethanol through grains required

This will provide additional source of income for sugar companies

OMCs have achieved 7.2% ethanol blending in the present scenario

To achieve targets production of ethanol through grains required

This will provide additional source of income for sugar companies

4C/ Growth – Export

The GoI is promoting export of sugar by providing export incentive

Export subsidy of INR 5.85/kg of sugar export

Global sugar prices on the rise

The sugar closing inventory is expected to fall to 8MT by September 2021

Reduced production in Brazil & Thailand

The GoI is promoting export of sugar by providing export incentive

Export subsidy of INR 5.85/kg of sugar export

Global sugar prices on the rise

The sugar closing inventory is expected to fall to 8MT by September 2021

Reduced production in Brazil & Thailand

4D/ Growth – Other

The adoption of CO-0238 seed since 2016 has increased yield from of sugarcane

Industry undertaking significant capex

The government is expecting distillery projects worth INR 40,000 Cr. to be commissioned in 4-5 yrs

The adoption of CO-0238 seed since 2016 has increased yield from of sugarcane

Industry undertaking significant capex

The government is expecting distillery projects worth INR 40,000 Cr. to be commissioned in 4-5 yrs

• • •

Missing some Tweet in this thread? You can try to

force a refresh