$DADA and $JD

$DADA's goal is to empower stores to have the ability to deliver everything to their customers within an hour on-demand. $JD owns 51% of $DADA. Here is a thread on the things you need to know as a $DADA or $JD investor.

Let's get started 👇👇

$DADA's goal is to empower stores to have the ability to deliver everything to their customers within an hour on-demand. $JD owns 51% of $DADA. Here is a thread on the things you need to know as a $DADA or $JD investor.

Let's get started 👇👇

1. The Chinese E-commerce Market – Growth

The China E-commerce market has grown rapidly over the past decade and is poised to continue to grow for the coming decades.

The China E-commerce market has grown rapidly over the past decade and is poised to continue to grow for the coming decades.

2. China E-commerce as a % of total sales

Despite strong growth, Chinese E-commerce share has only taken up 24.9% of the total retail sales in consumer goods in 2020. There is still great potential in the coming 5-10 years in Chinese E-commerce.

Despite strong growth, Chinese E-commerce share has only taken up 24.9% of the total retail sales in consumer goods in 2020. There is still great potential in the coming 5-10 years in Chinese E-commerce.

3. The 3 phrases of E-commerce in China

The first phrase of E-commerce is when products are delivered in days, the second phrase delivered under 24 hours, and the third phrase, ‘on-demand’, products are being delivered within an hour. China is currently entering the third phase.

The first phrase of E-commerce is when products are delivered in days, the second phrase delivered under 24 hours, and the third phrase, ‘on-demand’, products are being delivered within an hour. China is currently entering the third phase.

4. On-Demand Delivery Orders

China has experienced rapid growth in total on-demand delivery orders over the past couple years. As of 2019, there are more than 18 billion total on-demand orders delivered, a growth of 36.93%.

China has experienced rapid growth in total on-demand delivery orders over the past couple years. As of 2019, there are more than 18 billion total on-demand orders delivered, a growth of 36.93%.

5. China On-Demand Delivery Market Segment

Food delivery orders take up most online delivery orders. However, there is a trend that on-demand delivery orders are widening to all other kinds of products.

Food delivery orders take up most online delivery orders. However, there is a trend that on-demand delivery orders are widening to all other kinds of products.

6. On-Demand Food Delivery Users

According to Statista, China has the largest userbase, over 400 million users, of on-demand food delivery services in 2019. A growth of approximately 20%. The China on-demand food delivery market is valued at $51.5 billion USD in 2020.

According to Statista, China has the largest userbase, over 400 million users, of on-demand food delivery services in 2019. A growth of approximately 20%. The China on-demand food delivery market is valued at $51.5 billion USD in 2020.

7. Supermarket On-Demand GMV

Supermarket retail GMV is expected to grow to 3.6 trillion RMB (560 billion USD) in 2023. The supermarket O2O (online to offline, way of describing on-demand delivery) penetration is only 1.4% in 2019 and is expected to grow at a CAGR of 70%.

Supermarket retail GMV is expected to grow to 3.6 trillion RMB (560 billion USD) in 2023. The supermarket O2O (online to offline, way of describing on-demand delivery) penetration is only 1.4% in 2019 and is expected to grow at a CAGR of 70%.

8. Covid tailwind

Covid has created strong tailwind and accelerated on-demand delivery, as more people have experienced the conveniency provided by on-demand delivery. Covid has creating a lot of growth especially in 2nd and 3rd tier cities in China.

Covid has created strong tailwind and accelerated on-demand delivery, as more people have experienced the conveniency provided by on-demand delivery. Covid has creating a lot of growth especially in 2nd and 3rd tier cities in China.

9. Overview - $DADA

With all that said, here is where $DADA comes in. $DADA is a leading platform for local on-demand delivery in China. $DADA runs DADA Now, a leading local on-demand delivery platform for merchants and individuals, and JDDJ (JD to Home), one of China’s largest

With all that said, here is where $DADA comes in. $DADA is a leading platform for local on-demand delivery in China. $DADA runs DADA Now, a leading local on-demand delivery platform for merchants and individuals, and JDDJ (JD to Home), one of China’s largest

9.1 local on-demand retail platforms for retailers. $DADA primarily focuses on on-demand delivery on groceries and products except food delivery orders, as that market is saturated.

10. Dada Now

Dada Now is an open on-demand delivery platform serving both merchants and individuals. DADA Now aims to deliver an integrated full channel on-demand delivery service within an hour for logistics companies, chain businesses, SMEs, and individuals.

Dada Now is an open on-demand delivery platform serving both merchants and individuals. DADA Now aims to deliver an integrated full channel on-demand delivery service within an hour for logistics companies, chain businesses, SMEs, and individuals.

10.1 DADA Now aims to build a more efficient distribution network for operation and fulfilment. It also provides digitalization of supply chain management, product management, and service that increase efficiency of stores’ own delivery fleet.

10.2 DADA Now spanned over 2,700 cities and counties in China with daily orders over 10 million in their peak days. DADA now serves companies like Walmart, Aeon, BBK electronics, JD Logistics and many more.

11. JDDJ (JD to Home)

JDDJ, was established by $JD, but later spinoff and merged with DADA in 2016, where JD acquired 47.4% of DADA. JDDJ is a local on-demand platform that connects retailers and brand owners directly with consumers. JDDJ is like UberEATS, but for groceries and

JDDJ, was established by $JD, but later spinoff and merged with DADA in 2016, where JD acquired 47.4% of DADA. JDDJ is a local on-demand platform that connects retailers and brand owners directly with consumers. JDDJ is like UberEATS, but for groceries and

11.1 other products. JDDJ covers 1400 cities and counties in China with around 40 million active users.

JDDJ aims to be a ‘cloud supermarket and cloud department stores’ that can delivered any product within an hour by aggregating all physical supermarkets/stores.

JDDJ aims to be a ‘cloud supermarket and cloud department stores’ that can delivered any product within an hour by aggregating all physical supermarkets/stores.

13. Largest Supermarket O2O platform

JDDJ is the largest supermarket O2O platform. Almost all supermarket, Walmart, YongHui Superstores, China Resources Vanguard and 100 thousand more stores are all on JDDJ. More than 60% of the top 100 supermarket has partnership with $DADA.

JDDJ is the largest supermarket O2O platform. Almost all supermarket, Walmart, YongHui Superstores, China Resources Vanguard and 100 thousand more stores are all on JDDJ. More than 60% of the top 100 supermarket has partnership with $DADA.

14. Benefits to Physical Stores

$DADA with JDDJ’s 40 million users and $JD app’s 400 million AAU, acts as a channel that increase traffic for traditional physical stores. $DADA allows physical stores to have the ability to deliver products within an hour in a cost-effective way.

$DADA with JDDJ’s 40 million users and $JD app’s 400 million AAU, acts as a channel that increase traffic for traditional physical stores. $DADA allows physical stores to have the ability to deliver products within an hour in a cost-effective way.

14.1 $DADA enables stores to decrease human labor requirements with product management and picking system that eliminates unwanted product, make product suggestions and controls product in real time. This decreases out of stock rate and increase inventory turnover for stores.

14.2 Stores that partnered with $DADA has reported an increase of sales by 10-30% without increasing their physical space.

15. No competition, only partnerships

$DADA’s CEO, Phillip Kuai, has promised that DADA will never be involved in selling the products themselves and compete with traditional retailers. $DADA will only help traditional retailers to digitalize and fulfil on-demand delivery.

$DADA’s CEO, Phillip Kuai, has promised that DADA will never be involved in selling the products themselves and compete with traditional retailers. $DADA will only help traditional retailers to digitalize and fulfil on-demand delivery.

16. Efficiency

$DADA uses smart distribution of orders to determine the best route for couriers, dynamic scheduling, real time orders volume to increase the efficiency of each courier and delivery.

$DADA uses smart distribution of orders to determine the best route for couriers, dynamic scheduling, real time orders volume to increase the efficiency of each courier and delivery.

17. Time Saving

Like UberEATS, the biggest value proposition of $DADA is time saving. A $DADA service costs around $5-$15ish RMB ($0.77 to $2.32 USD), allows customers to save time and ‘opportunity costs’ that are wasted for daily shopping while not paying a hefty price.

Like UberEATS, the biggest value proposition of $DADA is time saving. A $DADA service costs around $5-$15ish RMB ($0.77 to $2.32 USD), allows customers to save time and ‘opportunity costs’ that are wasted for daily shopping while not paying a hefty price.

18. Peak Shaving for $JD Logistics

Although $JD has the best logistics team in $JD Logistics, $JD still faces issues during 618 and double 11, China’s shopping festival. $DADA’s crowdsourcing model can provide more workers and assist $JD logistics during these spikes. CONTINUE

Although $JD has the best logistics team in $JD Logistics, $JD still faces issues during 618 and double 11, China’s shopping festival. $DADA’s crowdsourcing model can provide more workers and assist $JD logistics during these spikes. CONTINUE

19. Results

$DADA uses big data, AI, software, and technologies, to achieve an average delivery time of around 30 minutes, matching intra-city orders within 1 minute, decrease picking time to as little as 3 minutes.

$DADA uses big data, AI, software, and technologies, to achieve an average delivery time of around 30 minutes, matching intra-city orders within 1 minute, decrease picking time to as little as 3 minutes.

20. Fun fact: the faster order was delivered within 3 minutes and 12 seconds on $DADA, and at most 700 orders has been delivered by one courier of $DADA in a single day.

21. Before looking at $DADA’s customers reviews let’s look at delivery fees and time, and customers’ concern about the on-demand delivery market to have a better understanding of what customer faces and wants.

22. Delivery Fees and Time

Currently, most on-demand delivery cost around $5-$15 RMB (around 0.7 to 2.2 USD), and only takes around 0.5-2 hours on average to be delivered.

Currently, most on-demand delivery cost around $5-$15 RMB (around 0.7 to 2.2 USD), and only takes around 0.5-2 hours on average to be delivered.

23. Customer’s focus & concerns

In China, customers care about the delivery time, quality, and price the most for an on-demand O2O delivery service.

In China, customers care about the delivery time, quality, and price the most for an on-demand O2O delivery service.

24. Customer Reviews

Due to most customer reviews on DADA now and JDDJ being in Chinese, I will try to summarise some of my main takeaways from browsing the customer reviews. I must admit, the overall reviews have been overwhelmingly bad for JDDJ and to a lesser extent DADA Now.

Due to most customer reviews on DADA now and JDDJ being in Chinese, I will try to summarise some of my main takeaways from browsing the customer reviews. I must admit, the overall reviews have been overwhelmingly bad for JDDJ and to a lesser extent DADA Now.

24.1 Some main complains include poor delivery timing, weird/random cancellation of orders, poor product selection/quality. The biggest complaint that customers have is that JDDJ promised delivery within 1-2 hours, but their orders are not delivered within such time period.

24.2 This likely defeat the purpose of using JDDJ, as customer likely expect speedy delivery.

24.3 Customers have experienced random cancellation of orders or communication issues with either the courier or store. This is common for online platforms, but it indicates that $DADA has more work to do to create a rounded platform that connects the user, stores and courier.

24.4 Other customers complain about being delivered bad products, rotten groceries, and even less weight than what the customer has ordered. This is a major problem because if JDDJ cannot provide quality products, it will greatly damage their reputation. One main reason that

24.5 attributes to this issue is that couriers focus on being fast rather than picking the best products for the customers (because couriers are paid based on how delivery orders). $DADA should put more effort into ensuring that only good products are picked by their couriers as

24.6 both quality and timeliness are valued by customers.

These suggests that $DADA is not performing well, or at least could done better, in the two most important thing, ‘delivery time’ and ‘product quality’, that a customer valued for O2O on-demand delivery.

These suggests that $DADA is not performing well, or at least could done better, in the two most important thing, ‘delivery time’ and ‘product quality’, that a customer valued for O2O on-demand delivery.

24.7 There are other complains listed on Zhihu.com, if you can read Chinese, I would recommend go checking it out. Nevertheless, I believe $DADA still have quit some work to do to enhance their customer experience,

24.8 as many reviewers recommend other on-demand delivery services over $DADA over, which is concerning in my opinion.

25. Competitors

Meituan and Ele.me are JDDJ's main competitors in the on-demand delivery market. Although $DADA has emphasized that they do not compete directly with Meituan and Ele.me, as those two focuses more on food deliveries,

Meituan and Ele.me are JDDJ's main competitors in the on-demand delivery market. Although $DADA has emphasized that they do not compete directly with Meituan and Ele.me, as those two focuses more on food deliveries,

25.1 I believe they are competitors, because both Meituan and Ele.me has been expanding their reach into on-demand delivery to all kinds of products.

25.2 $DADA and several reports have claim that $DADA is the largest or one of the largest O2O on-demand delivery platform in China. In the data sets that I found, $DADA has a market share of around 22-27%, whereas Meituan 25-35% and Ele.me 27-28%.

25.3 However, such ‘claim’, can be misleading as these data excludes food delivery orders, and only focuses on on-demand delivery for ‘groceries and other products’, because $DADA does not do food delivery orders.

25.4 If we look at average daily delivery orders, a more accurate measure, Meituan has a daily delivery orders of 21.8 million, Ele.me 12 million and $DADA only 2.2 million. This indicates the gap between $DADA and Meituan and Ele.me.

25.5 $DADA do not have a presence in food delivery orders because $DADA strategically avoided food delivery orders against the like of Meituan and Ele.me.

25.6 Unfortunately for $DADA, competition is not slowing down but only getting fiercer, as Meituan, Ele.me, and other logistics companies have expanded to all kinds of on-demand delivery because of on-demand delivery’s long-term potential.

25.7 All these companies are competing on a cost basis. It is hard to say that $DADA will be the ultimate winner, because in my opinion $DADA do not enjoy any material advantages over these other competitors.

26. Revenue

$DADA's revenue has reached 5.74 billion RMB (890 million USD) in 2020. $DADA’s revenue has experienced strong growth with a CARG rate of 67.7% over the last three years and a 58.8% growth for 2020.

$DADA's revenue has reached 5.74 billion RMB (890 million USD) in 2020. $DADA’s revenue has experienced strong growth with a CARG rate of 67.7% over the last three years and a 58.8% growth for 2020.

27. Revenue from $JD and $WMT

$DADA earns around 50% of revenue from $JD and 14% from $WMT. These lack of income diversification, should not be concerning in the short run, as $JD and $WMT each holds 51% and around 10% of $DADA. However, in the LR, $DADA must expand further.

$DADA earns around 50% of revenue from $JD and 14% from $WMT. These lack of income diversification, should not be concerning in the short run, as $JD and $WMT each holds 51% and around 10% of $DADA. However, in the LR, $DADA must expand further.

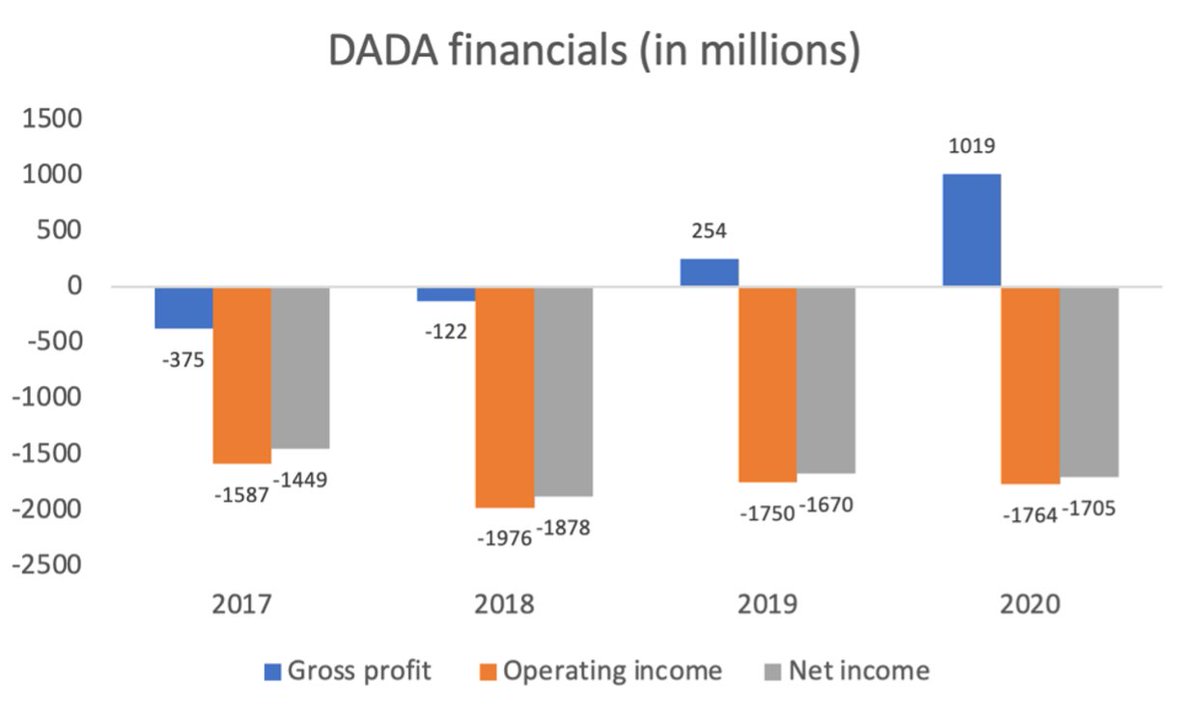

28. Money losing

Out of $DADA’s gross profit, operating income and net income, only gross profit has improved over the past 4 years. This point to the concern that all ridehail/on-demand delivery platform has in common, when will or how can these platforms be profitable? CON

Out of $DADA’s gross profit, operating income and net income, only gross profit has improved over the past 4 years. This point to the concern that all ridehail/on-demand delivery platform has in common, when will or how can these platforms be profitable? CON

29. Costs Breakdown

$DADA’s expenses as a %of revenue is high (131.8% in 2020). Operations, which includes the heaviest expense, labour, by itself makes up 82.2% of revenue. Although the decreasing trend is great, $DADA still have a long way to go before profitability.

$DADA’s expenses as a %of revenue is high (131.8% in 2020). Operations, which includes the heaviest expense, labour, by itself makes up 82.2% of revenue. Although the decreasing trend is great, $DADA still have a long way to go before profitability.

30. Conclusion

$DADA as a Chinese local on-demand delivery platform has enjoyed and should continue to enjoy the growing on-demand delivery market. However, while $DADA’s top line continue to increase, $DADA’s bottom line improvement still remains to be seen.

$DADA as a Chinese local on-demand delivery platform has enjoyed and should continue to enjoy the growing on-demand delivery market. However, while $DADA’s top line continue to increase, $DADA’s bottom line improvement still remains to be seen.

30.1 $DADA also faces fierce competition from other huge players like Meituan and Ele.me, which I do not see how $DADA can differentiate itself from. They are likely to continue to compete on price for the foreseeable future.

30.2 $DADA’s customer reviews are concerning in my opinion, as any great business should have overwhelmingly positive customer reviews. Although the poor review may be due to the inherent nature of on demand delivery, $DADA will need to provide better customer experience.

30.3 From an investment perspective, it is hard for me to treat $DADA as a ‘separate company’ outside of $JD, because of $JD’s 51% stake and $JD contribution to $DADA’s revenue. Therefore, I view $DADA more as a service that fulfill frequent needs of the $JD logistics network.

30.4 $DADA also allows $JD to provide a more comprehensive shopping experience with on-demand delivery, therefore I would argue $DADA is quite important for $JD, but as an individual investment, I am not particularly sold on $DADA. END//

31. Thank you for reading this thread. I hope you have learnt one thing or two about the Chinese on-demand delivery market and $DADA. If you like this thread, please consider liking and retweeting it, it really does helps me out a lot and I really appreciate it!

32. If you like this content, please follow me @joshuatai0427, where I post regularly threads like these every 2-3 days. My next deep dive thread should be my final thread on $JD, where I combined all my previous $JD threads and outlined a comprehensive analysis of $JD.

32.1 I shall move on to making more $BABA threads after my final $JD threads. Thank you for your support!

Tagging some $JD, $DADA bulls or users who may be interested in this thread! @daniel_toloko @TanArrowz @DennisHong17 @jablamsky @Matematikern3 @EugeneNg_VCap @BuyandHoldd @FinanceGhost @Krevix @TomInvesting @Gambiste1 @SlingshotCap @RihardJarc @paul_essen @JordsNel

Would really appreciate any comments, feedbacks, thoughts or insights on either $DADA, its relationship with $JD, and the on-demand delivery market! Thank you very much!

• • •

Missing some Tweet in this thread? You can try to

force a refresh