It's been widely believed that retail is to blame for Bitcoin's price drop.

However, the data shows this is not the case. Retail (entities with 0.001BTC to 1BTC) has been aggressively adding to their holdings.

However, the data shows this is not the case. Retail (entities with 0.001BTC to 1BTC) has been aggressively adding to their holdings.

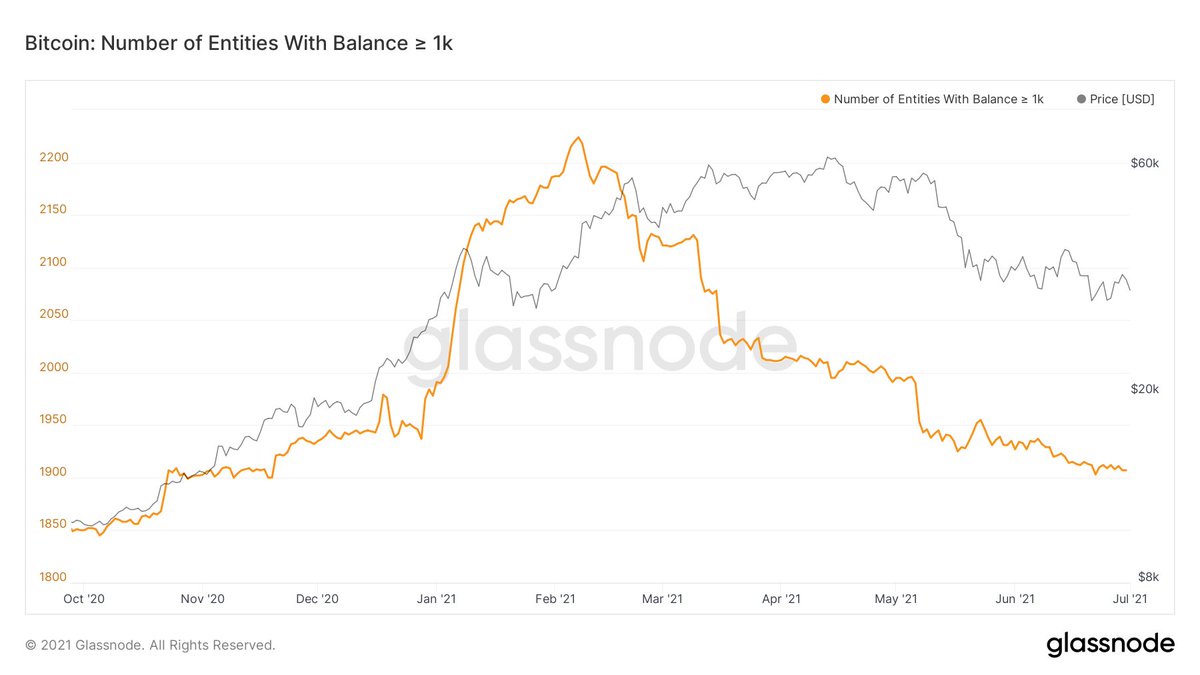

It actually seems like most selling has come from whales (entities with >1K BTC), as the number of whales on-chain has continued to trend down.

Although this is good for adoption, it shows that retail cannot sustain Bitcoin as a trillion-dollar asset and I suspect if there's going to be any continuation of this bull run, we're going to need to see at least a jolt in new whales coming on the network.

To add, thanks Willy.

https://twitter.com/woonomic/status/1410640000908107781?s=20

Younger whales (weak hands) selling while older whales (strong hands) absorbing those coins. Hence this chart:

https://twitter.com/WClementeIII/status/1409884875612643341?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh