You’re going to call me a hypocrite.

Because last week I was touting ESG and this week I am talking about my oil holdings!

But the truth is, in order to live the lives we do today, we have needed and still need oil.

It’s the lifeblood of nearly everything we consume.

Because last week I was touting ESG and this week I am talking about my oil holdings!

But the truth is, in order to live the lives we do today, we have needed and still need oil.

It’s the lifeblood of nearly everything we consume.

And now that revenge travel & shopping is upon us and storage levels are running near record lows…

Gas stations are literally running out of gas 👀

Gas stations are literally running out of gas 👀

This week, in 5 minutes, let’s breakdown Oil:

Setting the table 👉 How I think about the demand/supply dynamics

Recent Activist Action 👉 Board seats & competitor subsidies, but focus on the DELTA

Recent advances👉 Value rotation along with the rate movements

Let’s get started!

Setting the table 👉 How I think about the demand/supply dynamics

Recent Activist Action 👉 Board seats & competitor subsidies, but focus on the DELTA

Recent advances👉 Value rotation along with the rate movements

Let’s get started!

1.1/ Setting the table 👉 How I think about the demand/ supply dynamics

Trying to predict the individual political components of the energy trade I felt confusing and frustrating.

Give me an Advil and wake me up in a decade…

Trying to predict the individual political components of the energy trade I felt confusing and frustrating.

Give me an Advil and wake me up in a decade…

1.2/ ECON 101

Basic economics tells us that as long as demand exceeds supply, prices go up. As pricing goes up, more supply will come online, therefore reaching a new equilibrium.

All this jockeying for position and posturing are attempts at measuring the levels of supply.

Basic economics tells us that as long as demand exceeds supply, prices go up. As pricing goes up, more supply will come online, therefore reaching a new equilibrium.

All this jockeying for position and posturing are attempts at measuring the levels of supply.

1.3/ TOO MUCH

It is frequently beyond the control of even the most expert forecasters in the field. There are just too many moving pieces.

Instead, I like to understand the big pieces of supply, but shift more of my focus on the demand component.

It is frequently beyond the control of even the most expert forecasters in the field. There are just too many moving pieces.

Instead, I like to understand the big pieces of supply, but shift more of my focus on the demand component.

1.4/ TAKE A STEP BACK

I like to first say, “what do I know to be true?” and “what important truth do very few people agree with you on?”

What I “know to be true” is that a lot of my friends are ready for some revenge travel, revenge shopping, and frankly - revenge spending.

I like to first say, “what do I know to be true?” and “what important truth do very few people agree with you on?”

What I “know to be true” is that a lot of my friends are ready for some revenge travel, revenge shopping, and frankly - revenge spending.

1.5/ REVENGE

They have been cooped up for far too long, which has led to a spike in personal savings rates, which have sustained higher levels:

This money will be spent.

They have been cooped up for far too long, which has led to a spike in personal savings rates, which have sustained higher levels:

This money will be spent.

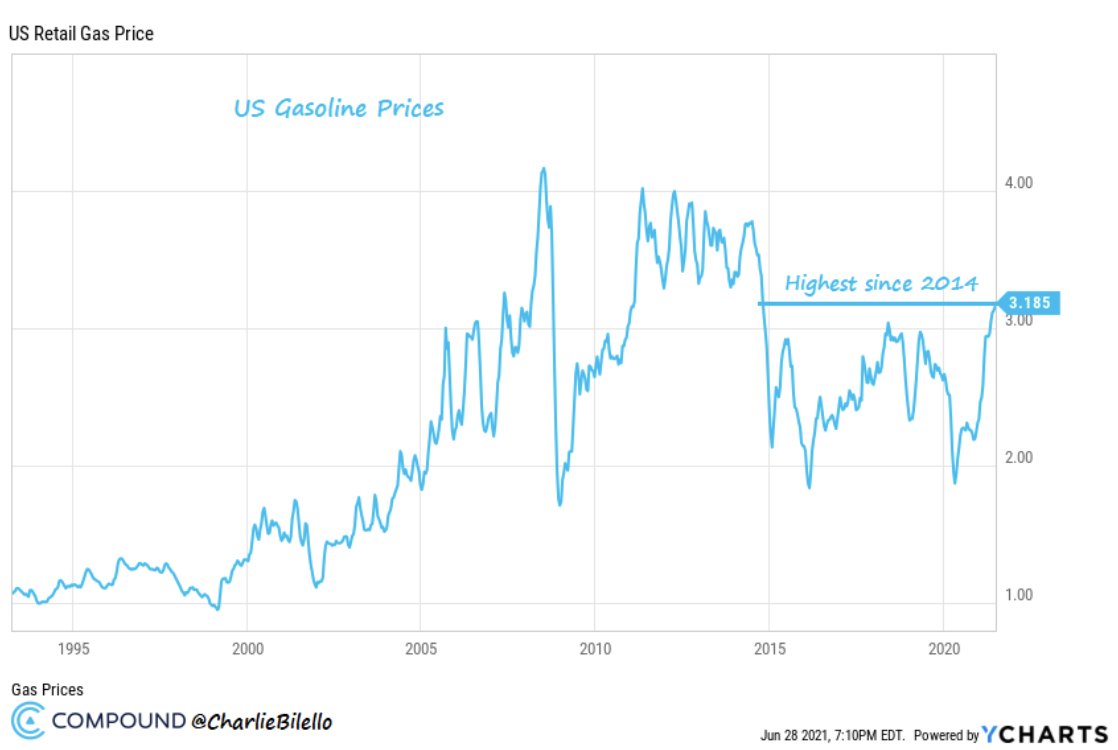

1.6/ OIL INCREASE

Increase in travel = increase in oil demand

Increase in consumption of manufactured goods = increase in oil demand

This leads me to the second part: “what important truth do very few people agree with you on?”:

Oil stocks are still great investments.

Increase in travel = increase in oil demand

Increase in consumption of manufactured goods = increase in oil demand

This leads me to the second part: “what important truth do very few people agree with you on?”:

Oil stocks are still great investments.

2.1/ Recent activist action 👉 Board seats & competitor subsidies, but focus on the DELTA

People claim that oil is in secular decline, and that’s probably right. But it doesn’t mean you can’t make money in the interim.

People claim that oil is in secular decline, and that’s probably right. But it doesn’t mean you can’t make money in the interim.

2.2/ CHEVRON

The battle against Big Oil accelerated even recently as a bunch of headlines hit the tape:

Chevron shareholders voted against management last month, directing the company to cut greenhouse gas emissions.

The battle against Big Oil accelerated even recently as a bunch of headlines hit the tape:

Chevron shareholders voted against management last month, directing the company to cut greenhouse gas emissions.

2.3/ EXXON

Exxon shareholders defied the executive suite and voted to install three independent directors with the goal of pushing the energy giant to reduce its carbon footprint.

Exxon shareholders defied the executive suite and voted to install three independent directors with the goal of pushing the energy giant to reduce its carbon footprint.

2.4/ SHELL

Shell had a Dutch rule that it should slash its greenhouse gas emissions by 45% compared with 2019 levels by 2030. Shell said it would appeal, while environmentalists exulted that the decision set a precedent for concerted legal efforts worldwide.

Shell had a Dutch rule that it should slash its greenhouse gas emissions by 45% compared with 2019 levels by 2030. Shell said it would appeal, while environmentalists exulted that the decision set a precedent for concerted legal efforts worldwide.

2.5/ ESG

And I think that this ESG movement is a good thing but hear me out on this one… it could be an even better thing for oil companies that reinvent themselves.

When it comes to ESG ratings - all the alpha has been ‘priced in’ from a multiple perspective.

And I think that this ESG movement is a good thing but hear me out on this one… it could be an even better thing for oil companies that reinvent themselves.

When it comes to ESG ratings - all the alpha has been ‘priced in’ from a multiple perspective.

2.6/ ESG

Most of the leaders with higher ESG scores already got their market premium as they were recently bid up.

What companies have more to gain on the ESG front than oil companies? Focus on the second derivatives, the rate of change. Skate where the puck is going.

Most of the leaders with higher ESG scores already got their market premium as they were recently bid up.

What companies have more to gain on the ESG front than oil companies? Focus on the second derivatives, the rate of change. Skate where the puck is going.

2.7/ RERATE

If they can show steady incline in their shift to carbon capture in production, or electric drilling, etc… the rate of change in their score could be a solid catalyst for a re-rate.

If they can show steady incline in their shift to carbon capture in production, or electric drilling, etc… the rate of change in their score could be a solid catalyst for a re-rate.

3.1/ Recent advances 👉 Value rotation along with interest rate movements

The “topic du jour” amongst the markets recently has been all the talk in the 10yr rate. To oversimplify, think of this rate as a gauge on the temperature of the overall economy.

The “topic du jour” amongst the markets recently has been all the talk in the 10yr rate. To oversimplify, think of this rate as a gauge on the temperature of the overall economy.

3.2/ LOW RATE

A low rate is supportive of growthier assets and a higher rate is more supportive of value plays.

Over this time period, we’ve seen a huge shakeout in growth and rotation into value. The chart below is the iShares Russell 2000 Growth/Value ETFs.

A low rate is supportive of growthier assets and a higher rate is more supportive of value plays.

Over this time period, we’ve seen a huge shakeout in growth and rotation into value. The chart below is the iShares Russell 2000 Growth/Value ETFs.

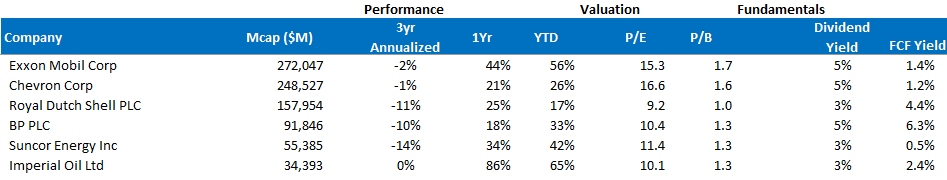

3.3/ THE NUMBERS

If you look at Chevron, Exxon, BP, Shell: P/E ratios are in the 10-15x range, Price/Book ratios are 1-1.7x. Dividend yields range from 3% to 5%. FCF profile is strong. These are great value plays!

If you look at Chevron, Exxon, BP, Shell: P/E ratios are in the 10-15x range, Price/Book ratios are 1-1.7x. Dividend yields range from 3% to 5%. FCF profile is strong. These are great value plays!

3.4/ What stocks do I own?

My paid subscribers know….

Two weeks ago, I added a junior energy position to my portfolio and it’s up +40%. Higher oil and liquid prices have led to significant free cash flow generation.

My paid subscribers know….

Two weeks ago, I added a junior energy position to my portfolio and it’s up +40%. Higher oil and liquid prices have led to significant free cash flow generation.

3.5/ NEWSLETTER

They have had a “step change” in debt reduction and are accelerating drilling. The chart keeps climbing! If you want to find out which one click below and upgrade to my PAID newsletter to see my entire portfolio. 👇

gritcapital.substack.com/subscribe

They have had a “step change” in debt reduction and are accelerating drilling. The chart keeps climbing! If you want to find out which one click below and upgrade to my PAID newsletter to see my entire portfolio. 👇

gritcapital.substack.com/subscribe

• • •

Missing some Tweet in this thread? You can try to

force a refresh