California’s hydropower reserves are drying up in the most literal sense.

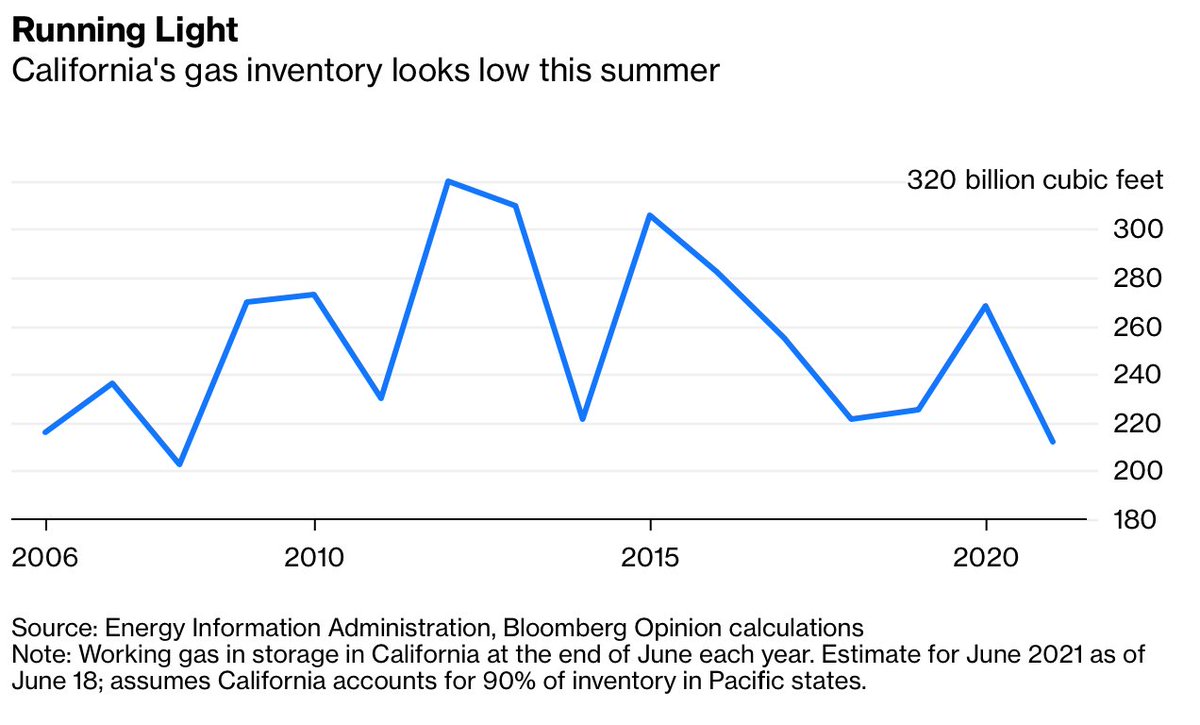

This summer, the fuel that normally stands in for water is also running lower than usual trib.al/UQVzi8s

This summer, the fuel that normally stands in for water is also running lower than usual trib.al/UQVzi8s

Natural gas typically fulfills two roles for California’s power grid during the summer:

➡️ It fills in the gap left by depleted hydropower

➡️ It handles much of the state’s surge in electricity demand during the early evening trib.al/13I89vX

➡️ It fills in the gap left by depleted hydropower

➡️ It handles much of the state’s surge in electricity demand during the early evening trib.al/13I89vX

The premium on local gas supplies has jumped to its highest level since February.

Power stations in California and Nevada Were also suddenly burning double the amount of gas compared to the previous month as a heatwave washed over the West trib.al/13I89vX

Power stations in California and Nevada Were also suddenly burning double the amount of gas compared to the previous month as a heatwave washed over the West trib.al/13I89vX

It looks like California may be entering the height of a particularly demanding summer with the lowest stockpile of gas in more than a decade.

One reason for this concerns prior events in another state far away from Sacramento: Texas trib.al/13I89vX

One reason for this concerns prior events in another state far away from Sacramento: Texas trib.al/13I89vX

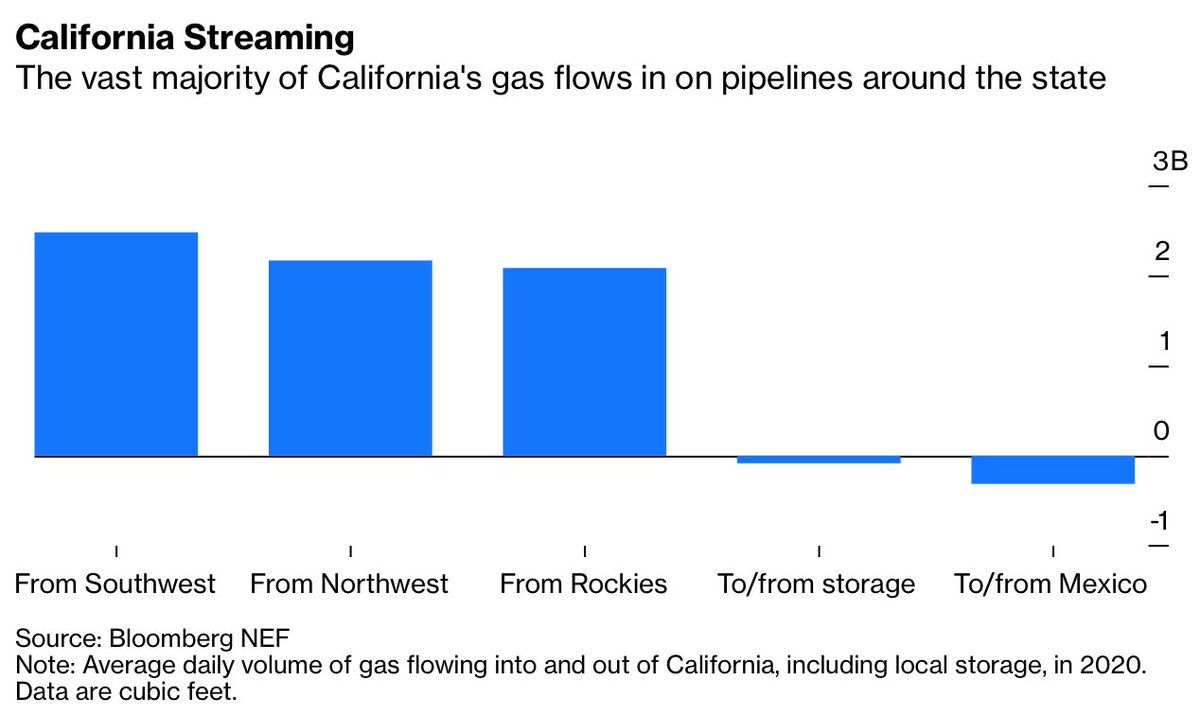

California produces very little gas of its own, relying on imports from the Rockies, Canada and Texas.

A little of that gas then usually heads south out of California to Mexico trib.al/13I89vX

A little of that gas then usually heads south out of California to Mexico trib.al/13I89vX

When Texas suffered its devastating freeze in February, the isolation of its power grid rightly came under criticism.

But its natural gas network, which also failed, definitely isn’t an island.

Permian basin gas flows all over — and to California trib.al/13I89vX

But its natural gas network, which also failed, definitely isn’t an island.

Permian basin gas flows all over — and to California trib.al/13I89vX

This chart shows natural gas imports from the major regions supplying California on Tuesday, February 16 — in the depths of Texas’s energy crisis — compared with the third Tuesday in February for previous years trib.al/13I89vX

There are two conclusions to draw:

➡️ California will be paying up for gas, especially if it suffers more heatwaves

➡️ Everything’s connected. Texas' gas-starved power plants couldn’t supply juice to pipeline compressors, reinforcing gas shortages trib.al/13I89vX

➡️ California will be paying up for gas, especially if it suffers more heatwaves

➡️ Everything’s connected. Texas' gas-starved power plants couldn’t supply juice to pipeline compressors, reinforcing gas shortages trib.al/13I89vX

• • •

Missing some Tweet in this thread? You can try to

force a refresh