Property Analysis Friday

‘Rent or buy’

• Investing in Property

• Alternative Asset Classes

#DYOR applies to all asset classes, not only stocks.

Case study

(Thread) 👇🏽

‘Rent or buy’

• Investing in Property

• Alternative Asset Classes

#DYOR applies to all asset classes, not only stocks.

Case study

(Thread) 👇🏽

•Location

- Johannesburg South

- Eikenhof

- Kibler Park

The offering👇🏽

property24.com/for-sale/eiken…

- Johannesburg South

- Eikenhof

- Kibler Park

The offering👇🏽

property24.com/for-sale/eiken…

• Features

- 2 bedrooms

- 45sqm

• Selling points

- Water/electricity metre

- Fibre

- Biometric Access

- Security

- Close to schools

- Transport areas

It’s targeting a very distinct group of people. (At a price)

- 2 bedrooms

- 45sqm

• Selling points

- Water/electricity metre

- Fibre

- Biometric Access

- Security

- Close to schools

- Transport areas

It’s targeting a very distinct group of people. (At a price)

• Purchase Price

R710 000

100% coverage

7% @ 20 years

1stly, never work with current rate, work with higher to anticipate ⬆️rates.

2nd, never not pay a deposit.

These are the agents selling points. Their goal is to sell it to you, not worry about if you can afford it.

R710 000

100% coverage

7% @ 20 years

1stly, never work with current rate, work with higher to anticipate ⬆️rates.

2nd, never not pay a deposit.

These are the agents selling points. Their goal is to sell it to you, not worry about if you can afford it.

• Agents Tone

“Price increases from 1 July”

(Typical marketing gimmick - never be rushed into a decision)

They emphasize on

“no transfer duties”.

(Under 1 million usually is)

“Buying straight from developer”. Nothing great about that

(They make money off of you)

“Price increases from 1 July”

(Typical marketing gimmick - never be rushed into a decision)

They emphasize on

“no transfer duties”.

(Under 1 million usually is)

“Buying straight from developer”. Nothing great about that

(They make money off of you)

• Fees

- Bond costs = R5504

- Rates/ T = R250

- Levies = R1000

* insurance (R200-R1000) will work with R500

Total cost: R7254

- Bond costs = R5504

- Rates/ T = R250

- Levies = R1000

* insurance (R200-R1000) will work with R500

Total cost: R7254

• Extra Fees

Besides the 710k bond, you’ll need to fork out some upfront payments to seal the deal.

Always have liquid cash to cover other associated fees.

Besides the 710k bond, you’ll need to fork out some upfront payments to seal the deal.

Always have liquid cash to cover other associated fees.

•Running the numbers (1)

Just your bond costs, let me repeat this; “Just your bond cost”

You’ll pay back

-Principal = R 710 000

-Interest = R 611 109.39

Total: R1 321 109.00

•86% more than what the asset is worth

Just your bond costs, let me repeat this; “Just your bond cost”

You’ll pay back

-Principal = R 710 000

-Interest = R 611 109.39

Total: R1 321 109.00

•86% more than what the asset is worth

• Running the numbers (2)

If I include other monthly costs

- levies / rates

- Insurance

- Bond

R7254 x 240

Total = R 1 740 960 (excludes rising costs like levy increases, rates and taxes or rising interest rates)

If I include other monthly costs

- levies / rates

- Insurance

- Bond

R7254 x 240

Total = R 1 740 960 (excludes rising costs like levy increases, rates and taxes or rising interest rates)

• Things to ponder

- Developers make money off of you, it’s why their target market is folks wanting property as a primary residence

*Property investors know there is no equity and ultimately it’s a bad deal.

- Will house prices more than double in the next 20 years?

- Developers make money off of you, it’s why their target market is folks wanting property as a primary residence

*Property investors know there is no equity and ultimately it’s a bad deal.

- Will house prices more than double in the next 20 years?

- Will Sectional titles be able to hold value - I don’t think so.

- Is there a risk of rising interest rates + rising rates /taxes - count on it.

- Should I consider renting rather, and investing the difference into other asset classes - IMO, yes.

Let me explain 👇🏽

- Is there a risk of rising interest rates + rising rates /taxes - count on it.

- Should I consider renting rather, and investing the difference into other asset classes - IMO, yes.

Let me explain 👇🏽

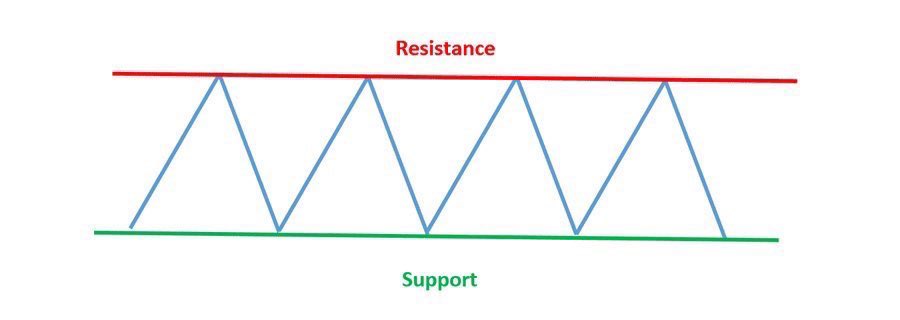

• Buying or renting

Renting a Two bedroom where I rent for R5k, because trust me property prices are coming down. (Rental and purchase prices) ⬇️

Check Gauteng - it’s already happening - deflationary.

It’s a renters market, not a buyers!

Agents are there to make sales.

Renting a Two bedroom where I rent for R5k, because trust me property prices are coming down. (Rental and purchase prices) ⬇️

Check Gauteng - it’s already happening - deflationary.

It’s a renters market, not a buyers!

Agents are there to make sales.

https://twitter.com/talkcentss/status/1408051870589853707

- Renting may be the smartest move you make to protect your capital.

R5000x R240months

= R1.2million.

You’ve saved R500k in fees and we didn’t even consider maintenance costs.

IMO- It would be smart to take your surplus every month, by renting and not buying+ invest it.

R5000x R240months

= R1.2million.

You’ve saved R500k in fees and we didn’t even consider maintenance costs.

IMO- It would be smart to take your surplus every month, by renting and not buying+ invest it.

- Example ⬇️

R2000 invested monthly- at 10% a year- for 20 years;

You’d have a future value of R1.5million.

Calculator 👇🏽

rapidtables.com/calc/finance/c…

In this case renting would be better than buying. I’d have liquid cash and be able to buy property in the future.

R2000 invested monthly- at 10% a year- for 20 years;

You’d have a future value of R1.5million.

Calculator 👇🏽

rapidtables.com/calc/finance/c…

In this case renting would be better than buying. I’d have liquid cash and be able to buy property in the future.

• Secrets

The example ⬆️ was for primary residence.

‘Renting or buying’

Below are more secrets, the ebook will help you make better investment decisions when it comes to property and what to look out for.

35% off ( Today only )

Code: freedom

gum.co/property

The example ⬆️ was for primary residence.

‘Renting or buying’

Below are more secrets, the ebook will help you make better investment decisions when it comes to property and what to look out for.

35% off ( Today only )

Code: freedom

gum.co/property

Shout- out

To all you #DYOR people. It’s so important, it will protect you from capital erosion and put you on the path to financial freedom.

Thanks for making it to the end.

To all you #DYOR people. It’s so important, it will protect you from capital erosion and put you on the path to financial freedom.

Thanks for making it to the end.

• • •

Missing some Tweet in this thread? You can try to

force a refresh