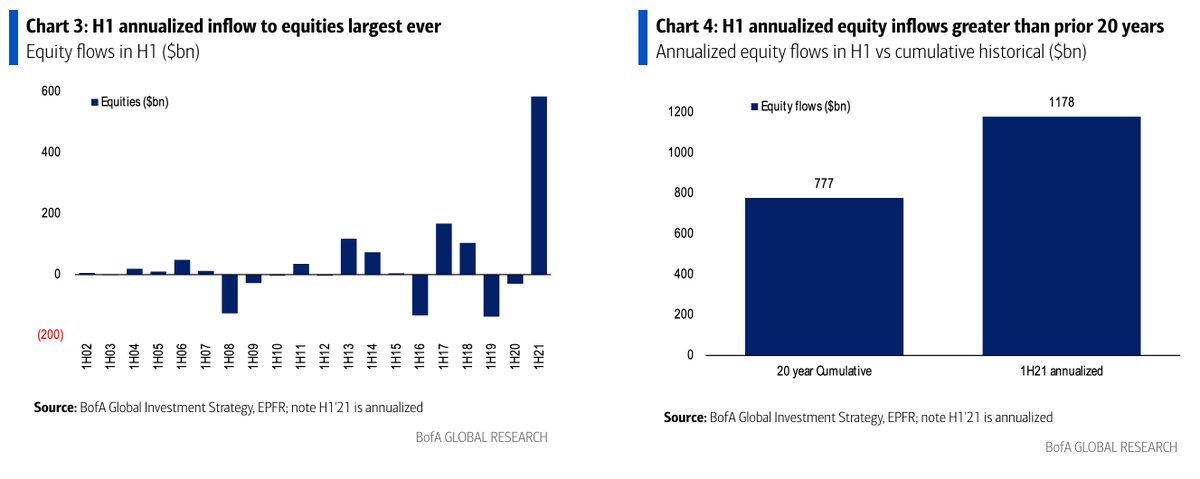

This is WILD. If equity fund flow continue at the current pace, this year will see greater net inflows than the preceding 20 years COMBINED.

Best first half for global stock market in nearly four decades, and the seventh best of the past century.

This is the Everything Rally though. Even US Treasuries are enjoying inflows (though swamped by inflows into TIPS and financial stocks)

Best first-half of a year for commodity prices in nearly five decades, and the fifth best for the past century.

Stunning BofA chart showing US jobs data v retail sales. Still some labour market recovery to go, but retail sales have gone ballistic.

Final factoid to cap this all off. Central banks globally have bought an average of $10bn bonds a day over the past six months.

• • •

Missing some Tweet in this thread? You can try to

force a refresh