Hello Everyone. Thank you for the lovely wishes. Just thought to create a master thread of my timeline, so that all the past tweets can be organized better. Just an effort to have everything at one place. There is much more to this, will keep adding in time to come.

1. My initial part of the trading journey was covered by MoneyControl, and had it not been the conviction of Shishir Sir, a very dear friend and brother now, it would've never been published. So Thank You @asthanashishir Sir for the push 🙏🙏

https://t.co/o2usNJuMMq

https://t.co/o2usNJuMMq

https://twitter.com/asitbaran/status/1203311895643480065?s=20

2. Over the period of time, have written few threads in my own understanding on varied topics, and hopefully it will be a worthy read for you. Tried to collate and put it in one place. Will keep adding too the list as and when I put more.

3.

1/IV: The Power of Implied Volatility

2/Options Guidelines

https://t.co/cPnTQ3a8VB

3/Gamma Write-Up

https://t.co/hbyawLhcyH

4/Probability of Trading Success

https://t.co/mCPattu08E

5/Basic Checklist while going Long Options

https://t.co/EY8cAPSRNH

1/IV: The Power of Implied Volatility

2/Options Guidelines

https://t.co/cPnTQ3a8VB

3/Gamma Write-Up

https://t.co/hbyawLhcyH

4/Probability of Trading Success

https://t.co/mCPattu08E

5/Basic Checklist while going Long Options

https://t.co/EY8cAPSRNH

https://twitter.com/asitbaran/status/1279807429622951936?s=20

https://twitter.com/asitbaran/status/1276171941905403904?s=20

https://twitter.com/asitbaran/status/1284867698061504513?s=20

https://twitter.com/asitbaran/status/1361377541043359745?s=20

https://twitter.com/asitbaran/status/1396836831715463173?s=20

4.

6/Strategy based on MACD

7/Strategy based upon Weekly & Daily Stochastic

https://t.co/Lykx4n0jaP

8/Strategy based upon BB + RSI

https://t.co/RqYQngPWgA

9/ATR + STOCHA Strategy (which was also covered in MC article)

https://t.co/3GYpvBZR4c

6/Strategy based on MACD

7/Strategy based upon Weekly & Daily Stochastic

https://t.co/Lykx4n0jaP

8/Strategy based upon BB + RSI

https://t.co/RqYQngPWgA

9/ATR + STOCHA Strategy (which was also covered in MC article)

https://t.co/3GYpvBZR4c

https://twitter.com/asitbaran/status/1223955197547859968?s=20

https://twitter.com/asitbaran/status/1226380935110643712?s=20

https://twitter.com/asitbaran/status/1221355173924069376?s=20

https://twitter.com/asitbaran/status/1381130251057516549?s=20

5.

10/A thread on not to be trapped by Random calls

11/Observations

https://t.co/hN0U49EHH3

12/Bank Nifty Scalping done for Spider Software

https://t.co/mCPattu08E

Posted on YouTube

https://t.co/1mdnuRnEg0

Thread on Scalping

https://t.co/uKTVRQBMRI https://t.co/lSzziQgj89

10/A thread on not to be trapped by Random calls

11/Observations

https://t.co/hN0U49EHH3

12/Bank Nifty Scalping done for Spider Software

https://t.co/mCPattu08E

Posted on YouTube

https://t.co/1mdnuRnEg0

Thread on Scalping

https://t.co/uKTVRQBMRI https://t.co/lSzziQgj89

https://twitter.com/asitbaran/status/1381629284486246403?s=20

https://twitter.com/asitbaran/status/1205712323127603201?s=20

https://twitter.com/asitbaran/status/1361377541043359745?s=20

https://twitter.com/asitbaran/status/1251729817231331330?s=20

7.

Noted down few of my flaws and shortcomings

Talk of major Losses

https://t.co/fuOcapWTF5

Noted down few of my flaws and shortcomings

Talk of major Losses

https://t.co/fuOcapWTF5

https://twitter.com/asitbaran/status/1395421485418745857?s=20

https://twitter.com/asitbaran/status/1279320813146001410?s=20

8. Seminars

Have done 3 of them and take lot of pride in them. Post that have done few seminars as well. Never knew I'll be training 700+ people as of now, but feels good all of them have positive to say and the sessions have been hugely positive for them.

Have done 3 of them and take lot of pride in them. Post that have done few seminars as well. Never knew I'll be training 700+ people as of now, but feels good all of them have positive to say and the sessions have been hugely positive for them.

9.

Delhi:

Bangalore:

https://t.co/v08QTSbcvE

Hyderabad:

https://t.co/f74KbPdD5j

Hopefully I would be able to do more Offline sessions in coming time. https://t.co/fNjzcIYPz2

Delhi:

Bangalore:

https://t.co/v08QTSbcvE

Hyderabad:

https://t.co/f74KbPdD5j

Hopefully I would be able to do more Offline sessions in coming time. https://t.co/fNjzcIYPz2

https://twitter.com/asitbaran/status/1219207911051685888?s=20

https://twitter.com/asitbaran/status/1229093672949407745?s=20

https://twitter.com/asitbaran/status/1234155688084951041?s=20

10. Events / Seminars

Have been to TradersCarnival events for last two years, and thoroughly enjoyed them as you would meet traders across the country and its a joy to speak to them and share your experiences.

Have been to TradersCarnival events for last two years, and thoroughly enjoyed them as you would meet traders across the country and its a joy to speak to them and share your experiences.

11.

Thanks @Traderscarnival for the opportunities

https://t.co/QW1oTJ3nqG

https://t.co/E9YCxGrqk2 https://t.co/B4R3f5N3u1

Thanks @Traderscarnival for the opportunities

https://t.co/QW1oTJ3nqG

https://t.co/E9YCxGrqk2 https://t.co/B4R3f5N3u1

https://twitter.com/Traderscarnival/status/1227496484553183234?s=20

https://twitter.com/Traderscarnival/status/1363687453580664832?s=20

https://twitter.com/CNBC_Awaaz/status/1375768012473524229?s=20

12. NMIMS

Gave a couple of hour session to NM's MBA students on Options Greeks. Had a great time interacting with the Dean and faculty members.

https://t.co/1o9d6WXsDR

Gave a couple of hour session to NM's MBA students on Options Greeks. Had a great time interacting with the Dean and faculty members.

https://t.co/1o9d6WXsDR

https://twitter.com/asitbaran/status/1235125404270129153

13.

Did a session with QuantsApp on Gamma scalping on their Quant Sapp Option Expert Series. Thank You @Tinagadodia for the opportunity

https://t.co/NfqEnMOPIA

Did a session with QuantsApp on Gamma scalping on their Quant Sapp Option Expert Series. Thank You @Tinagadodia for the opportunity

https://t.co/NfqEnMOPIA

https://twitter.com/quantsapp/status/1262707072287858688?s=20

14.

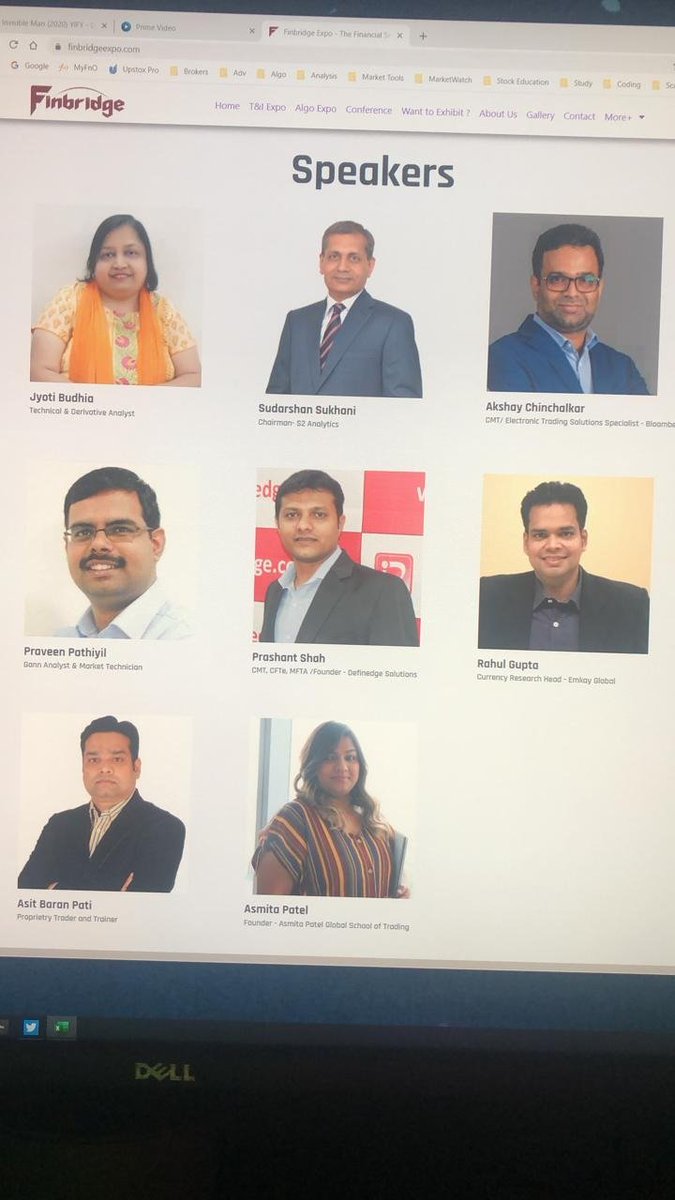

Was a panelist at AlgoConvention last year on Discretionary v/s Systematic Trading. Thank You @technovestor and @SOVITCMT

Did a session with finbridge, and highlight of the session was to share the screen with Mr. Sukhani :) https://t.co/gKhuImgPnq

Was a panelist at AlgoConvention last year on Discretionary v/s Systematic Trading. Thank You @technovestor and @SOVITCMT

Did a session with finbridge, and highlight of the session was to share the screen with Mr. Sukhani :) https://t.co/gKhuImgPnq

https://twitter.com/asitbaran/status/1303709541293461504?s=20

15. Last but not the least as of now, did a session with CMT it was an honor to share my learning and experience.

16.

2021, has been a landmark year for me in terms of turnaround, never ever had thought of coming on @CNBC_Awaaz , but approached @shail_bhatnagar Sir if I can be featured on the Khiladi Nu 1 show, he gave me a chance to which started of on a very bad note, lost the weekly game

2021, has been a landmark year for me in terms of turnaround, never ever had thought of coming on @CNBC_Awaaz , but approached @shail_bhatnagar Sir if I can be featured on the Khiladi Nu 1 show, he gave me a chance to which started of on a very bad note, lost the weekly game

17.

for the first four days and was surprised to see me as a winner on the 5th day and just sure couldn't have been possible without Jagannath prahu's blessing. And somehow managed win the Monthly competition as well.

https://t.co/bXI5aLKwlS https://t.co/Yh6aPMBwOp

for the first four days and was surprised to see me as a winner on the 5th day and just sure couldn't have been possible without Jagannath prahu's blessing. And somehow managed win the Monthly competition as well.

https://t.co/bXI5aLKwlS https://t.co/Yh6aPMBwOp

https://twitter.com/CNBC_Awaaz/status/1352563926983004161?s=20

https://twitter.com/CNBC_Awaaz/status/1355100874717057027?s=20

18. And never knew I could be forayed into morning and afternoon shows, and am glad am being able to do okay and and haven't let down @shail_bhatnagar Sir and his team. And will keep doing my best with best of effort.

19.

And its been 6 months that I've been appearing on the shows, and from the DMs and feedbacks, just know that the honesty is paying off. Some of the great calls over the period of time.

https://t.co/ziYNd4tgjL

https://t.co/06QVYrgmOh

And its been 6 months that I've been appearing on the shows, and from the DMs and feedbacks, just know that the honesty is paying off. Some of the great calls over the period of time.

https://t.co/ziYNd4tgjL

https://t.co/06QVYrgmOh

https://twitter.com/CNBC_Awaaz/status/1385074097621635073?s=20

https://twitter.com/asitbaran/status/1406969663473348611?s=20

https://twitter.com/asitbaran/status/1405831165005627398?s=20

20.

https://t.co/uKCZYLS6we

https://t.co/mtTgwYEbcK

https://t.co/mDmntt6uRL

https://t.co/StnQx52xBk

https://t.co/fImrWjZeSQ

https://t.co/eaEhgYS601

https://t.co/OxUIkbDuAD

https://t.co/zjZmYzZ5g4

https://t.co/uKCZYLS6we

https://t.co/mtTgwYEbcK

https://t.co/mDmntt6uRL

https://t.co/StnQx52xBk

https://t.co/fImrWjZeSQ

https://t.co/eaEhgYS601

https://t.co/OxUIkbDuAD

https://t.co/zjZmYzZ5g4

https://twitter.com/CNBC_Awaaz/status/1400375671612796929?s=20

https://twitter.com/asitbaran/status/1400041595890663439?s=20

https://twitter.com/asitbaran/status/1387636103482511361?s=20

https://twitter.com/asitbaran/status/1386985040060379136?s=20

https://twitter.com/asitbaran/status/1385085688626905089?s=20

https://twitter.com/asitbaran/status/1372415885999177733?s=20

https://twitter.com/asitbaran/status/1366690838600966144?s=20

https://twitter.com/asitbaran/status/1362438384631750661?s=20

https://twitter.com/asitbaran/status/1361716338608070658?s=20

21.

Have been putting the Trading / Life quotes which I have found lot of inspirations from, will keep updating these as well.

I'll keep updating this thread from time to time, if anything significant happening. Hope it was worth the effort. Cheers.

Have been putting the Trading / Life quotes which I have found lot of inspirations from, will keep updating these as well.

I'll keep updating this thread from time to time, if anything significant happening. Hope it was worth the effort. Cheers.

https://twitter.com/asitbaran/status/1249745140719046661?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh