Things I learned from Volume Price Analysis - Anna Couling

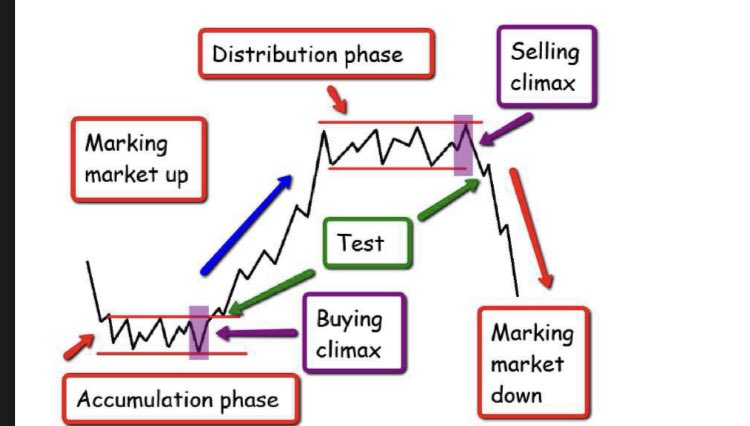

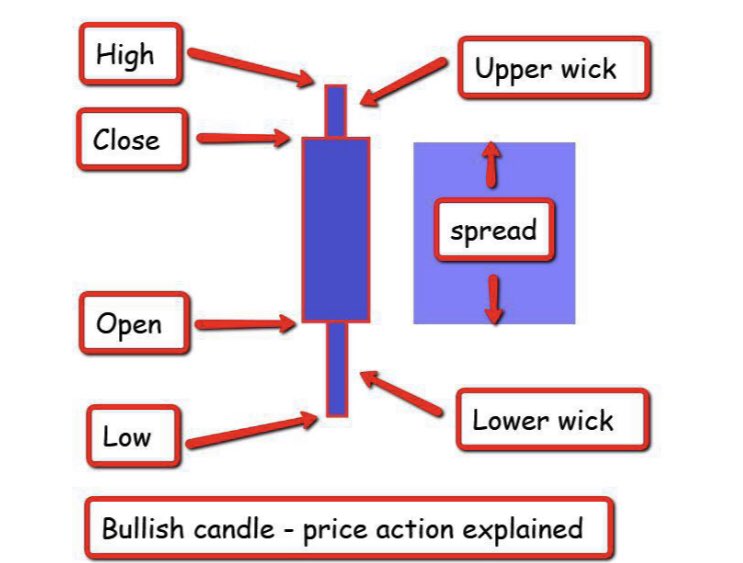

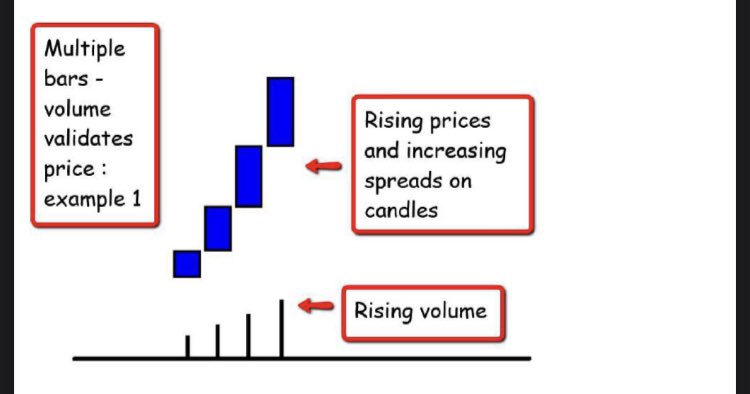

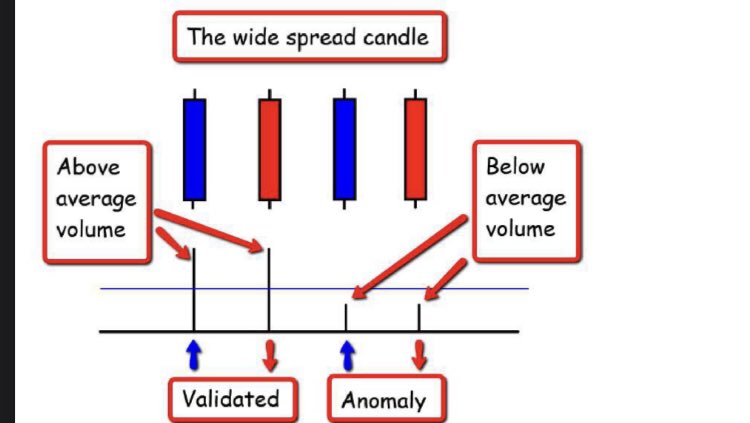

Volume should represent the spread of the candle if the volume is huge but the spread is little that is usually a sign of reversal

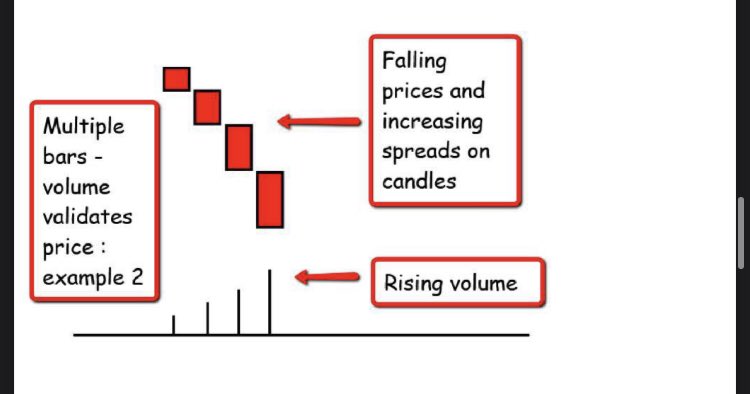

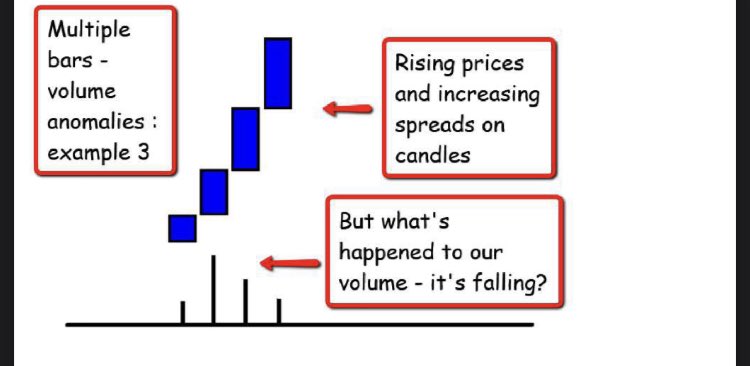

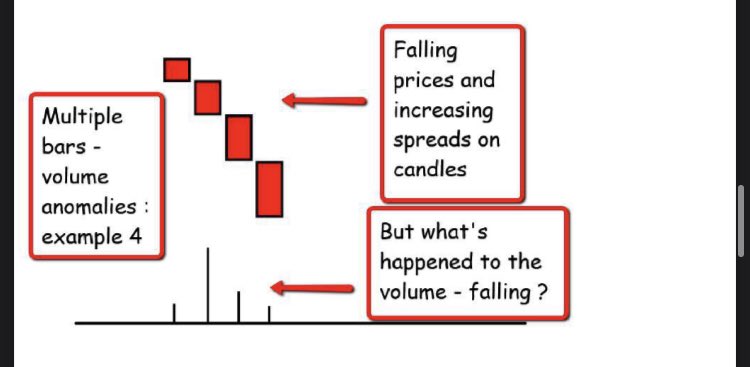

If volume isn’t matching the trend than that means trend is probably coming to an end and showing signs of weakness

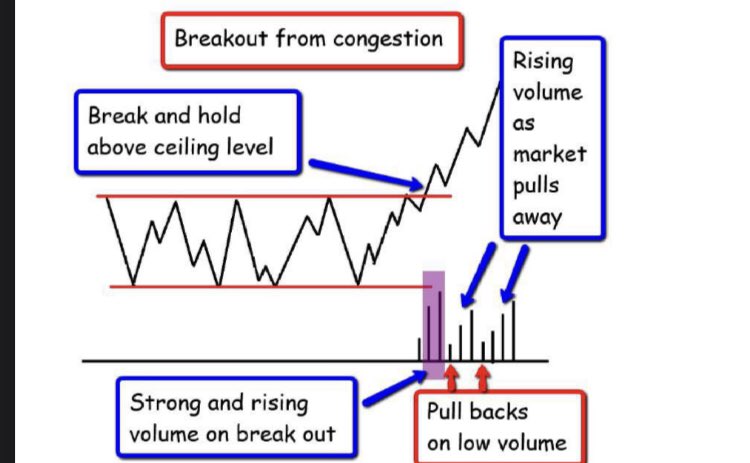

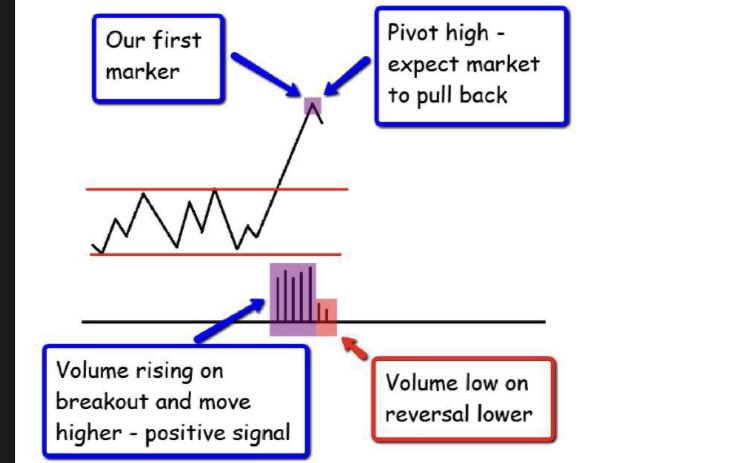

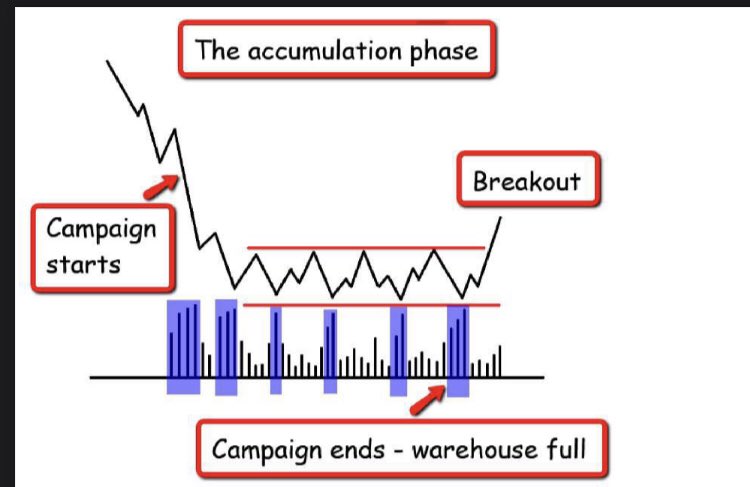

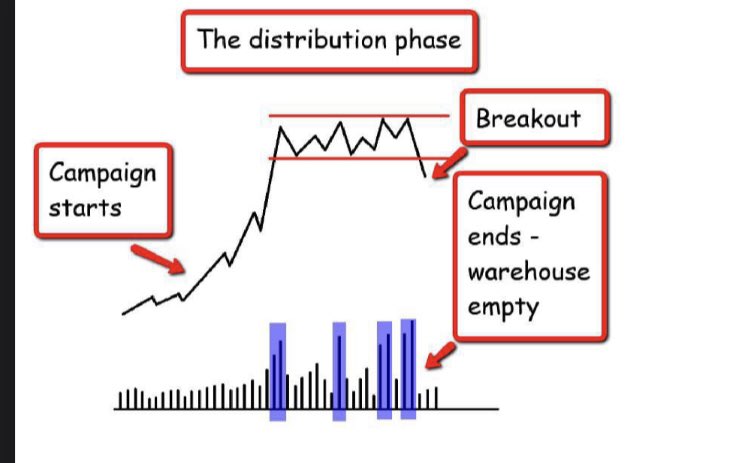

Volume can confirm a breakout and shows signs of accumulation/ distribution . The longer the consolidation the bigger the breakout

Volume can also confirm fake outs and traps. There are a lot of examples of traps with different candle sticks but the volume has to match the candle to show strength

Btw don’t expect to get used to this in one day you have to keep coming back and reviewing and it’ll eventually come with experience

• • •

Missing some Tweet in this thread? You can try to

force a refresh