1/ New to Token Terminal?

Here’s a thread with tips & tricks that will help you get started using the platform! 👇

Here’s a thread with tips & tricks that will help you get started using the platform! 👇

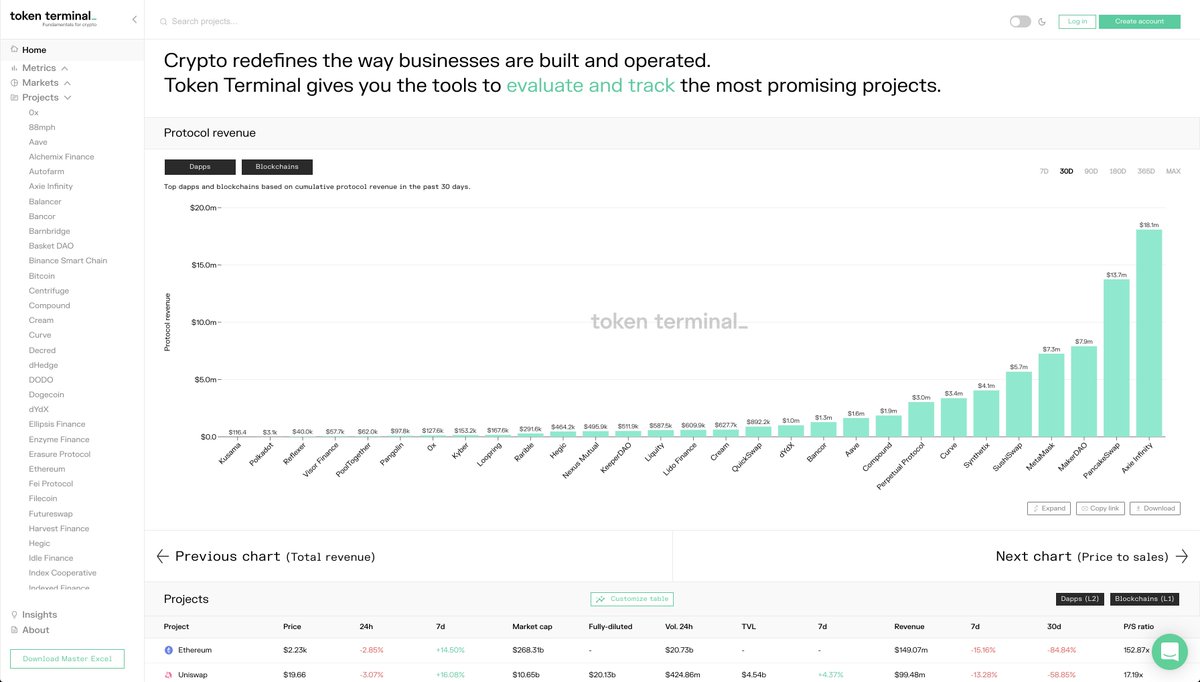

2/ Website layout 🎨

• Landing page: protocol revenue chart + customisable data table

• Metrics dashboards: total revenue, protocol revenue, P/S ratio, TVL

• Markets dashboards: exchange, lending, blockchain, DeFi

• Project dashboards: choose your favourite!

• Landing page: protocol revenue chart + customisable data table

• Metrics dashboards: total revenue, protocol revenue, P/S ratio, TVL

• Markets dashboards: exchange, lending, blockchain, DeFi

• Project dashboards: choose your favourite!

3/ Landing page 🛬

• Protocol revenue chart shows you which protocols are generating money for their token holders.

• With the toggle, you'll get similar charts for Total Revenue & Price to sales ratio.

• The customisable data table lets you choose metrics & sort the results.

• Protocol revenue chart shows you which protocols are generating money for their token holders.

• With the toggle, you'll get similar charts for Total Revenue & Price to sales ratio.

• The customisable data table lets you choose metrics & sort the results.

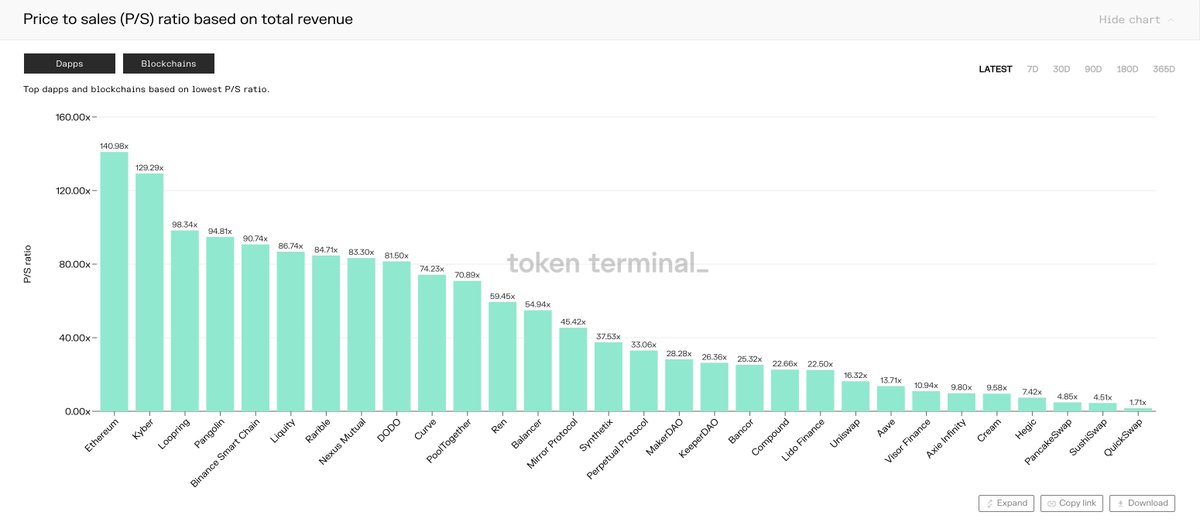

4/ Metrics dashboards 📈

• 1st, pick a metric you’re interested in: total revenue, protocol revenue, P/S ratio, TVL.

• 2nd, analyse how different projects have performed against that metric over time.

• 3rd, for specific projects: use the competitive landscape feature.

• 1st, pick a metric you’re interested in: total revenue, protocol revenue, P/S ratio, TVL.

• 2nd, analyse how different projects have performed against that metric over time.

• 3rd, for specific projects: use the competitive landscape feature.

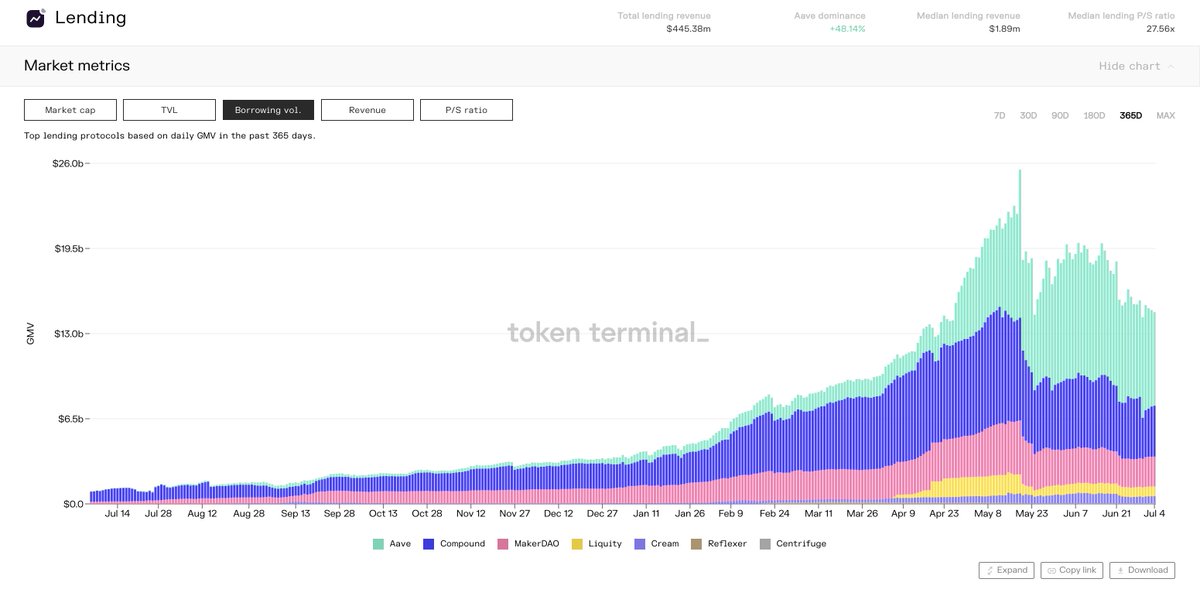

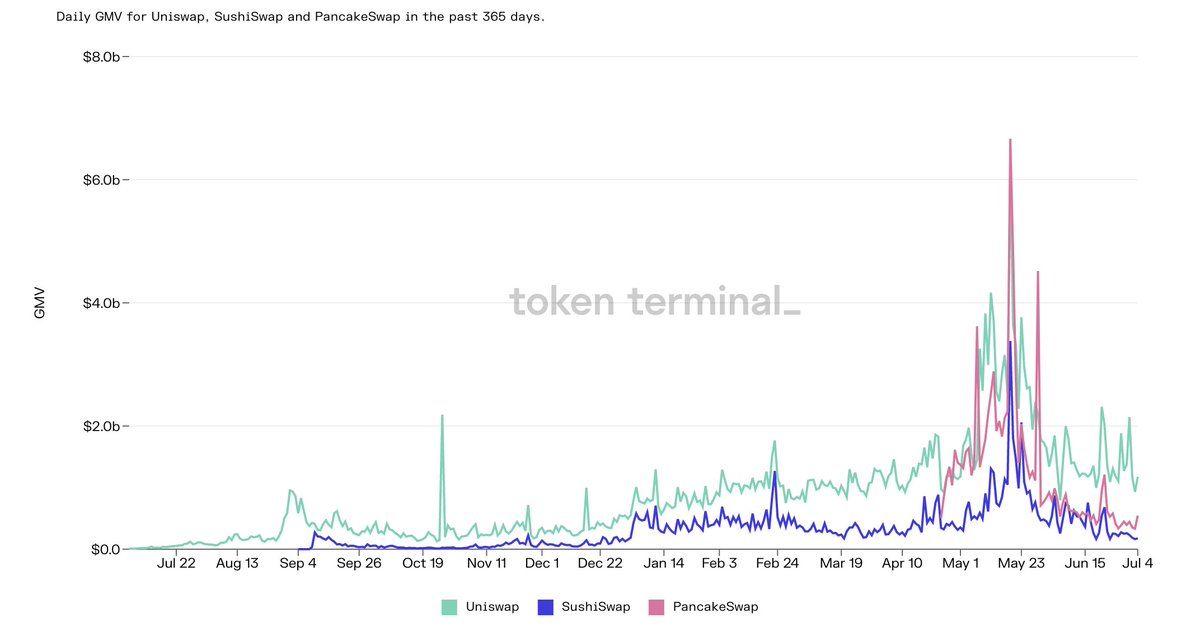

5/ Markets dashboards 📊

• 1st, pick a market you’re interested in: exchange, lending, blockchain, DeFi

• 2nd, analyse how project’s within that market/sector have performed against each other over time.

• 3rd, for specific projects: use the competitive landscape feature.

• 1st, pick a market you’re interested in: exchange, lending, blockchain, DeFi

• 2nd, analyse how project’s within that market/sector have performed against each other over time.

• 3rd, for specific projects: use the competitive landscape feature.

6/ For the rest of the thread, we'll go through the layout of the project-specific dashboards:

• Key metrics

• Revenue share

• Composition

• Competitive landscape

• Key metrics

• Revenue share

• Composition

• Competitive landscape

7/ Key metrics 🔑

Here you can pick different project-specific metrics and evaluate their correlation over different periods of time.

The market cap button has a dropdown for both circ. & fully-diluted & revenue for total, supply-side & protocol revenue (where applicable).

Here you can pick different project-specific metrics and evaluate their correlation over different periods of time.

The market cap button has a dropdown for both circ. & fully-diluted & revenue for total, supply-side & protocol revenue (where applicable).

8/ Revenue share 💰/💰

Currently, we divide the revenue (total fees paid by demand-side users) into three different categories:

1. Total revenue (2+3)

2. Supply-side revenue (goes to LPs, lenders, etc.)

3. Protocol revenue (goes to token holders)

Currently, we divide the revenue (total fees paid by demand-side users) into three different categories:

1. Total revenue (2+3)

2. Supply-side revenue (goes to LPs, lenders, etc.)

3. Protocol revenue (goes to token holders)

9/ Composition 🎨

Here you can go deeper on the different project-specific metrics to better evaluate their quality.

For example, does the majority of a lending protocol’s revenue come from only a few markets or is the revenue-generation spread across multiple markets?

Here you can go deeper on the different project-specific metrics to better evaluate their quality.

For example, does the majority of a lending protocol’s revenue come from only a few markets or is the revenue-generation spread across multiple markets?

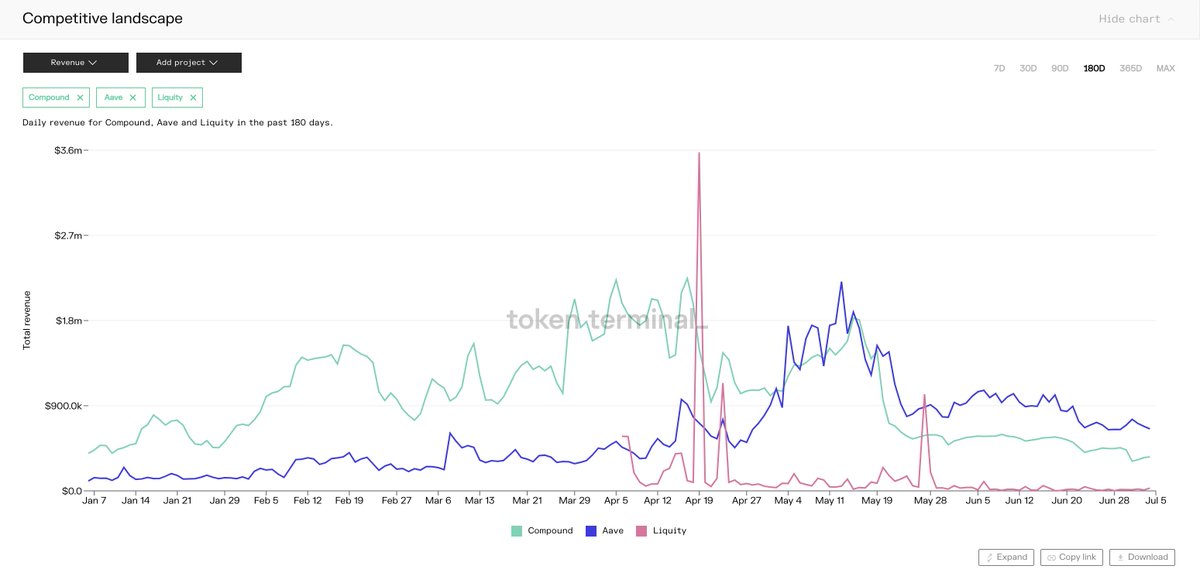

10/ Competitive landscape 🤺

Here you can select multiple projects and a metric and compare their performance over different time periods.

For example, you might want to compare different lending protocols based on their historical price to sales (P/S) ratio.

Here you can select multiple projects and a metric and compare their performance over different time periods.

For example, you might want to compare different lending protocols based on their historical price to sales (P/S) ratio.

11/ Access the underlying datasets 🤓

Finally, the paid version of Token Terminal gives researchers & analysts access to the underlying datasets in both excel & CSV formats.

Early subscribers are also granted API access to the data: tokenterminal.com/signup

Finally, the paid version of Token Terminal gives researchers & analysts access to the underlying datasets in both excel & CSV formats.

Early subscribers are also granted API access to the data: tokenterminal.com/signup

12/ You can check out a sample (Excel file) of our daily master sheet here:

d2kyooqkgm9ipp.cloudfront.net/Token%20Termin…

d2kyooqkgm9ipp.cloudfront.net/Token%20Termin…

fin/ Subscribe to our newsletter for more data-driven insights on the crypto markets!

tokenterminal.substack.com

tokenterminal.substack.com

• • •

Missing some Tweet in this thread? You can try to

force a refresh