Jeff Bezos is officially stepping down as CEO of Amazon today.

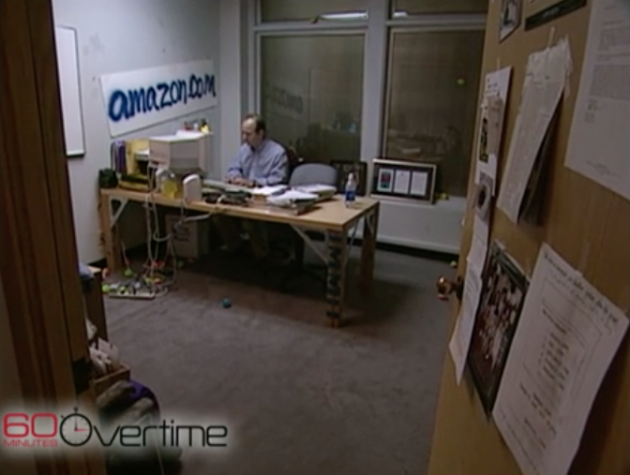

Here is a thread of epic photos from the early days of Jeff's journey to build the world's largest retailer.

👇🏽👇🏽👇🏽

Here is a thread of epic photos from the early days of Jeff's journey to build the world's largest retailer.

👇🏽👇🏽👇🏽

Jeff Bezos is one of the best entrepreneurs in history.

I wouldn't bet against him, regardless of what he chooses to pursue next.

I wouldn't bet against him, regardless of what he chooses to pursue next.

• • •

Missing some Tweet in this thread? You can try to

force a refresh