What is electrical steel Lamination-

-An electrical steel lamination is an iron alloy that consists of up to 6.5% of silicone. Usually, commercial alloys contain up to 3.5% of silicone.

-An electrical steel lamination is an iron alloy that consists of up to 6.5% of silicone. Usually, commercial alloys contain up to 3.5% of silicone.

-Increase in the percentage of silicone increases electrical resistivity of steel remarkably.

- Increased resistivity reduces the eddy current induced and lowers the core losses. However, the metal hardens and becomes brittle, which affects workability of the material.

- Increased resistivity reduces the eddy current induced and lowers the core losses. However, the metal hardens and becomes brittle, which affects workability of the material.

The electrical steel lamination is widely used to laminate the core of transformers and motors. The transformer core is an iron core constructed from a highly permeable material made from thin silicon steel laminations.

Laminations are aligned together to provide required magnetic path with minimum magnetic losses.

SoThe method of producing a material in several layers, so that the material attains improved strength, insulation, stability, appearance, and other qualities, is known as lamination.

SoThe method of producing a material in several layers, so that the material attains improved strength, insulation, stability, appearance, and other qualities, is known as lamination.

-The electrical steel lamination market can be segmented into non-oriented electrical steel and grain-oriented electrical steel.

1- Non-oriented electrical steel has linear magnetic characteristics in all directions.

1- Non-oriented electrical steel has linear magnetic characteristics in all directions.

It is mostly used in rotary machines and iron core materials ranging from large transformers to small electric motors. Special processing of steel is carried to control the grain orientation.

Non-oriented electrical steel has similar magnetic properties in all directions and

Non-oriented electrical steel has similar magnetic properties in all directions and

it consists of 2% to 3.5% of silicone. Non-oriented electrical steel is abbreviated as CRNGO (i.e. cold-rolled non-grain-oriented) electrical steel. CRNGO is economical. It is preferred when cost is the primary consideration and efficiency is secondary.

It is also used when there is less area to align components that make use of directional properties of grain-oriented electrical steel.

2-Grain-oriented electrical steel has good magnetic properties in the direction of rolling. This type of steel is applied in the manufacture

2-Grain-oriented electrical steel has good magnetic properties in the direction of rolling. This type of steel is applied in the manufacture

of large, medium, and small transformers, reactors, and distribution transformers. It contains around 3% of silicone. The processing of steel is carried out in such a way that favorable properties are developed in the rolling direction, .

due to the tight grain orientation relative to the sheet. Grain-oriented electrical steel is also known as CRGO i.e. cold-rolled grain-oriented electrical steel. CRGO is most commonly supplied in coil form. Then, it is cut into laminations.

These laminations are used in transformer cores

Read about Stator and Rotor circuitglobe.com/difference-bet…

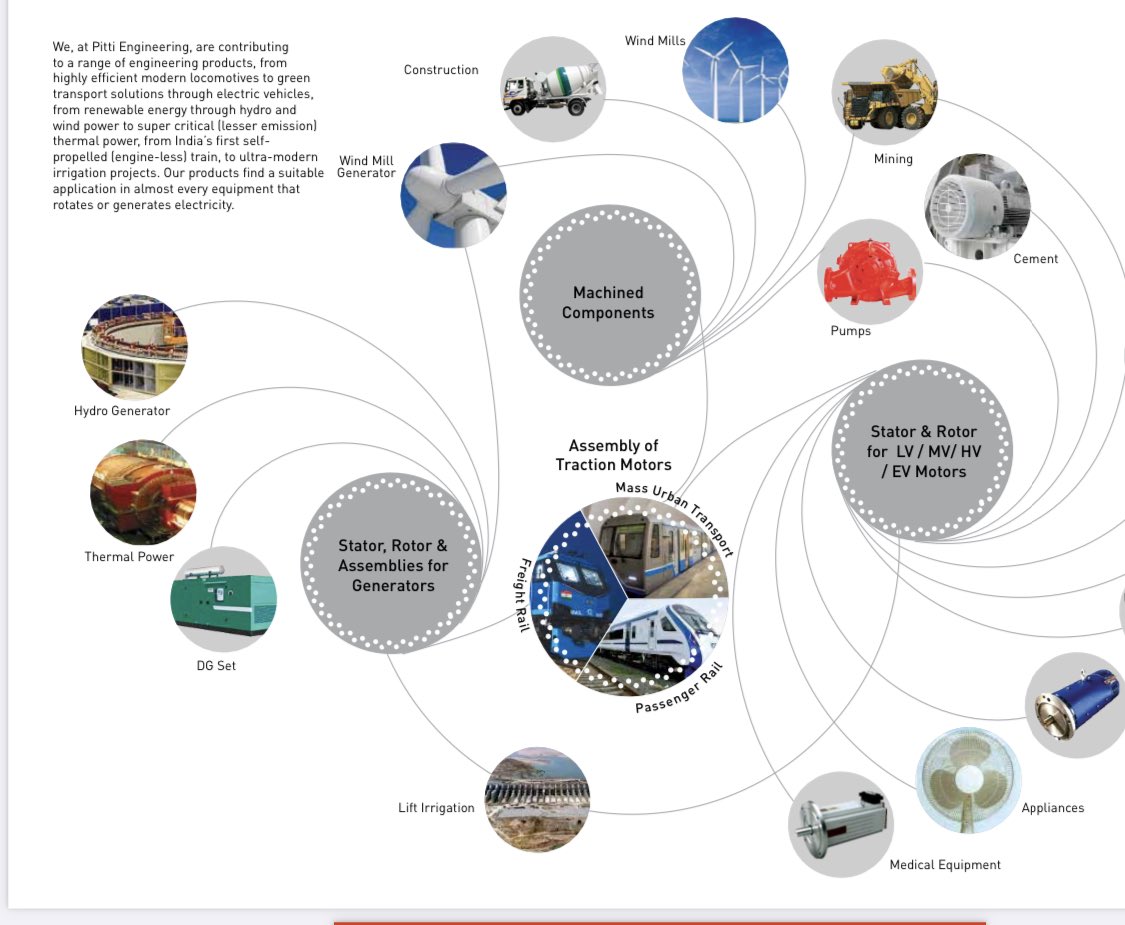

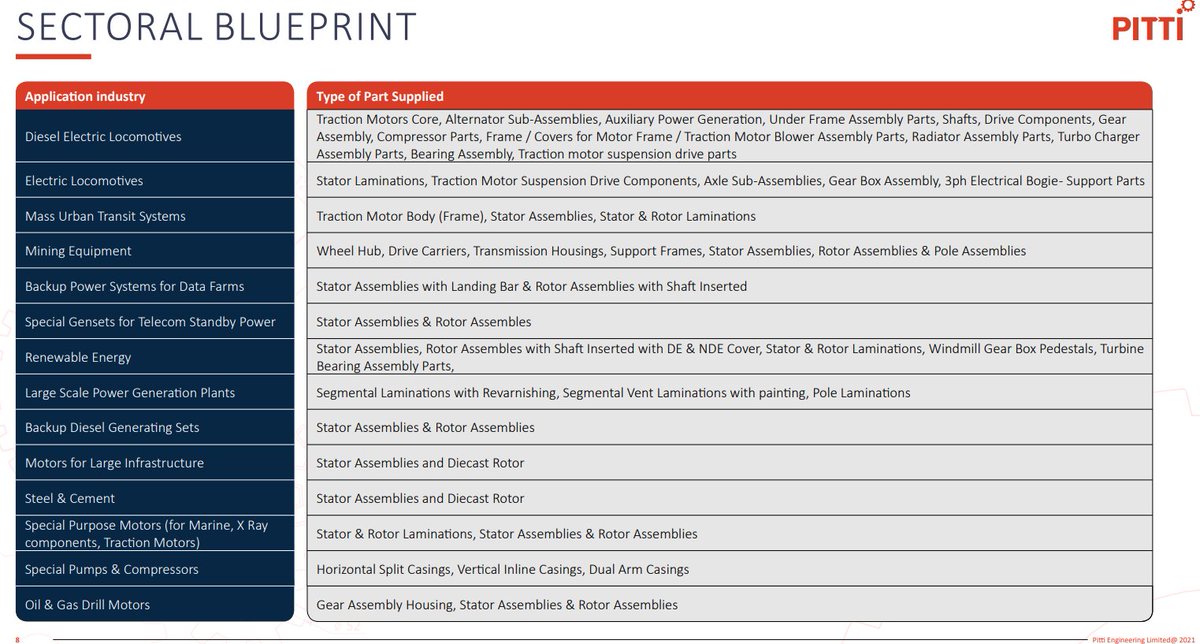

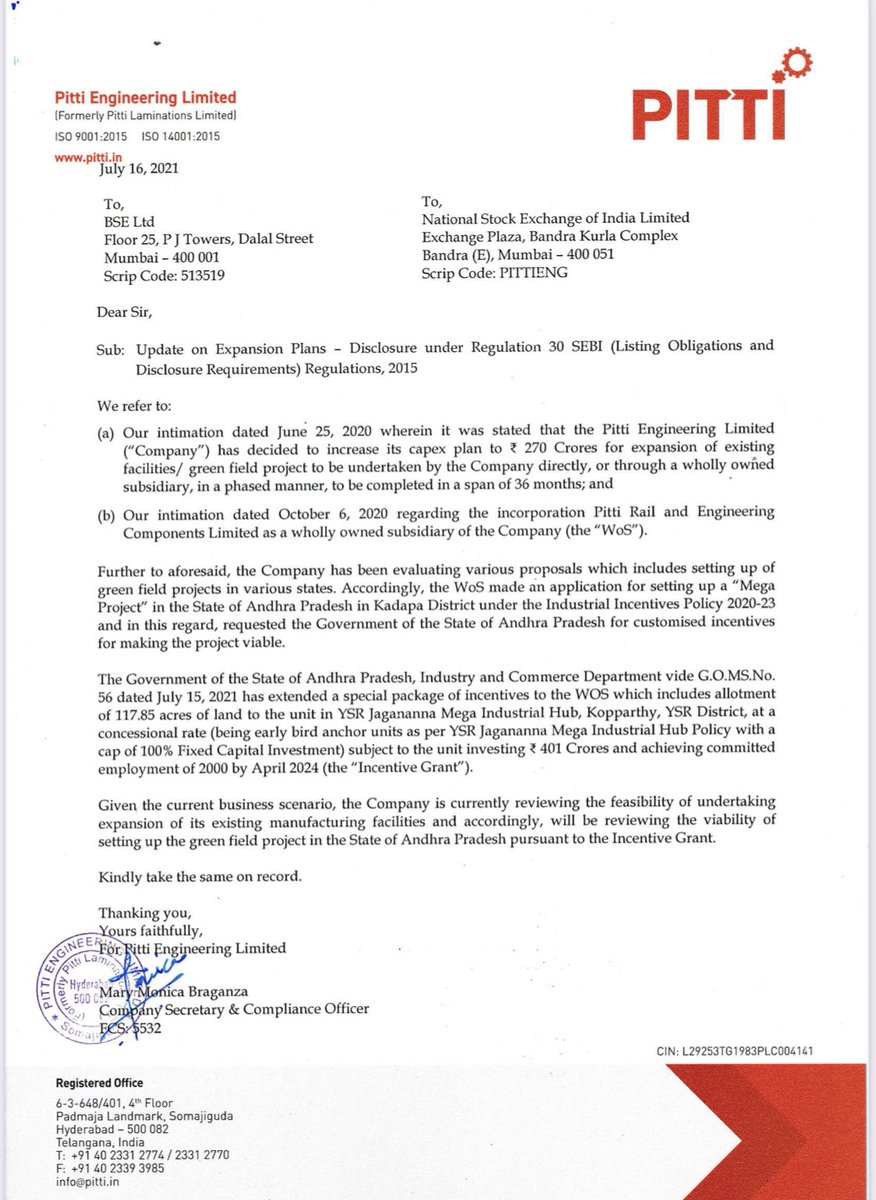

Pitti Engineering-Company is currently reviewing the feasibility of undertaking expansion of its existing manufacturing facilities and accordingly, will be reviewing the viability of setting up the green field project in the State of Andhra Pradesh pursuant to the Incentive Grant

Understand How lamination works and how induction motor works .

https://twitter.com/drprashantmish6/status/1416815326650535937

Gyan on electrical steel and pitti is in business of lamination using this electrical steel alliedmarketresearch.com/electrical-ste…

Gyan on Traction motors

https://twitter.com/drprashantmish6/status/1419331739449581575

annual capacity of 36,000 tonnes in March 2021, which increased to 39,600 in June 2021 and by the end of the financial year the capacity will reach up to 45,000 tonnes. Capacity utilization stands at 60% at present and it is expected that it will reach 90% by the end of the year.

Pitti Engineering Q2FY22 Concall Highlights*

( WA forward - not my notes)Only Important points

- The company recorded highest ever quarterly results such as Sales, EBITDA and PAT. The company is witnessing higher demand and expecting more orders in going forward.

( WA forward - not my notes)Only Important points

- The company recorded highest ever quarterly results such as Sales, EBITDA and PAT. The company is witnessing higher demand and expecting more orders in going forward.

In FY21, The company's top line stood at INR 518cr. The management expects, after completion of capex, topline expected to reach 3.5x to INR 1,800cr in FY24. The company is in discussions with EV companies, this would lead to the new stream of revenue.

*Revenue Mix*

The sales mixes are Domestic -63% and Exports- 36%. The revenue potential of INR 1,800 cr, exports revenue not more than 25% in going forward.

The company focused more on domestic business.

The sales mixes are Domestic -63% and Exports- 36%. The revenue potential of INR 1,800 cr, exports revenue not more than 25% in going forward.

The company focused more on domestic business.

*Revenue Potential – Every year*

In H1FY22, the company developed products for certain applications; 3.4 MW wind generator for Gamesa, 4.5 MW compact hydro generator for Siemens and metro rail motors for Mitsubishi leads to add INR 45cr revenue potential in every year.

In H1FY22, the company developed products for certain applications; 3.4 MW wind generator for Gamesa, 4.5 MW compact hydro generator for Siemens and metro rail motors for Mitsubishi leads to add INR 45cr revenue potential in every year.

*Order Book*

The order book consists of INR 984cr as on Q2FY22, The order book is well diversified in the sectors; consumer durable, locomotives, railways, mining, oil and special purpose motors etc.

The company executed an INR 300cr order book and balance will be in the

The order book consists of INR 984cr as on Q2FY22, The order book is well diversified in the sectors; consumer durable, locomotives, railways, mining, oil and special purpose motors etc.

The company executed an INR 300cr order book and balance will be in the

next 6 to 9 months.

*Govt Incentives*

The company expects to receive incentives of INR 160cr in equal annual instalments over the period of 7-9 years, from maharashtra government. It will boost working capital and cash flows available for expansion would lead the overall growth

*Govt Incentives*

The company expects to receive incentives of INR 160cr in equal annual instalments over the period of 7-9 years, from maharashtra government. It will boost working capital and cash flows available for expansion would lead the overall growth

*Working Capital*

The company continues to work to reduce its operating cycle. DSO days are 54 days vs 92 days in the previous quarter, they are targeting to reduce to 45days.

The company continues to work to reduce its operating cycle. DSO days are 54 days vs 92 days in the previous quarter, they are targeting to reduce to 45days.

.The Working Capital Cycle - 99 days in Q2FY22, They set a target for 75 days going forward.

*Capacity*

Sheet metal capacity grew ~14%YoY to 41,000 tons per annum vs 36,000 tons PA in Q2FY21. Sheet metals average Capacity utilization increased to 88.11%vs 60.52% in Q2FY21

*Capacity*

Sheet metal capacity grew ~14%YoY to 41,000 tons per annum vs 36,000 tons PA in Q2FY21. Sheet metals average Capacity utilization increased to 88.11%vs 60.52% in Q2FY21

Sheet metals capacity 41,000 tons per annum as on Q2FY22, expected to increase to 48,000 to 52,000 tons per annum depending on availability of machines in FY22.

In H1FY24, the capacity is expected to be 72,000 tons per annum and debt to equity mix should be 50:50.

In H1FY24, the capacity is expected to be 72,000 tons per annum and debt to equity mix should be 50:50.

Machining hours grew ~27%YoY to 3, 70,000 hours per annum vs 2,90,800 hours per annum in Q2FY21.

*Volumes*

In FY22, the total volumes are expected to be 36,300 MT. The volumes are Q1-6,500 MT, Q2- 8,600 MT, Q3- 9,200 MT, and Q4- 12000 MT.

*Volumes*

In FY22, the total volumes are expected to be 36,300 MT. The volumes are Q1-6,500 MT, Q2- 8,600 MT, Q3- 9,200 MT, and Q4- 12000 MT.

New machines are expected to arrive at the end of Dec to Mid of Jan leading to increased capacity, expected to increase higher volumes.

Capex

Capex was planned INR 270cr, despite challenges the company completed 35% of capex (~100cr) and remaining on the track for completion

Capex

Capex was planned INR 270cr, despite challenges the company completed 35% of capex (~100cr) and remaining on the track for completion

The capex cycle is expected to complete in H1FY24. At the end of the capex cycle, the company will have 72,000 metric ton per annum and 6,00,000 machining hours. After the capex the revenue potential INR 1,800 cr.

*Other Highlights*

The company imports machines from Japan, China, Taiwan, Italy and other countries. Supply chain challenges remain a key risk.

28% of business comes from railways and management expects 25 – 30% increase in next 2 years.

The company imports machines from Japan, China, Taiwan, Italy and other countries. Supply chain challenges remain a key risk.

28% of business comes from railways and management expects 25 – 30% increase in next 2 years.

Concall some more points-( Its my own effort ,not forwarded)

-February 2020, we had announced a capex of ₹ 270 Crores. I am happy to report that despite the challenging 18 months that we have faced, we have

completed 35% of the envisaged capex and remaining is on track .

-February 2020, we had announced a capex of ₹ 270 Crores. I am happy to report that despite the challenging 18 months that we have faced, we have

completed 35% of the envisaged capex and remaining is on track .

-Further, as our capacity is

modularly expandable any incremental additions that will keep getting added on a quarterly

basis shall keep getting utilized as they get commissioned-

-China has slowly and gradually withdrawn more and more export incentives that they had and as a

modularly expandable any incremental additions that will keep getting added on a quarterly

basis shall keep getting utilized as they get commissioned-

-China has slowly and gradually withdrawn more and more export incentives that they had and as a

result now India and China are having parity in

terms of most of the product that are manufactured and generalizing that statement, as far as

our industry is concerned, we always had better price parities than China so much of our

products were indirectly exported back to China.

terms of most of the product that are manufactured and generalizing that statement, as far as

our industry is concerned, we always had better price parities than China so much of our

products were indirectly exported back to China.

-our capacity utilization is running at 88% including new equipment arrival

in terms of new applications for a product they

- two very promising fields that we see, one is in terms of de-centralization plant at coal

in terms of new applications for a product they

- two very promising fields that we see, one is in terms of de-centralization plant at coal

power plant wherein to comply with environmental regulation they need to do carbon

capture and diesel emissions so that is one sector that we see maybe in the next 5 years to

become big and apart from that obviously the buzz word which is the electric vehicles

space.

capture and diesel emissions so that is one sector that we see maybe in the next 5 years to

become big and apart from that obviously the buzz word which is the electric vehicles

space.

-Today in terms of railways, railways I would say including metros because that is how we

account for it, 28% of our business comes from railways, going forward we see this

business increasing by 25% to 30% in the next two years

account for it, 28% of our business comes from railways, going forward we see this

business increasing by 25% to 30% in the next two years

Debt-We have our debt repayment also and we will be taking some amount of additional debt to

fund the new capex, at a net position we do not see out debt increasing by more than 25

Crores through FY2023 and then peak out in FY2023 and then start dropping

fund the new capex, at a net position we do not see out debt increasing by more than 25

Crores through FY2023 and then peak out in FY2023 and then start dropping

-kind of product we operate it is

very difficult for a new entrant to come in, we compete with three different industries, we

have a combination of three different industries, we have changed the way our end

customers do business so we started our traditional sheet metal company

very difficult for a new entrant to come in, we compete with three different industries, we

have a combination of three different industries, we have changed the way our end

customers do business so we started our traditional sheet metal company

hence we always talk in per tonne basis or per tonne capacity, but we have moved well beyond that, we have a fabrication facilities, we have our own tool room, we have our own machine shop, we

have our own shaft manufacturing facility to replace us in the supply chain,

have our own shaft manufacturing facility to replace us in the supply chain,

first and foremost my competitor needs to find three to four different companies each in a different

field and then find someone to integrate the product, assemble and supply it as a ready to

use unit, so in terms of capabilities we have a unique process .

field and then find someone to integrate the product, assemble and supply it as a ready to

use unit, so in terms of capabilities we have a unique process .

-We are already a contract manufacturer, it is just a level of supply that before, so we today

supply I would say certain products which was 99% ready to use, so whenever they give us

the opportunity we will move up the value chain

supply I would say certain products which was 99% ready to use, so whenever they give us

the opportunity we will move up the value chain

-Most of our customers will take at least two years to get a vendor for registration done, post

that development of one single product would take at least a year-and-a-half at the supplier

end, then the approval of the product supply to the customer it will go to a life cycle

that development of one single product would take at least a year-and-a-half at the supplier

end, then the approval of the product supply to the customer it will go to a life cycle

which would typically take 6 to 9 months and then you would have the first pilot of supply and

then the commercial supply, so I would say about 4 to 5 year timeline for anyone to come in

and then after that only the other products would be offered to a competitor, and then again

then the commercial supply, so I would say about 4 to 5 year timeline for anyone to come in

and then after that only the other products would be offered to a competitor, and then again

the similar timeline would be there to develop the rest of the product portfolio

-In sheet metal we compete with Temple Steel, which is a subsidiary of a US company, we

compete with Macros, which is the company based out of Bengaluru, we compete with

Capstan Industry and

-In sheet metal we compete with Temple Steel, which is a subsidiary of a US company, we

compete with Macros, which is the company based out of Bengaluru, we compete with

Capstan Industry and

then after that there are multiple smaller guys who must be doing a

turnover of 20 Crores to 30 Crores and they do not really compete with us because we are in

the more organized side of the business, in the machining we compete with Craftman

automation, and again number of

turnover of 20 Crores to 30 Crores and they do not really compete with us because we are in

the more organized side of the business, in the machining we compete with Craftman

automation, and again number of

machine shop that we compete with, in shaft

manufacturing we compete with SD Industry, we compete with Gowri Industry, Sanaka

Industries, in tool room again there are many people who make tools, but there are not a lot

of single company does all of this inhouse together and

manufacturing we compete with SD Industry, we compete with Gowri Industry, Sanaka

Industries, in tool room again there are many people who make tools, but there are not a lot

of single company does all of this inhouse together and

integrate the product, we are the

only one who do that.-

only one who do that.-

Our Customer-They would be Siemens, Wabtec, they would be ABB, they would be Cummins and the

fifth number keeps changing on and off sometimes it is Toshiba, sometimes it is Crompton,

but top four always remain constant, Siemens, ABB,

Cummins and Wabtec.

fifth number keeps changing on and off sometimes it is Toshiba, sometimes it is Crompton,

but top four always remain constant, Siemens, ABB,

Cummins and Wabtec.

• • •

Missing some Tweet in this thread? You can try to

force a refresh