Major new @OBR_UK report today on "fiscal risks" to UK has a big chapter on net-zero

OBR estimates net cost of net-zero by 2050 at £321bn

Crucially: "Unmitigated climate change would ultimately have catastrophic economic & fiscal consequences"

THREAD

obr.uk/frr/fiscal-ris…

OBR estimates net cost of net-zero by 2050 at £321bn

Crucially: "Unmitigated climate change would ultimately have catastrophic economic & fiscal consequences"

THREAD

obr.uk/frr/fiscal-ris…

The OBR identifies three "potentially catastrophic" sources of fiscal risk to the UK

These are the pandemic, unmitigated climate change & public sector debt

("the fiscal costs of reducing net emissions to zero…could be significant but not exceptional")

obr.uk/frr/fiscal-ris…

These are the pandemic, unmitigated climate change & public sector debt

("the fiscal costs of reducing net emissions to zero…could be significant but not exceptional")

obr.uk/frr/fiscal-ris…

On net-zero, the @OBR_UK chapter is a really detailed and nuanced look at the costs, benefits and risks of (not) acting on climate change, over 69 dense pages

I'd encourage you to read it

obr.uk/frr/fiscal-ris…

I'd encourage you to read it

obr.uk/frr/fiscal-ris…

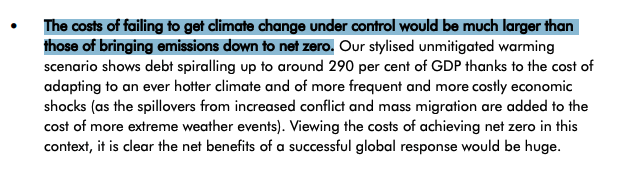

Notably, the @OBR_UK highlights the costs of **not** acting on climate change as being "much larger" than the cost of reaching net-zero

In a "stylised" scenario of unmitigated warming, it says public debt could "spiral" to nearly 290% of GDP, up from today's level of around 100%

In a "stylised" scenario of unmitigated warming, it says public debt could "spiral" to nearly 290% of GDP, up from today's level of around 100%

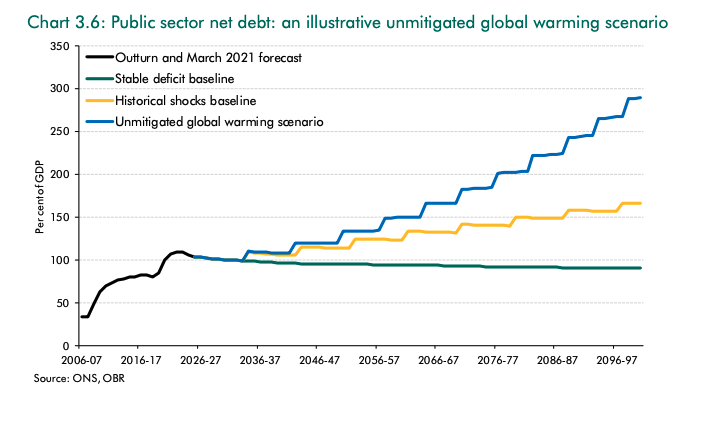

Here's the @OBR_UK scenario showing the UK fiscal impact of unmitigated warming

(It is open about the uncertainties: "These figures are based on extremely broad-brush assumptions, but do serve to highlight the magnitude of the fiscal costs that might be avoided")

(It is open about the uncertainties: "These figures are based on extremely broad-brush assumptions, but do serve to highlight the magnitude of the fiscal costs that might be avoided")

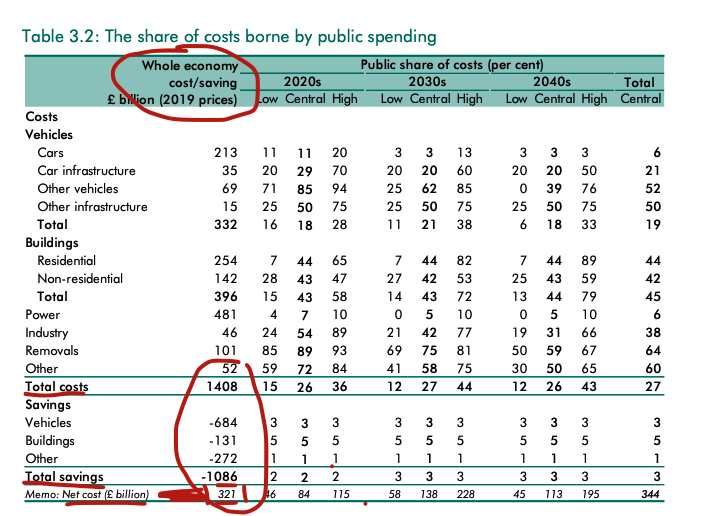

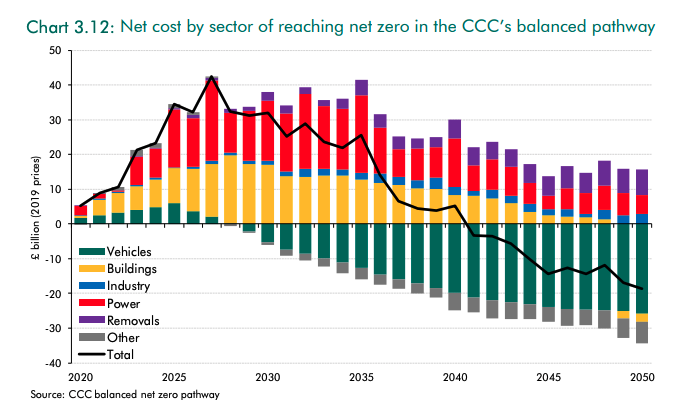

Turning to costs of net-zero, the @OBR_UK bases its analysis on estimates from @theCCCuk

This OBR chart is near-identical to the CCC's

It shows that net-zero by 2050 entails early investment in power + buildings, offset by savings from vehicles

This OBR chart is near-identical to the CCC's

It shows that net-zero by 2050 entails early investment in power + buildings, offset by savings from vehicles

https://twitter.com/DrSimEvans/status/1367774862366941187

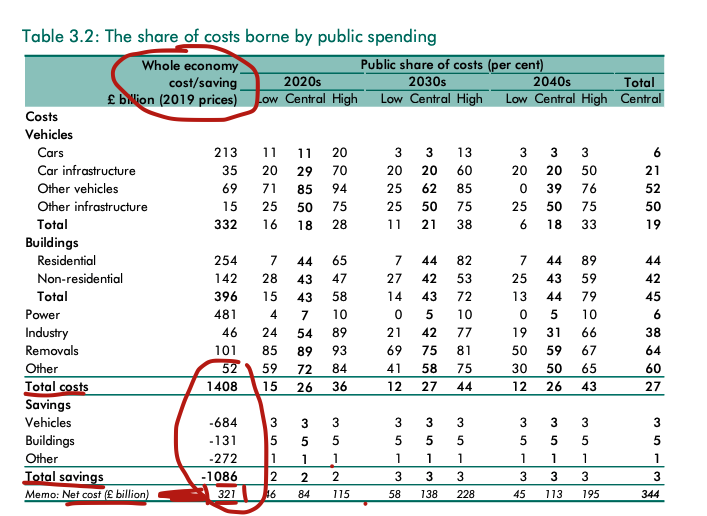

Taken together, the @OBR_UK shows @theCCCuk estimates the costs to the UK of reaching net-zero as £1.4tn, offset by savings of £1.1tn, with an overall net cost of £321bn over 30 years

(Anyone pointing to the costs, but not the savings, is being disingenuous)

(Anyone pointing to the costs, but not the savings, is being disingenuous)

This is a good moment to reiterate the point made by @ChiefExecCCC:

"We can certainly afford to do Net Zero – I would argue we can’t afford *not* to do Net Zero."

(read the whole thread if you haven't already)

"We can certainly afford to do Net Zero – I would argue we can’t afford *not* to do Net Zero."

(read the whole thread if you haven't already)

https://twitter.com/ChiefExecCCC/status/1408423359608672259

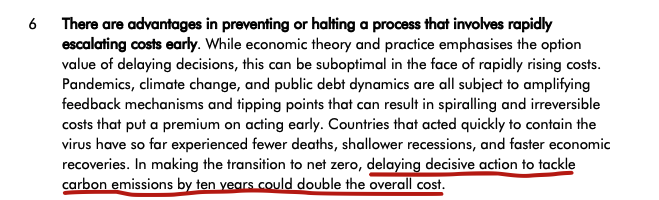

Moreover, the @OBR_UK says reaching net-zero by 2050 after delaying action for a decade "could double the overall cost" for the UK

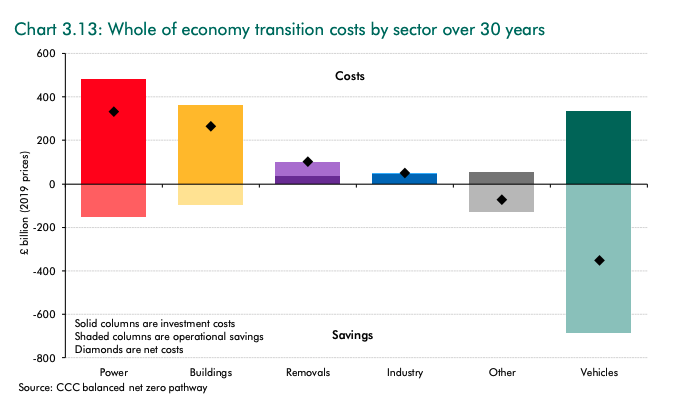

The @OBR_UK has another helpful chart breaking down the costs and benefits of net-zero by sector

It's clear the large majority of costs are the power sector (electricity) and buildings (heat, insulation), whereas most savings are from transport (EVs)

obr.uk/frr/fiscal-ris…

It's clear the large majority of costs are the power sector (electricity) and buildings (heat, insulation), whereas most savings are from transport (EVs)

obr.uk/frr/fiscal-ris…

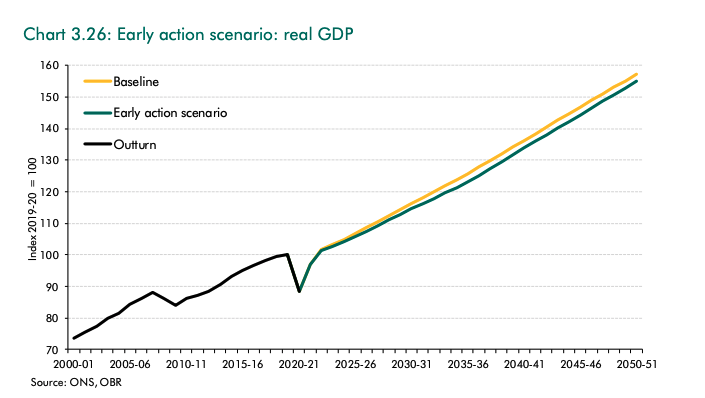

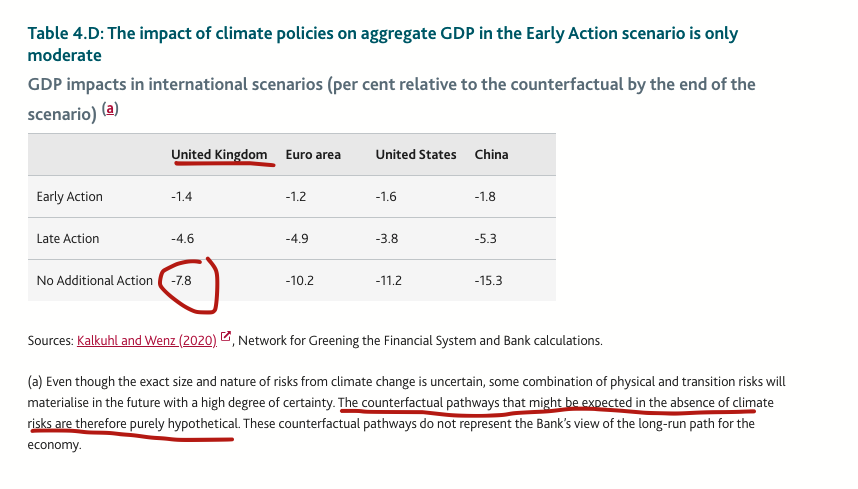

In terms GDP, the @OBR_UK says the UK economy in 2050 would be very slightly smaller if it reaches net-zero emissions, compared to if it doesn't (and ignoring the impacts of warming)

Instead of reaching ~158% of today's GDP, it'd be more like 156.6% (1.4% less)

Instead of reaching ~158% of today's GDP, it'd be more like 156.6% (1.4% less)

Notably, this 1.4% hit to GDP comes from the @bankofengland & is measured "below a (purely hypothetical) counterfactual path in which there are no additional headwinds from climate risks"

The Bank estimates a hit of 7.8% to UK GDP, without climate action

bankofengland.co.uk/stress-testing…

The Bank estimates a hit of 7.8% to UK GDP, without climate action

bankofengland.co.uk/stress-testing…

(@theCCCuk said a very small hit to GDP was the worst-case scenario for meeting net-zero; the @IEA recently said net-zero would *raise* global GDP this decade)

https://twitter.com/DrSimEvans/status/1397465028819836930

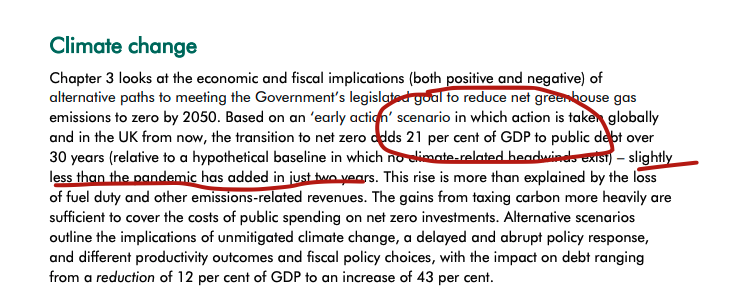

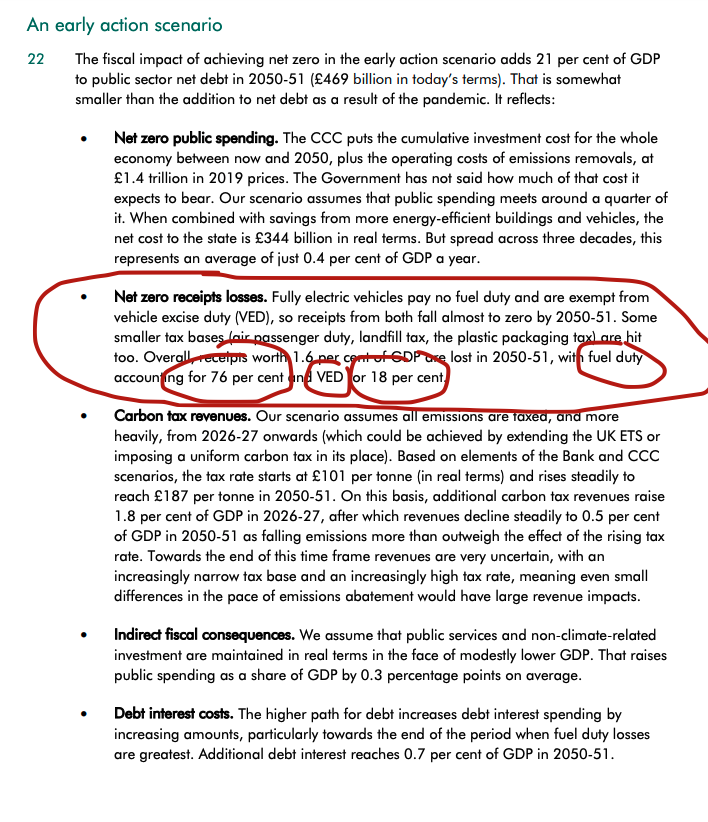

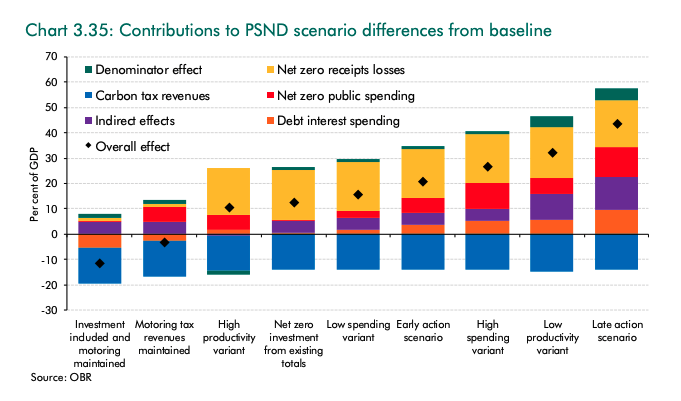

The @OBR_UK takes things a step further to answer the Q, what might net-zero mean for UK public spending & public sector net debt as a % of GDP

Its central "early action" scenario says debt would be 21% higher with net-zero by 2050, which it compares to the impact of Covid

Its central "early action" scenario says debt would be 21% higher with net-zero by 2050, which it compares to the impact of Covid

Crucially, however, a huge chunk of this higher debt from meeting net-zero is due to lost revenue from fuel duty and road tax, according to the @OBR_UK

In an alternative scenario, where the UK reaches net-zero while maintaining public spending and holding car tax revenues steady, public sector debt is actually *lower* than in the @OBR_UK baseline pathway

("early action" vs "investment included & motoring maintained")

("early action" vs "investment included & motoring maintained")

I'll leave it there for now but as ever, I've prob forgotten something and may well come back to this thread later / tomorrow

/ENDS

/ENDS

• • •

Missing some Tweet in this thread? You can try to

force a refresh