Read all these books in the first half of 2021 📖📚

Recommending all of them 👇🏼

Recommending all of them 👇🏼

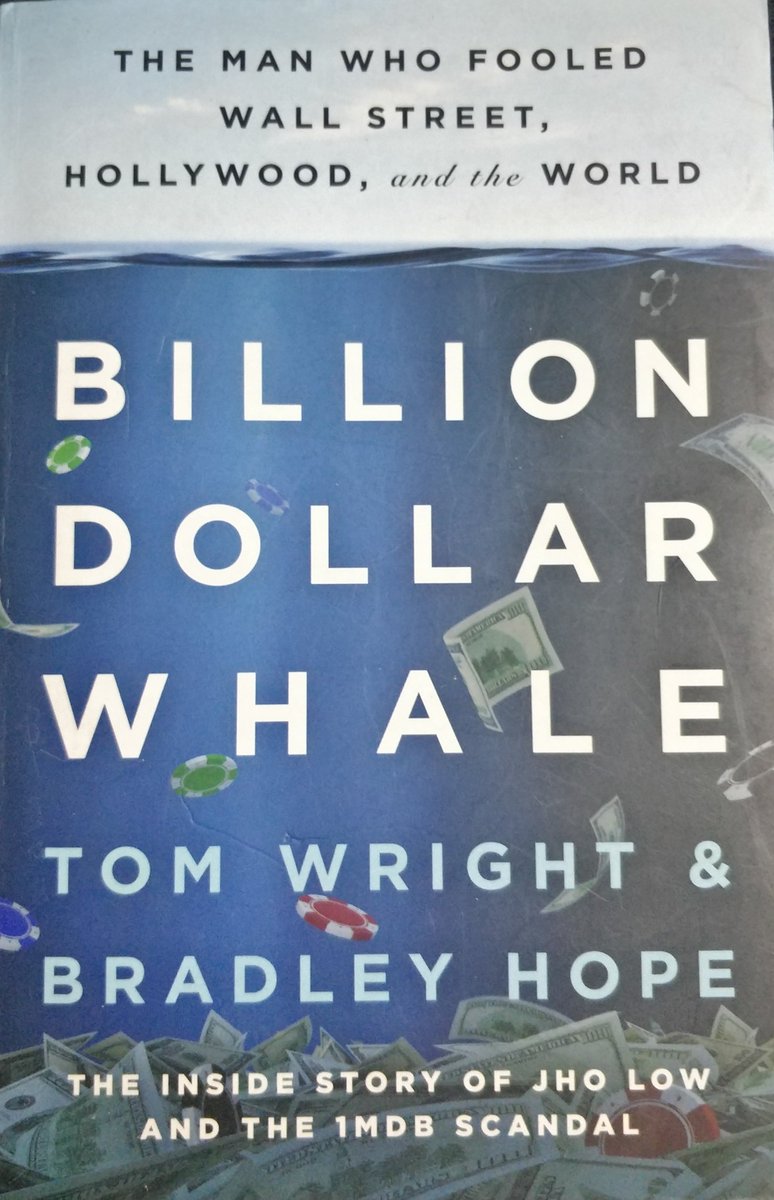

Billion Dollar Whale is a fascinating story about how one mastermind was able to rob billions of dollars from Malaysian Sovereign Fund and use that money to finance everything from parties with Paris Hilton to the movie Wolf of Wall Street.

Thrilling and Insightful 💰

Thrilling and Insightful 💰

Joys of Compounding by @Gautam__Baid teaches you various aspects of the magic that is compounding.

From finance to more importantly how compounding lessons in life play an important role.

This one has both lessons in life and investing packed into one.

Highly recommended 🌱

From finance to more importantly how compounding lessons in life play an important role.

This one has both lessons in life and investing packed into one.

Highly recommended 🌱

In The Plex give you an inside view on how one of the greatest companies in the world - Google, works.

Steven Levy is one of my favourite authors 🔍

Steven Levy is one of my favourite authors 🔍

If you're a fan of history and geopolitics then this one is for you.

The Rise and Fall of Nations by Ruchir Sharma has to be one of the best books written on global political landscape and the rules that govern them today. 🌇

The Rise and Fall of Nations by Ruchir Sharma has to be one of the best books written on global political landscape and the rules that govern them today. 🌇

Re read this gem of a book. Enough has been written about it, best one to pick up esp if you're a beginner in investing.

The text that was written in early 90s is still relevant after decades. 💹

The text that was written in early 90s is still relevant after decades. 💹

I read about David Sinclair's research a few years ago. The idea that growing old is a disease and like any other disease, can be cured intrigued me.

The author presents detailed arguments why human lifespan can be increased beyond its current limit.

Interesting Read. 👴🏽

The author presents detailed arguments why human lifespan can be increased beyond its current limit.

Interesting Read. 👴🏽

Excited to pick next 6 books for second half of this year ✌🏻

What did you read this first half of 2021? Share the names and recommendations below 👇🏼

What did you read this first half of 2021? Share the names and recommendations below 👇🏼

• • •

Missing some Tweet in this thread? You can try to

force a refresh