This is political and economic madness bbc.co.uk/news/uk-politi…

Cutting the incomes of 6 million households by £1,000 a year from October is a huge hit to family incomes just as the recovery is getting going. The poorest households in the country will see their incomes fall by 5% overnight

Even if you somehow think (despite widespread food insecurity amongst poorer families) that the current level of benefits is too high, here's three reasons why the context of this Autumn means a huge cut isn't a good idea

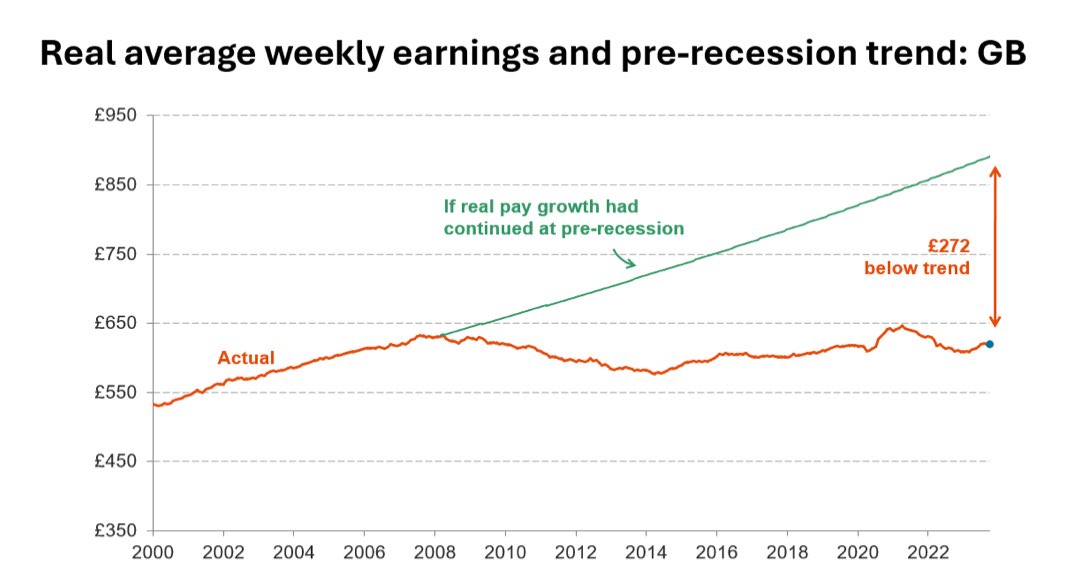

1) we'll be cutting incomes just as an inflation spike is pushing up the cost of living. We think inflation could be hitting 4% by the end of the year. That is going to drag on household incomes just as we're hoping the recovery will be getting going - doing this on top = unwise

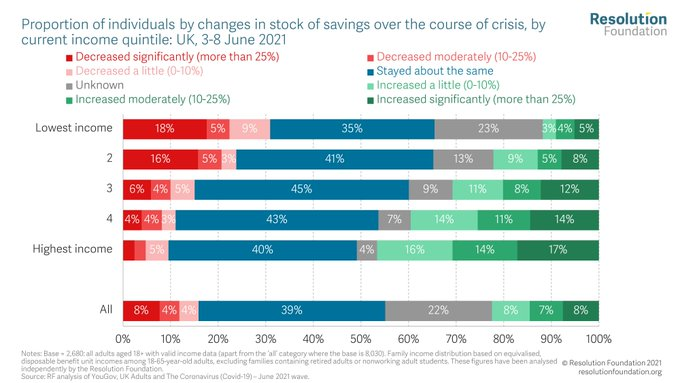

2) the households seeing their incomes hit by this are very different households to the ones who have seen their savings increase loads during the pandemic. So don't tell yourself people can just use their new savings to compensate for the income fall

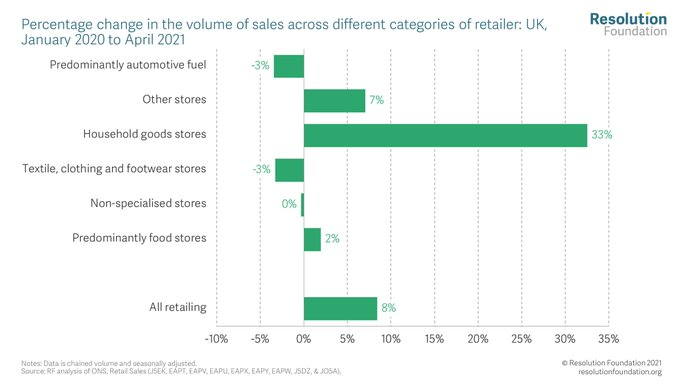

3) This recovery will be more bumpy than current boom rhetoric implies. Some sectors need to shrink as others grow (e.g household goods sales need to fall a lot if hospitality/holiday spending is to recover) and unemployment is likely to be rising just as this cut takes place.

Of course keeping the £20 costs billions. & those billions will need to be paid for via tax eventually. But scrapping it while we're getting the recovery established and household incomes face headwinds (having been protected mid-crisis) is what you'd politely call unwise

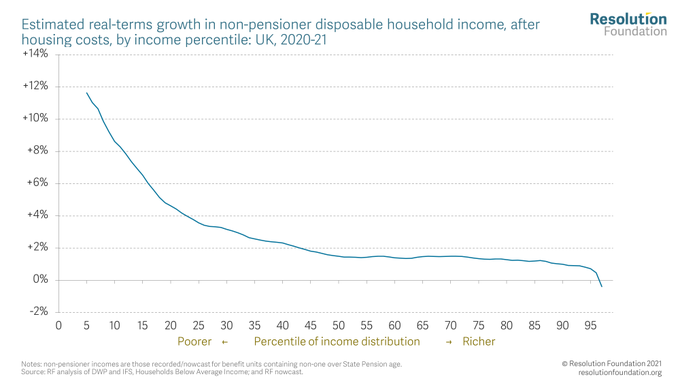

It also undermines what has been one of the government's success stories of the pandemic: protecting incomes on average (especially those of poorer households) from the huge fall in GDP

• • •

Missing some Tweet in this thread? You can try to

force a refresh