The #SOFR derivatives market is much larger than you think.

A thread🧵 courtesy of the July 2021 Rates Recap... spr.ly/6010ynMKj

A thread🧵 courtesy of the July 2021 Rates Recap... spr.ly/6010ynMKj

At just over 3 years old, the SOFR futures market has developed rapidly into a sizeable ecosystem of over 550 participants, ADV of 114K contracts, and OI of 841K contracts.

But SOFR-linked derivatives exposure is larger than these numbers suggest...

But SOFR-linked derivatives exposure is larger than these numbers suggest...

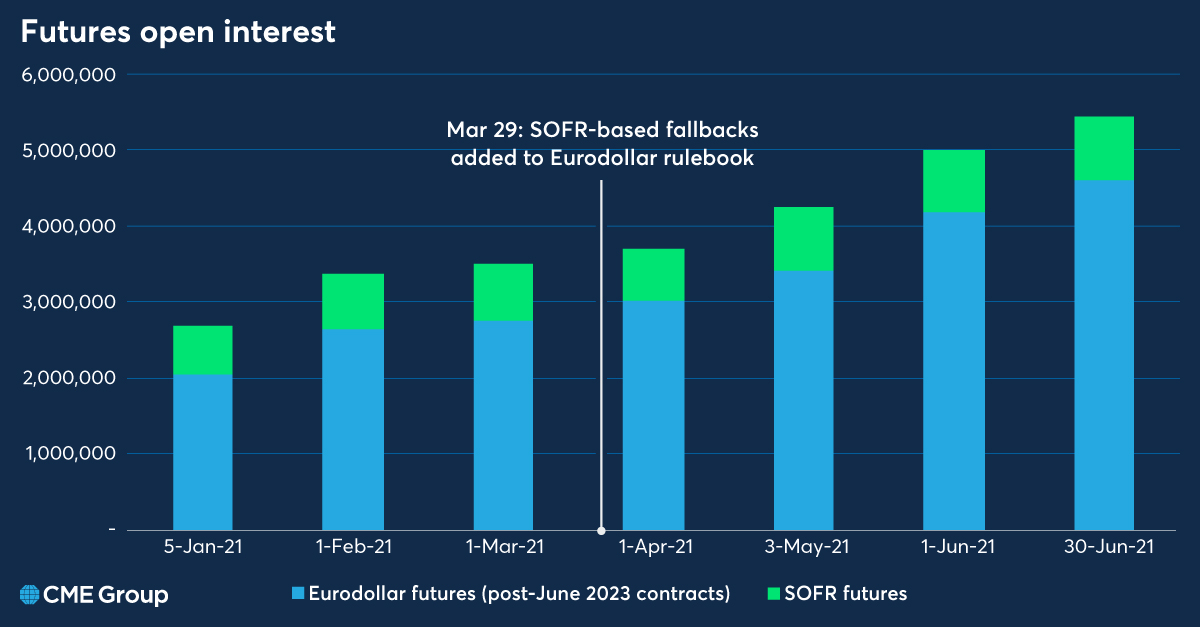

On March 29, the Eurodollar rulebook was amended to include SOFR-based fallbacks.

Whereby, upon the cessation of 3M USD LIBOR in June 2023, position holders in Eurodollars will be assigned contracts in 3M SOFR based on this formula:

SR3 assignment price = ED price + 26.161 bps

Whereby, upon the cessation of 3M USD LIBOR in June 2023, position holders in Eurodollars will be assigned contracts in 3M SOFR based on this formula:

SR3 assignment price = ED price + 26.161 bps

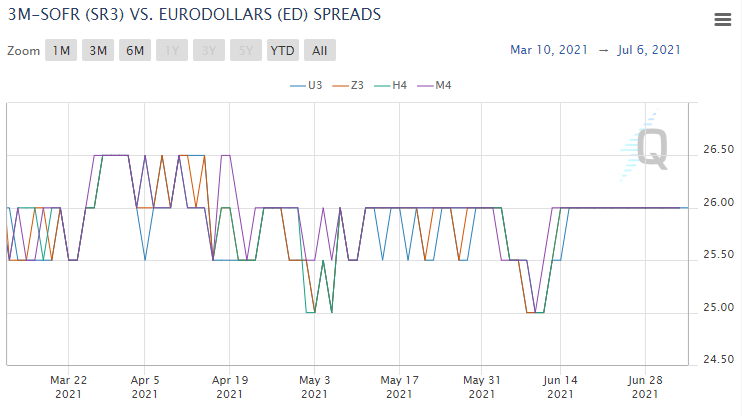

With this change, Eurodollar exposure post-June 2023 became closely tied to SOFR exposure. This is highlighted by SOFR-Eurodollar basis spreads U3 and beyond, which trade in a tight range around the 26.161 bps ISDA spread.

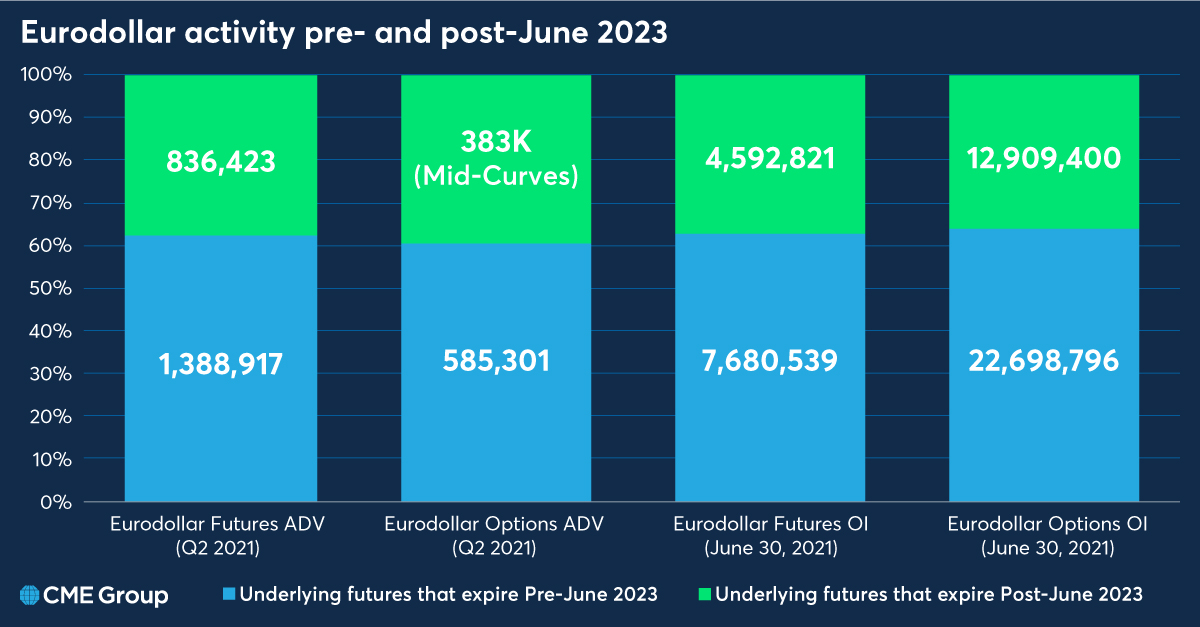

And Eurodollar activity tied to futures expiries from Sep 2023 and beyond is significant and growing.

More than one in every three contracts of Eurodollar futures and options activity is tied to futures expiring after June 2023.

More than one in every three contracts of Eurodollar futures and options activity is tied to futures expiring after June 2023.

Eurodollar futures open interest held in Sep 2023 and beyond has grown 123% YTD to over 4.5M contracts. Together with SOFR futures open interest of 841K, there is now over 5M contracts of futures open interest tied explicitly or via fallbacks to SOFR.

• • •

Missing some Tweet in this thread? You can try to

force a refresh