The market is in a lull where there is ~zero constructive gamma on stocks to help push them higher. In fact, most names are pretty heavy on puts.

Look for building of negative Skew-Adjusted Gamma Exposure and Gamma Call Ladders. Until then sit on some cash and enjoy Summer.

Look for building of negative Skew-Adjusted Gamma Exposure and Gamma Call Ladders. Until then sit on some cash and enjoy Summer.

Every meme stock builds to exploding higher by establishing negative Skew-Adjusted GEX and a gamma call ladder.

Once the gamma structure changes and call ladder dissipates the move has generally run its course.

Once the gamma structure changes and call ladder dissipates the move has generally run its course.

Our morning routine of processing millions of options for thousands of stocks to calculate gamma exposure, gamma structure, skew, price compression, and dark pool activity just finished.

Slow summer action continues. Waiting for gamma to build back up.

stocks.tradingvolatility.net/gexDashboard

Slow summer action continues. Waiting for gamma to build back up.

stocks.tradingvolatility.net/gexDashboard

You should at least start trying to locate your Buy button now.

📢 Today:

Free access to our database of 1,000s of stocks for:

⭐GEX and Skew-Adjusted GEX readings

⭐Skew, IV, and put/call trends

⭐Dark pool activity

The start of a new gamma squeeze cycle is approaching...

stocks.tradingvolatility.net/gexCharts

Free access to our database of 1,000s of stocks for:

⭐GEX and Skew-Adjusted GEX readings

⭐Skew, IV, and put/call trends

⭐Dark pool activity

The start of a new gamma squeeze cycle is approaching...

stocks.tradingvolatility.net/gexCharts

Dip your toe in the water.. it's nice.

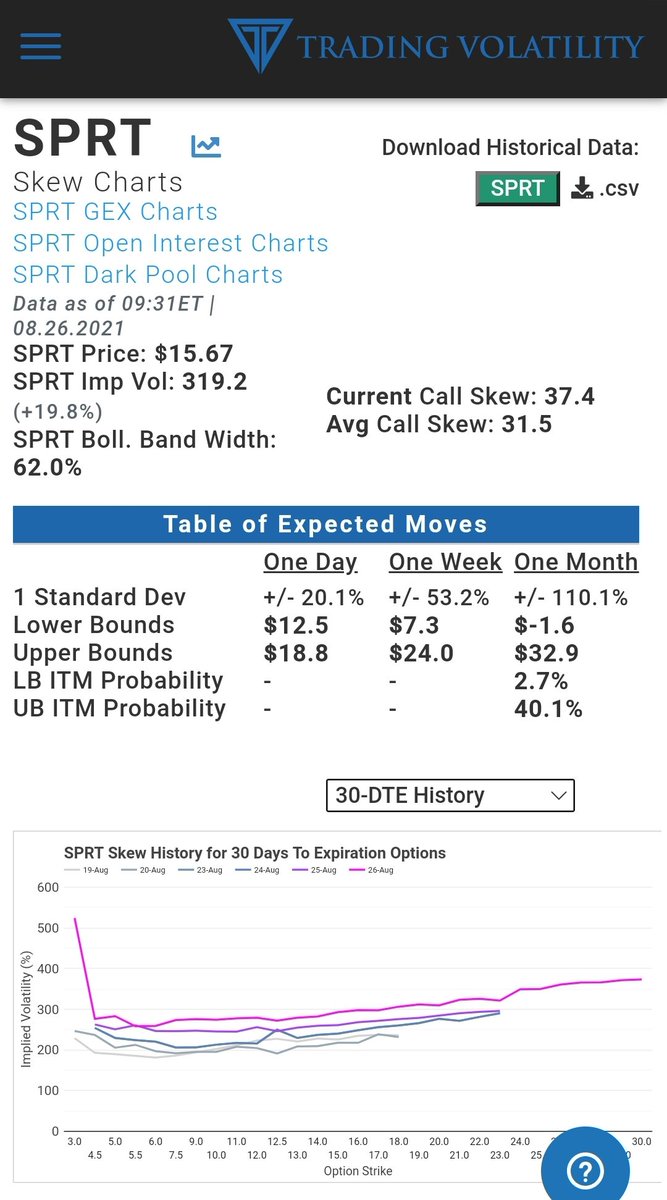

$SPRT highest option strike yesterday was $18. Today strikes added up to $23 as an attempt to spread out the gamma exposure to irrelevant strikes.

The #APESNOTLEAVING idea is that $AMC $GME are hold forever stocks that are destined to go up.

Maybe would be better to find something else to focus on?

Like go find a new gamma squeeze setup like $SPRT was.

+200% in the past month. That's fun. right?

stocks.tradingvolatility.net/gexCharts?tick…

Maybe would be better to find something else to focus on?

Like go find a new gamma squeeze setup like $SPRT was.

+200% in the past month. That's fun. right?

stocks.tradingvolatility.net/gexCharts?tick…

$1 into $25 in 3 weeks.

Many thanks to whichever of our subscribers found this one and added it to our database. 🤗

Many thanks to whichever of our subscribers found this one and added it to our database. 🤗

• • •

Missing some Tweet in this thread? You can try to

force a refresh