Make stock & option trading easier with our advanced tools & ratings. Gamma | Option Flows | 0-DTE | VIX VXX SVIX Trade Signals 🇺🇸

8 subscribers

How to get URL link on X (Twitter) App

From today's release:

From today's release:

https://twitter.com/TradeVolatility/status/1668346403137937421Our 3 primary indicators for trading $VIX ETFs have been negative most of this time.

2) use probabilities to identify a day's likely closing price.

2) use probabilities to identify a day's likely closing price.https://twitter.com/TradeVolatility/status/1651949539568529408

A lot of DIY traders/investors rely on charts, volume, & TA.

A lot of DIY traders/investors rely on charts, volume, & TA.

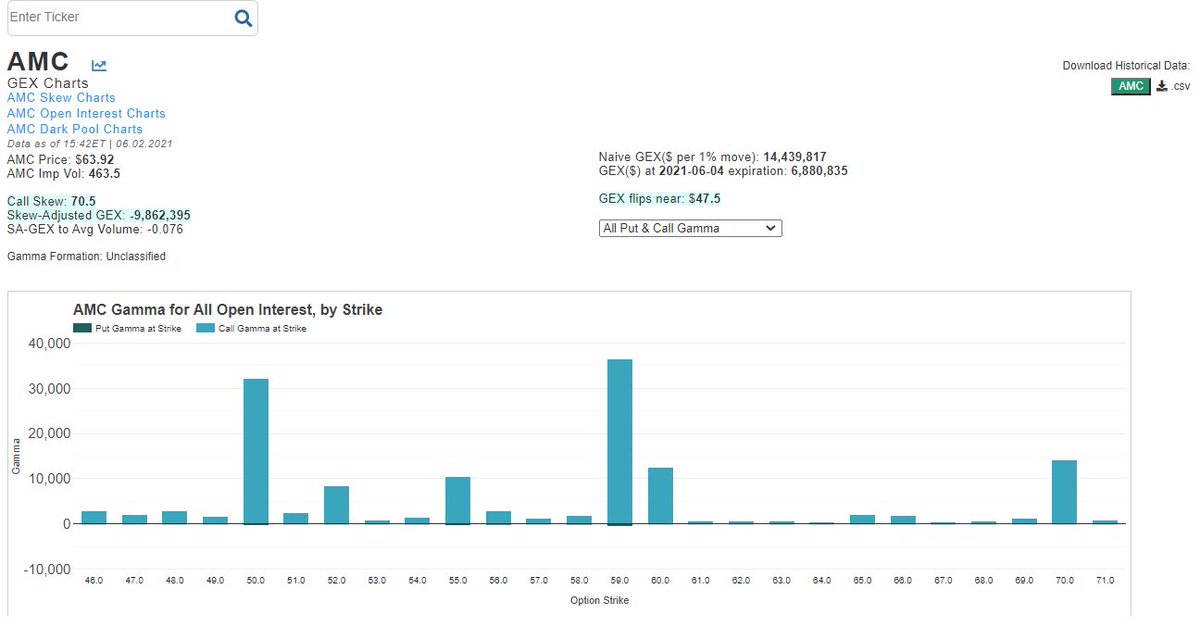

It's not that useful to just look at a headline Naive GEX or adjusted GEX number. The gamma structure is much more important as defines how gamma changes as underlying price moves.

It's not that useful to just look at a headline Naive GEX or adjusted GEX number. The gamma structure is much more important as defines how gamma changes as underlying price moves.

https://twitter.com/TradeVolatility/status/1397195815928705027SA-GEX/avg trade volume is large at -0.716.