The VC data bible is out

Our Q2 2021 Venture Report is out and it's 190 pages of data on global venture + Asia, LatAm, Europe and US trends

cbinsights.com/research/repor…

Some key takeaways 👇

Our Q2 2021 Venture Report is out and it's 190 pages of data on global venture + Asia, LatAm, Europe and US trends

cbinsights.com/research/repor…

Some key takeaways 👇

2/ 136 new unicorns

in 1 quarter!!!

An absolutely gigantic quarter for unicorn births

Aren't unicorns supposed to be rare?

Quick - someone come up with a new name

in 1 quarter!!!

An absolutely gigantic quarter for unicorn births

Aren't unicorns supposed to be rare?

Quick - someone come up with a new name

3/ $156.2B invested in the quarter

The biggest quarter for VC in the history of the universe

Yes - let the bubble takes begin

BTW, I think all those takes are wrong

The biggest quarter for VC in the history of the universe

Yes - let the bubble takes begin

BTW, I think all those takes are wrong

4/ Of course, with global venture increasing, the USA was also up

The first half of the year for the US was a record as well

The first half of the year for the US was a record as well

5/ Valuation inflation?

Maybe

But it's competitive out there

The median Series A deal valuation in 2021 sits at $42M

Maybe

But it's competitive out there

The median Series A deal valuation in 2021 sits at $42M

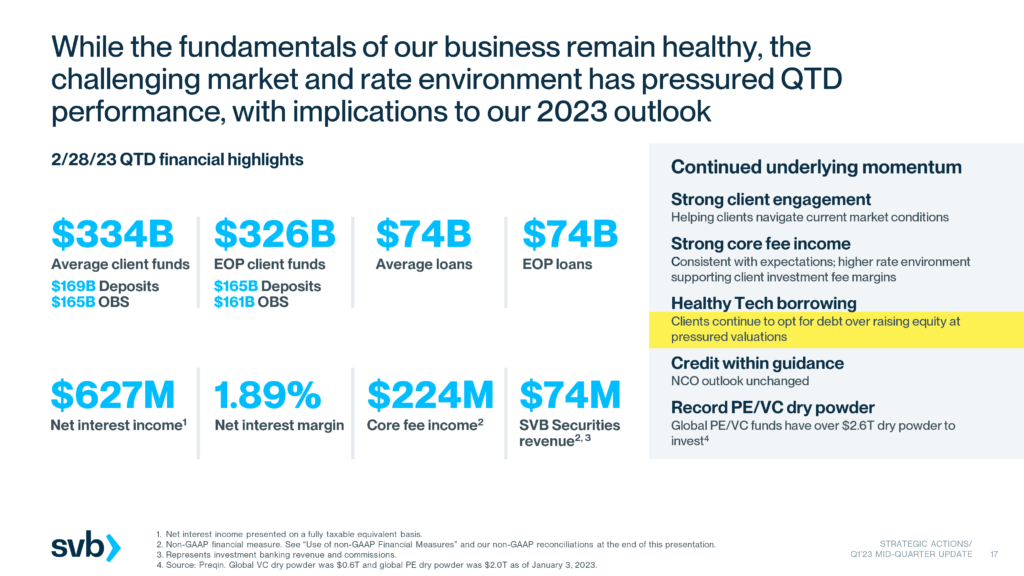

6/ There is no hotter sector than FinTech

$30B invested into fintech in the quarter

or 1 of every $5 venture dollars

wild

$30B invested into fintech in the quarter

or 1 of every $5 venture dollars

wild

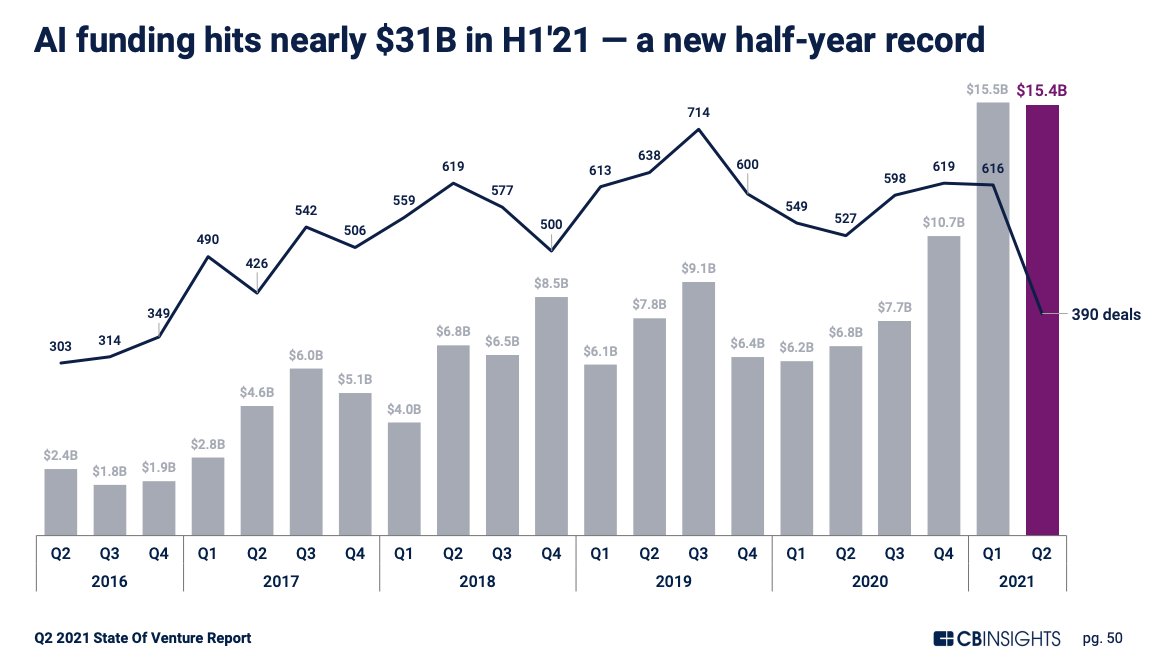

7/ There were 390 venture rounds of $100 million+ in Q2

The "private IPO" is pretty common these days

The "private IPO" is pretty common these days

8/ The one big market that saw a funding decline was China which dropped 18% from its all time high

But remember, this is an 18% drop from an all-time high

Tons of innovation and activity still coming out of China

And it will continue to

But remember, this is an 18% drop from an all-time high

Tons of innovation and activity still coming out of China

And it will continue to

9/ 1.26 deals per working day!!

Yes - that is how fast Tiger Global is making investments

Easily led the pack for most active investor in Q2

Yes - that is how fast Tiger Global is making investments

Easily led the pack for most active investor in Q2

10/ The exit environment was also very healthy in Q2 with 2893 exits (M&A and IPOs)

Lots of financial buyers of tech companies + strategics and a healthy SPAC/IPO environment

Lots of financial buyers of tech companies + strategics and a healthy SPAC/IPO environment

Money is flowing everywhere

While the disruption of Silicon Valley talk is always overblown, there is a gargantuan amount of innovation happening everywhere

While the disruption of Silicon Valley talk is always overblown, there is a gargantuan amount of innovation happening everywhere

12/ Lots of rankings and league tables about funding, valuations, exits

Here's the top 10 venture exits of Q2

Here's the top 10 venture exits of Q2

16/ Interestingly, as investors all unicorn hunting, the share of deals to the early stage fell to a 5 year low

Seed investing by the big dogs of venture has generally declined dramatically

Seed investing by the big dogs of venture has generally declined dramatically

17/ The @rabois Effect in Miami has yet to show up in the numbers with $711M invested in Miami cos

For comparison's sake, sunny Chicago saw ~$2B invested in the quarter

For comparison's sake, sunny Chicago saw ~$2B invested in the quarter

19/ Europe also saw $ and deal records

Interestingly, early-stage deals in Europe were 69% of total deals

Suggests good things for the future of the European venture ecosystem

Interestingly, early-stage deals in Europe were 69% of total deals

Suggests good things for the future of the European venture ecosystem

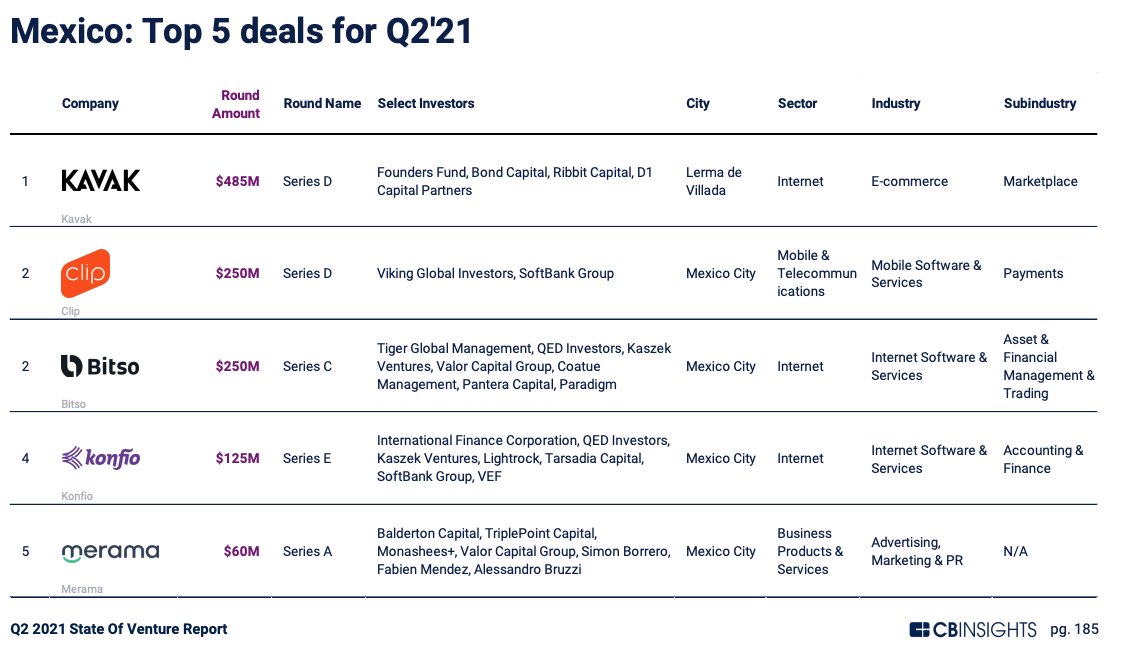

21/ The region with the biggest pop in venture funding was LatAm

$7.2B invested is so much larger than any prior quarter

$7.2B invested is so much larger than any prior quarter

23/ So in summary, Q2 was a gargantuan quarter

Get the full 190 page report here for free

cbinsights.com/research/repor…

Happy reading

Get the full 190 page report here for free

cbinsights.com/research/repor…

Happy reading

24/ I'm seeing lots of takes that this is like 1999 (the infamous dot com bubble)

This is a quick attention-grabbing take which is likely great for clicks but belies a lack of understanding of 1999 vs now

First, yes there are some things that seem similar

Like what?

This is a quick attention-grabbing take which is likely great for clicks but belies a lack of understanding of 1999 vs now

First, yes there are some things that seem similar

Like what?

25/ Similarities

* lots of $ piling into startups

* everyone (not just VCs) wanted a piece of tech

* tech was top of my mind for media

* some 'silly' companies were getting funded at lofty valuations

* lots of $ piling into startups

* everyone (not just VCs) wanted a piece of tech

* tech was top of my mind for media

* some 'silly' companies were getting funded at lofty valuations

26/ Differences

* a lot more enterprise tech/SaaS today vs heavy consumer. It's not eyeball monetization and other nonsense. It's ARR, churn, etc.

* the $ today are going to building product and getting to product-market fit and not racks of servers, colocation facilities, etc

* a lot more enterprise tech/SaaS today vs heavy consumer. It's not eyeball monetization and other nonsense. It's ARR, churn, etc.

* the $ today are going to building product and getting to product-market fit and not racks of servers, colocation facilities, etc

27/ More differences

* The money is increasingly going to perceived winners vs speculative early stage cos. Look at the decline in early-stage in this quarter. It's at a 5 year low.

* The money is increasingly going to perceived winners vs speculative early stage cos. Look at the decline in early-stage in this quarter. It's at a 5 year low.

28/ 5% of total rounds are mega-rounds ($100M+) but they account for 58% of $

So when folks do these facile comparisons of 1999 $ to 2021 $, it's like comparing an apple to a lawn mower

So when folks do these facile comparisons of 1999 $ to 2021 $, it's like comparing an apple to a lawn mower

29/ Venture is more global than ever

It's also a lot less incestuous than '99 when recycling of investor $ among ad tech, ecommerce, hosting cos was the norm

One toppled and we watched the dominoes fall

There was no Asia, LatAm, Europe VC scene then. Now they're huge!

It's also a lot less incestuous than '99 when recycling of investor $ among ad tech, ecommerce, hosting cos was the norm

One toppled and we watched the dominoes fall

There was no Asia, LatAm, Europe VC scene then. Now they're huge!

30/ Finally, this doesn't mean that there aren't excesses in venture today

Price discipline gone ✔️

Some silly ideas getting $ ✔️

New investor (family offices, HFs/MFs, corps) may be taken for a ride ✔️

All good critiques but let's pls stop with the "It's like 1999" nonsense

Price discipline gone ✔️

Some silly ideas getting $ ✔️

New investor (family offices, HFs/MFs, corps) may be taken for a ride ✔️

All good critiques but let's pls stop with the "It's like 1999" nonsense

• • •

Missing some Tweet in this thread? You can try to

force a refresh