Four Investor Portfolios & their Networth Progression to Study

1️⃣ Anil Kumar Goel (Commodity King)

2️⃣ Akash Bhansali

3️⃣ Vijay Kedia

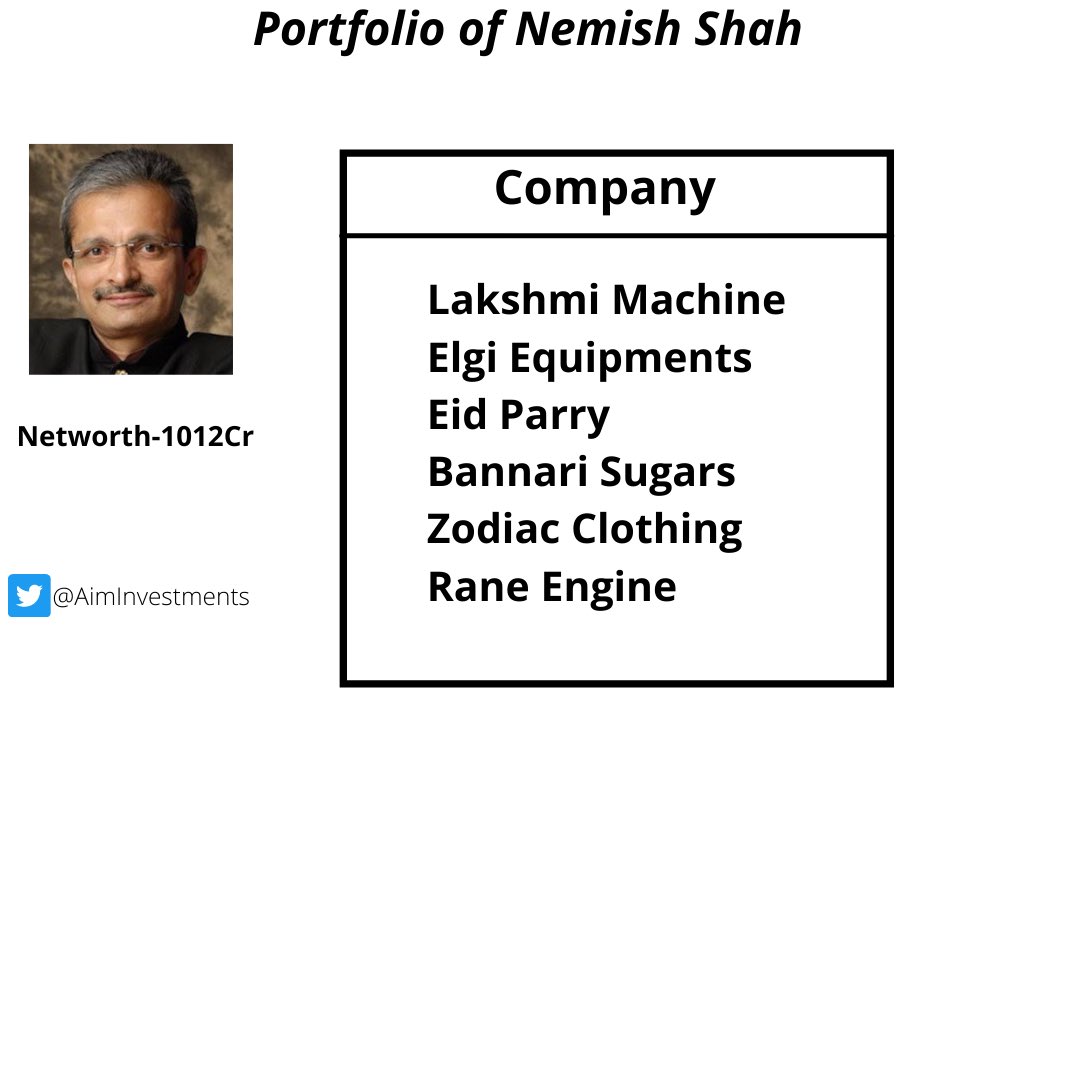

4️⃣ Nemish Shah

1️⃣ Anil Kumar Goel (Commodity King)

2️⃣ Akash Bhansali

3️⃣ Vijay Kedia

4️⃣ Nemish Shah

• • •

Missing some Tweet in this thread? You can try to

force a refresh