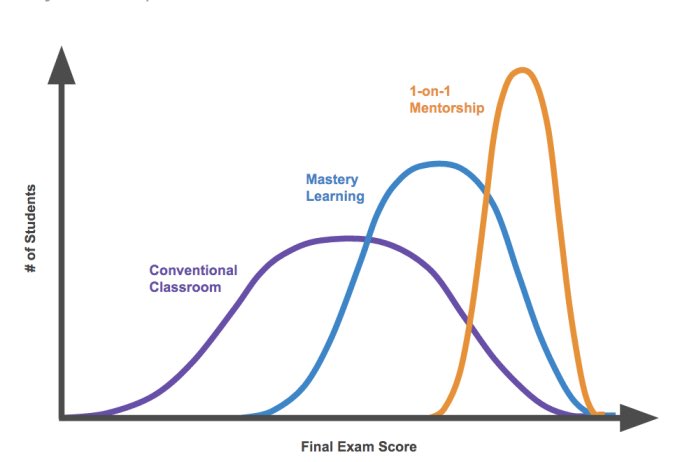

In 1984 a researcher named Bloom found that students learning mastery-based and with one-on-one mentorship perform two standard deviations better than those in a conventional classroom.

Incredible to know, but too expensive to do anything about, so nothing changed.

Incredible to know, but too expensive to do anything about, so nothing changed.

We’re now in the early days of software that not only mimics 1-on-1 mentorship and mastery-based learning for cheap, but actually *surpasses* traditional mentorship.

We’re entering a completely new world where kids in classrooms (even expensive ones) will be left behind.

We’re entering a completely new world where kids in classrooms (even expensive ones) will be left behind.

I’m talking to schools concerned about figuring out what to do when 13-year-olds have completed High School at an advanced level with perfect standardized test scores.

Kids starting at the bottom of a class in 6th grade and finishing High School in the 99th percentile. Literally.

It’s not widely distributed, but it’s live in classrooms now. It scales. It can be cheap.

The future of education will look absolutely nothing like the present.

The future of education will look absolutely nothing like the present.

• • •

Missing some Tweet in this thread? You can try to

force a refresh