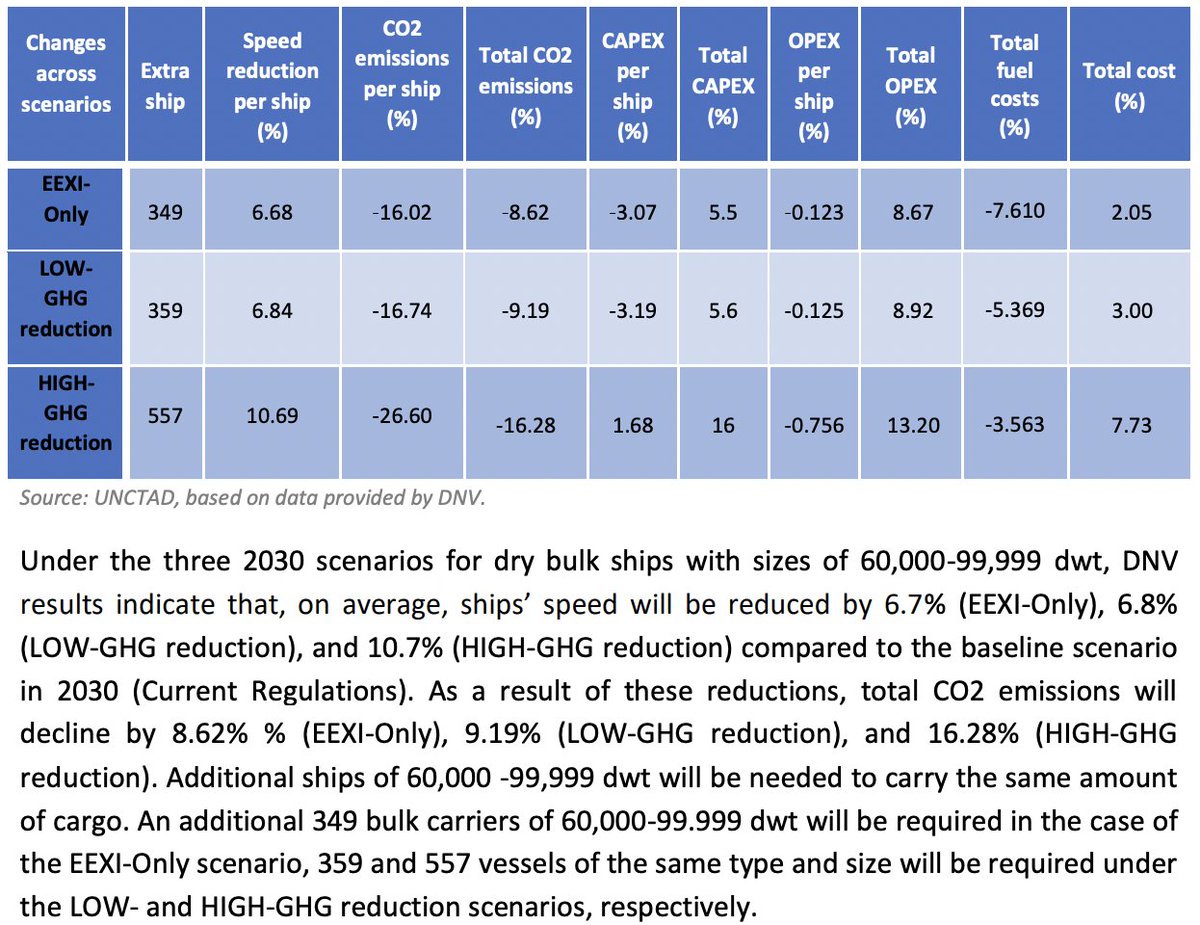

Even with the very weak current IMO regulations, UNCTAD expects the fleet to slow by 6.7% this decade. An extra ~1% of new ship capacity per year will be needed to offset in addition to ~2% per year to replace old ships. Compare this to a #drybulk orderbook of just 5.6% today.

#Drybulk demand grew at a CAGR of 4.7% per year since China was admitted to the WTO. Even if this slows SIGNIFICANTLY to 2.5%, this means to maintain the very tight supply/demand balance we see today, we will need 5%+ of new ship capacity to deliver each year this decade.

In DWT (capacity terms) this 5%+ per year of new ships needed is equivalent to ~50M DWT. This is more ship capacity than has been built in each of the past 8 years. Although not a problem in isolation, shipyards are already full through 2023 ships from other fast growing sectors

Over the same 8 year period shipbuilding capacity has actually been contracting and expected to contract further. All other sectors will need the same extra ~1% of new capacity per year to offset slow steaming and shipbuilding capacity is already sold out before this effect.

With shipbuilding capacity for large ships sold out through 2023 despite one of the lowest cross-sector orderbooks in history on a percentage basis of the global fleet, it is clear that shipbuilding capacity will be grossly insufficient by 2024.

Despite persistently high rates in the last cycle starting in 2003, it took many years to build enough shipbuilding capacity and then many more years to build enough ships to meet demand leading to a 7 year period of very high #drybulk shipping profits.

Although every cycle is different and this is NOT the last cycle, many of the same forces are at work. I expect an extended period of high profitability as forces constraining supply will cause supply to consistently lag demand making shipping a top performer in the coming years.

• • •

Missing some Tweet in this thread? You can try to

force a refresh