Bold and unfiltered takes on trade, shipping, and commodities. Not investment advice.

How to get URL link on X (Twitter) App

2/ I have been an unwavering $NMM, Tanker and Capesize drybulk bull ever since through some incredible volatility and so many doubters and so much disdain for this company and industry. I still have every last share of my huge tranche of <$4 cost basis shares I bought late 2020.

2/ I have been an unwavering $NMM, Tanker and Capesize drybulk bull ever since through some incredible volatility and so many doubters and so much disdain for this company and industry. I still have every last share of my huge tranche of <$4 cost basis shares I bought late 2020.

https://twitter.com/HFI_Research/status/19930235918611743792/ Only 42 of then global 105MMbpd of oil production is exported by sea. The rest is piped or consumed regionally. Although the 1MMbpd is only a 1% increase in global oil supply, its a 2.5%+ increase to seaborne traded volumes.

https://twitter.com/BurggrabenH/status/19414626360651451672/ I'll take the under on however many barrels the government energy agencies think Saudi has in reserve:

https://x.com/OpenSquareCap/status/1941559433483649489

https://twitter.com/wallstjesus/status/1924598895364980807

https://twitter.com/ed_fin/status/1903036285192642973Large crude tankers fetch much higher rates and margins in a tight market and fall back to the same near breakeven levels in a bear market.

https://x.com/AllVentured/status/1512844498241527819

2/ Here are the ratios of non-Chinese fleet to US share of global trade to show how many times over US trade is covered for each segment by the non-Chinese fleet:

2/ Here are the ratios of non-Chinese fleet to US share of global trade to show how many times over US trade is covered for each segment by the non-Chinese fleet:https://twitter.com/TankerTrackers/status/19002427755865949772/ It seems more ships are being added to OFAC sanctions almost weekly now with more related entities. The Trump admin is determined to stop black market trade. OFAC alone will cause tankers rates to moon.

https://x.com/AllVentured/status/1900312181855707251

https://twitter.com/Josh_Young_1/status/18632555218908902052/ With inventories at bottom of 5 year averages, it seems unlikely that inventories decline meaningfully from here. Just returning to flat inventories adds back the +30 VLCCs of demand. Adding the expected 1mm b/d supply/demand growth in 2025 requires another +30 VLCCs.

https://twitter.com/allventured/status/1711438251280503131

These sanctions actually DO work.

These sanctions actually DO work.

https://x.com/AllVentured/status/1512804391258099718?s=202/ The Biden Admin is in a tough spot. If Iran orchestrated the latest conflict in Israel, they will have to respond. How to do this without impacting oil prices? After all, turning a blind eye to existing sanctions has allowed Iran to increase exports by a huge ~500kb/d over the past year keeping a lid on prices.

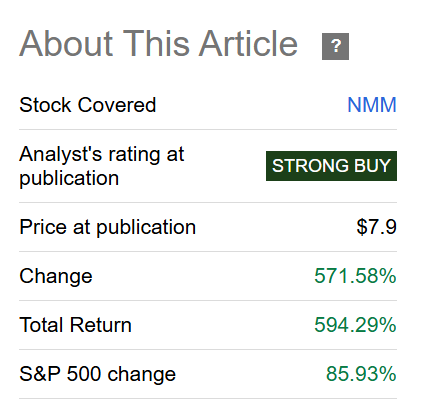

2/ Even though 71% of borrowers will still have a balance after $10k-$20k forgiveness or will not receive any forgiveness due to income, ALL eligible federal student loans currently remain in forbearance until this is resolved.

2/ Even though 71% of borrowers will still have a balance after $10k-$20k forgiveness or will not receive any forgiveness due to income, ALL eligible federal student loans currently remain in forbearance until this is resolved.

https://twitter.com/Reswot/status/1628081060339757084?s=202/ This is terrible for bank profits.

https://twitter.com/Reswot/status/1628078365692375064?s=20

https://twitter.com/mnicoletos/status/1624491921186996224

2/ TGA is the next easiest and totally calculable. ~$300B more of drawdowns (liquidity injections) due to debt ceiling then also tapped out.

2/ TGA is the next easiest and totally calculable. ~$300B more of drawdowns (liquidity injections) due to debt ceiling then also tapped out. https://twitter.com/AllVentured/status/1622269191368892416?s=20

https://twitter.com/AllVentured/status/16012104198129213462/ China is reopening. Don't overthink this as many on Twitter are. Omicron will burn through in 3 waves culminating with the last as people bring covid back to to their workplace after visiting family for Spring festival. China fully open in March.

https://twitter.com/AllVentured/status/1601212536732676097?s=20

https://twitter.com/AllVentured/status/15803353312780902412/ The bears have crushed it this year. Congrats to us.

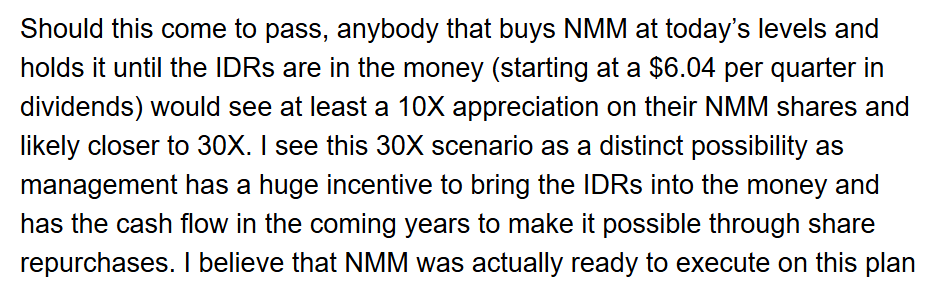

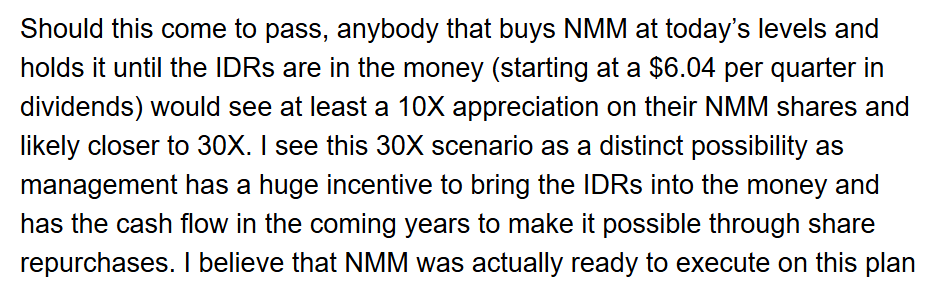

2/ $NMM has traded at a huge discount to both NAV and its peer group due to management concerns and skepticism that huge profits would ever be returned to shareholders.

2/ $NMM has traded at a huge discount to both NAV and its peer group due to management concerns and skepticism that huge profits would ever be returned to shareholders.