Garena is bankrolling much of Sea Limited ($SE) success with Shopee and SeaMoney.

This comprehensive thread will cover everything you need to know about Garena and its self-developed game: Free Fire.

Let's get started! 👇👇

This comprehensive thread will cover everything you need to know about Garena and its self-developed game: Free Fire.

Let's get started! 👇👇

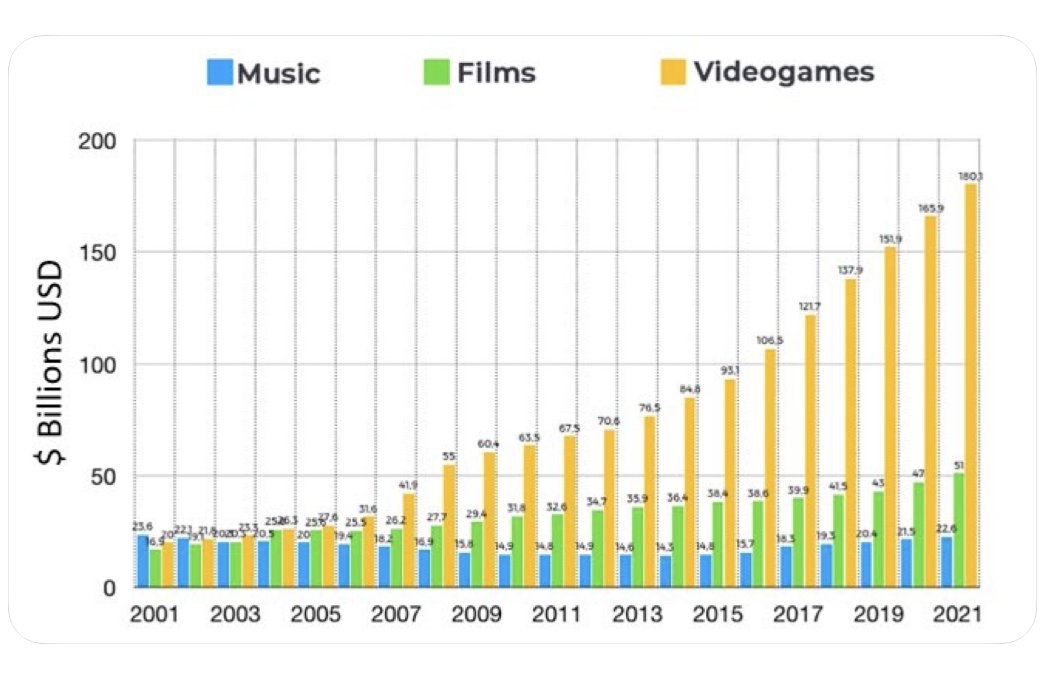

1. Video Game Market Overview

Garena is a growth monster sitting on the strong tailwind of video gaming.

This is the might of the tailwind we are talking about—the global video game market is about twice as big as the worldwide box office and music industries combined!

Garena is a growth monster sitting on the strong tailwind of video gaming.

This is the might of the tailwind we are talking about—the global video game market is about twice as big as the worldwide box office and music industries combined!

1.2 Even at today’s size, the global video game market is still expected to grow at double digits. And a huge amount of growth is coming from mobile gaming.

1.3 According to App Annie State of Mobile 2021 report, 66% of all mobile gaming revenue are from “core games” like Garena Free Fire, PUBG, and Honour of Kings.

Core games monetize through in-app purchases (e.g. upgrade weapons). They attract a more committed user base.

Core games monetize through in-app purchases (e.g. upgrade weapons). They attract a more committed user base.

2. Reasons for mobile gaming growth!

(1) Moore's Law

(2) Platform Agnostic

(3) Metcalfe’s Law

(1) Moore's Law

(2) Platform Agnostic

(3) Metcalfe’s Law

2.1 Moore’s Law.

Smartphones capabilities are rising while prices are becoming affordable.

Continued growth in smartphone penetration with most of the growth is coming from developing countries, where many can’t afford a laptop or console.

Smartphones capabilities are rising while prices are becoming affordable.

Continued growth in smartphone penetration with most of the growth is coming from developing countries, where many can’t afford a laptop or console.

2.2 Platform Agnostic.

This is important for driving growth! It means that users from different mobile devices (iPhone and Android) are able to play with each other.

A large user pool increases network effect and games are increasingly social.

This is important for driving growth! It means that users from different mobile devices (iPhone and Android) are able to play with each other.

A large user pool increases network effect and games are increasingly social.

2.3 Metcalfe’s Law.

As the number of users increases, the strength of the network increases with it.

Many popular games (e.g. Pokémon GO) adopt a freemium model.

The game is free, acquiring a large number of users quickly and the stickiness of the game increases with size.

As the number of users increases, the strength of the network increases with it.

Many popular games (e.g. Pokémon GO) adopt a freemium model.

The game is free, acquiring a large number of users quickly and the stickiness of the game increases with size.

3. The rapid rise of Garena

Alright! Now to talk about Garena and its flagship game—Free Fire, a battle royale game—which has simply knocked all games off the chart.

Alright! Now to talk about Garena and its flagship game—Free Fire, a battle royale game—which has simply knocked all games off the chart.

3.1 And this isn’t just a flash in the pan, it has clinched the top mobile game spot for key markets consecutively for several quarters.

3.2 In the recent SensorTower report, Free Fire has also clinched the top spot in the U.S., where the average revenue per user (ARPU) is much higher.

4. Garena Games Strategy

Led by Forrest Li, Garena has its roots going back to when it dominated internet cafes (or known more affectionately as lan shops in Singapore) in Southeast Asia.

Let’s take a look at how Garena’s strategy has evolved.

Led by Forrest Li, Garena has its roots going back to when it dominated internet cafes (or known more affectionately as lan shops in Singapore) in Southeast Asia.

Let’s take a look at how Garena’s strategy has evolved.

4.1 Licensing. Garena is a key distribution platform in Southeast Asia and players can download games directly from the platform.

The company has a strong partnership with Tencent, given its 25% stake in Sea Limited.

Example: League of Legends, Call of Duty Mobile, and more!

The company has a strong partnership with Tencent, given its 25% stake in Sea Limited.

Example: League of Legends, Call of Duty Mobile, and more!

4.2 Self-developed games.

By licensing successful games, Garena learned a whole lot about what makes a game successful and used that to launch its very own—Free Fire.

Having acquired a ton of users onto its Garena platform for many years, it lowered its CAC for Free Fire.

By licensing successful games, Garena learned a whole lot about what makes a game successful and used that to launch its very own—Free Fire.

Having acquired a ton of users onto its Garena platform for many years, it lowered its CAC for Free Fire.

4.3 Factors that contributed to Free Fire's success:

-Mobile-first approach

-Optimized for low-end smartphones

-Game download size was kept small

-Plenty of gameplay innovations

-Monetized well with Elite Pass

-Mobile-first approach

-Optimized for low-end smartphones

-Game download size was kept small

-Plenty of gameplay innovations

-Monetized well with Elite Pass

-Hyper localization, a key strategy of Sea Limited.

For Garena, its content is highly localized to the country it operates in

Through in-game events and in-game aesthetics, FF local cultures, e.g. real-world events like Carnival in Brazil or Songkran in Thailand.

For Garena, its content is highly localized to the country it operates in

Through in-game events and in-game aesthetics, FF local cultures, e.g. real-world events like Carnival in Brazil or Songkran in Thailand.

Garena also makes use of celebrity endorsements. When it made moves into India, it introduced a game character Jai, which was inspired by Bollywood megastar Hrithik Roshan.

Outside of the game, Garena has focused on localized marketing, which also involved Bollywood-style songs.

Outside of the game, Garena has focused on localized marketing, which also involved Bollywood-style songs.

-Esports and Live Streaming brings increased investment from sponsors, and with more players and fans comes higher engagement and spending, extending the life cycle of games.

The picture is from the Free Fire Champion Cups 🤯🤯

The picture is from the Free Fire Champion Cups 🤯🤯

-The BOOYAP! app helps increase social integration with streaming, chats, group calls and video sharing.

By leveraging Free Fire’s popularity, BOOYAH! has amassed more than 50 million downloads, 1.1 million ratings on the Google Play store and an average rating of 4.6 stars.

By leveraging Free Fire’s popularity, BOOYAH! has amassed more than 50 million downloads, 1.1 million ratings on the Google Play store and an average rating of 4.6 stars.

5. The future of Garena is to expand Free Fire's popularity through (1) geography expansion and through (2) content expansion.

5.1 Free Fire was originally designed for Southeast Asia, by creating a game that could run on all smartphones, with shorter session times and was tailored with lower ARPU players in mind.

It will now move upmarket with Fre Fire MAX, a version designed for high end-devices.

It will now move upmarket with Fre Fire MAX, a version designed for high end-devices.

5.2 Garena will further invest in live game operations to push out content regularly for Free Fire. More importantly, it will increase the “stickiness” over the long term by combining live game and social elements to keep players engaged in the Garena ecosystem.

6. Metrics

Since Free Fire was introduced in Sep 2017, they saw sales climbing from $365 million to $2,016 million in 2020, growing at a 63% compounded annual growth rate (CAGR) over 3.5 years.

Since Free Fire was introduced in Sep 2017, they saw sales climbing from $365 million to $2,016 million in 2020, growing at a 63% compounded annual growth rate (CAGR) over 3.5 years.

6.1 Quarterly active users explode from 69 million in Q3 2017 to 648.8 million in Q4 2021, a CAGR of almost 90%!

Their success in acquiring users came from a combination of excellent execution and luck (e.g. India banning PUBG and COVID-19 accelerating digital trends).

Their success in acquiring users came from a combination of excellent execution and luck (e.g. India banning PUBG and COVID-19 accelerating digital trends).

6.2 Here is where it gets interesting. The quarterly paying users have increased at a faster clip than QAUs. From 6.5 million QPUs in Q3 2017 to almost 80 million in Q4 2021, a CAGR of 105%!

6.3 When we look at the percentage of QPUs to the QAUs, we see a clear trend that Garena is able to monetize more and more of its freemium users. The dip in 2018 was from its rapid expansion in acquiring free users. As users get hooked on the game, they start spending more.

This shows how well Free Fire is monetizing with the Elite Pass, where users gain access to new gear and other goodies by paying and completing quests every season.

Monetizing freemium games is not an easy feat as it requires a delicate balance.

Monetizing freemium games is not an easy feat as it requires a delicate balance.

6.4 The ARPPU it has been trending downwards likely as a result of their rapid expansion in developing markets.

It is highly probable that we will see this trending upwards as users become more accustomed to Free Fire and with Free Fire expanding into developed markets.

It is highly probable that we will see this trending upwards as users become more accustomed to Free Fire and with Free Fire expanding into developed markets.

6.5 I’m not too concerned that the ARPPU is declining because of its success in expanding and it takes gamers time to warm up to make in-game purchases.

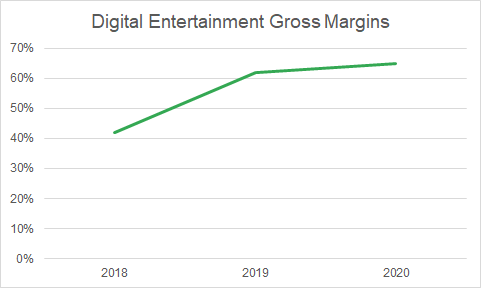

When we look at the gross profit margins, we see that there is a bump due to self-developed games having better economics.

When we look at the gross profit margins, we see that there is a bump due to self-developed games having better economics.

7. Risks

There are two key risks that stand out to me: (1) Risk of Free Fire falling out of favor, and (2) Regulatory risks.

There are two key risks that stand out to me: (1) Risk of Free Fire falling out of favor, and (2) Regulatory risks.

7.1 Garena derives most of its digital entertainment revenue and gross profit from Free Fire, and has a limited track record in game development and global game distribution.

7.2 Free Fire operates across multiple regions, and inevitably, the regulatory landscape in the different regions might be challenging to navigate. Take India for e.g. it banned the most popular Battle Royale game because of its stance against China tech companies.

8. Thank you for reading my thread on Garena $SE. If you like this, do consider liking, RTing and following me @SteadyCompound!

I will be doing a comprehensive thread on Shopee next.

I will be doing a comprehensive thread on Shopee next.

9. Tagging folks who may be interested in this Garena $SE thread!

@SlingshotCap

@BahamaBen9

@sloth_investor

@JoshuaTai0427

@Marlin_Capital

@InvestmentTalkk

@LiviamCapital

@DennisHong17

@HaydenCapital

@saxena_puru

@Prof_Kalkyl

@Brian_Stoffel_

@RamBhupatiraju

@SlingshotCap

@BahamaBen9

@sloth_investor

@JoshuaTai0427

@Marlin_Capital

@InvestmentTalkk

@LiviamCapital

@DennisHong17

@HaydenCapital

@saxena_puru

@Prof_Kalkyl

@Brian_Stoffel_

@RamBhupatiraju

• • •

Missing some Tweet in this thread? You can try to

force a refresh